Oiltek - Stock Analyst Research

| Target Price* | - |

| Recommendation | NON-RATED› NON-RATED |

| Market Cap* | - |

| Publication Date | 8 Apr 2024 |

*At the time of publication

Oiltek International Ltd - Beneficiary of the big push for sustainable fuel

- Oiltek provides design, engineering, maintenance, and turnkey solutions for refineries and processing plants in the vegetable oils industry. These include the major agricultural commodities such as palm, soybean, and rapeseed.

- FY23 net profit rose 50.9% to RM19.1mn on the back of strong order wins of RM322mn (FY22: RM196mn). The order book was a record RM382mn at end-2023 (FY22: RM210mn) to be completed in 18 to 24 months. Order wins are underpinned by higher oil consumption and downstream applications, increased use of renewable fuel such as biodiesel, and push for sustainable aviation fuel in the aviation industry.

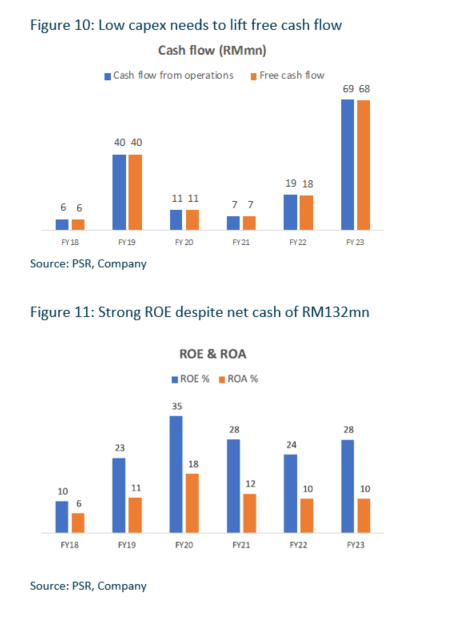

- Balance sheet has net cash of RM132mn, or S$0.265/share. The business model is asset-light, with low capex needs and fixed assets of only RM3mn. FY23 free cash flow generated was S$0.137/share. The share trades at 1.86x P/FCF. The current market cap is below net cash.

Background

Oiltek is a design and engineering specialist for vegetable oil refineries and processing plants for major agricultural commodities, including palm, soybean, and rapeseed. These refineries produce edible and non-edible oil, related downstream products, and renewable energy such as biodiesel and biogas. Oiltek also possesses the know-how to process waste fats/oil into an intermediate feedstock for the production of sustainable aviation fuel. Key customers are major listed plantation companies. Indonesia accounts for 78% of FY23 revenue.

Highlights

- There has been a regulatory push to raise biodiesel consumption, driving investments in biodiesel refineries. The Indonesian government’s biodiesel mandate was raised to B35 nationwide in August 2023 and is targeting B40 in the future. This directive blends 35% palm-based biodiesel with fossil diesel to reduce fuel imports, lift domestic demand for palm oil, and cut emissions.

- Malaysia has a similar proposed B20 mandate for the transport sector. However, this is not implemented nationwide due to limited blending facilities. We expect more investments into biodiesel plants as each state seeks to be self-reliant in supply.

- There is a growing demand for sustainable aviation fuel (SAF). Oiltek will ride on this demand as the international aviation industry targets reaching net zero carbon emissions by 2050. Many countries have mandated flights use 3-10% of SAF by 2030.

- To this end, European oil refining companies such as Neste Oyj and Total S.A. are building new hydrogenated vegetable oil (HVO) refineries. HVO is the second largest renewable diesel alternative worldwide and can be upgraded to SAF. Oiltek has the solutions to treat palm oil mill effluent and used cooking oil, in compliance with the International Sustainability & Carbon Certification, as feedstock for the production of HVO.

- Asset-light, strong ROE, and cash flow. Oiltek’s key assets are the proprietary process technology and know-how. Plant fabrication and installation work are outsourced to third-party fabrication plants, thus minimizing capex needs.

Hence, the attractive FY23 ROE of 28%, despite the net cash of RM132mn in its balance sheet, and strong free cash flow. FY23 FCF/share was S$0.137. The share trades at 1.86x P/FCF and below net cash of S$0.265/share. It pays a dividend of 1.6 cents or a yield of 6.4% in FY23.

Background

Oiltek is a design and engineering specialist for vegetable oil refineries and processing systems for major agricultural commodities, including palm, soybean, and rapeseed. These refineries produce edible and non-edible oil, related downstream products, and renewable energy such as biodiesel and biogas. Its key customers are major listed plantation companies.

Edible and non-edible oil refinery construction and upgrade accounted for 78% of revenue share in FY23 (Figure 1). Still, renewable energy, comprising biodiesel and biogas plants, grew at a faster rate of 83% YoY (Figure 2).

Oiltek has the technology solution to process waste fats/oil, such as palm oil mill effluent (POME) and used cooking oil (UCO), as well as other vegetable oil-based raw materials, into the feedstock for production of hydrogenated vegetable oil (HVO), which is used as sustainable aviation fuel. Its process technology complies with the International Sustainability and Carbon Certification (ISCC). Oiltek has delivered its first HVO feedstock treatment plant that uses POME to a customer in Malaysia.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump