Frequently Asked Questions

Unit Trust with POEMS

How are the Performance Returns and Annualised Performance Returns of funds derived?

Performance Returns are derived based on the past NAV of the fund. It expresses the total returns you would have achieved on your principal investment had you been invested in the fund for that period of time.

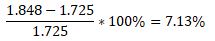

For example, the 3 Year Return of a fund will be derived from the

difference between the latest NAV and the NAV of the fund 3 years ago. If

the latest NAV of a fund is SGD1.848 and the NAV of the same fund 3 years

ago is SGD1.725, then the Performance Return is:

This means that the total returns you would have gained on your principal investment, had you been invested since 3 years ago, is 7.13%.

The Annualised Performance Returns expresses the annualised (yearly) returns on your principal investment had you been invested in the fund for that period of time. It only applies for periods of more than 1 year (i.e. there is no annualised performance return for periods of 1 week, 1 month, 3 months etc.)

Other faq that might help you

- What are the Fees and Charges?

- How do I transfer-in my holdings maintained with other distributors or banks?

- How do I opt-in for SMART Park (Excess Funds Management Facility) and invest in Phillip Money Market Fund??

- What is Customer Knowledge Assessment (CKA) and how does it affect me?

- Who can invest in unit trusts?

- What is the meaning of (Acc) or (Dis) which is sometimes seen in the names of some funds?

- How do I make payment for my Unit Trusts purchases?

- When will my unit trust orders be transacted?

- Since price (NAV) displayed is for the last dealing date, what is the NAV on the date that I have transacted?

- When will I receive my money after I have sold my unit trust holdings?

- Will I receive dividends?

- When will I receive dividends?

- What is CPF Investment Scheme (CPFIS)?

- What is Supplementary Retirement Scheme (SRS)?

- What is a CPF Investment Administrator (CPFIA)?

- Can a CPF investment be converted into a Cash investment?

- What is CPFIS Self-Awareness Questionnaire (SAQ)?

- How can I trade Unit Trust online?

- What is a Unit Trust Regular Savings Plan (RSP)?

- How do I apply for Unit Trust RSP and when will my Unit Trust RSP be effective?

- How do I apply for GIRO?

- How long will it take for my GIRO linkage to be approved?

- How will I be informed of the status of my Unit Trust RSP GIRO application?

- How can I start my Unit Trust RSP first while my GIRO linkage is pending for approval?

- Is an initial investment required before I can subscribe to Unit Trust RSP?

- When will the Unit Trust RSP investment amount be deducted?

- What will happen if I have insufficient money in my bank/CPF account for GIRO deductions for RSP?

- What will happen to my unit holdings after my Unit Trust RSP GIRO payments have been stopped?

- Can my Unit Trust RSP be settled in non-SGD currency?

- What are the Sales Charges for Unit Trust RSP?

- Is there any lock-in period for Unit Trust RSP?

- How do I make amendments on my Unit Trust RSP?

- When will my Unit Trust RSP amendments and/or terminations be effective?

- How can I terminate my Unit Trust RSP?

- Will my Unit Trust RSP be terminated automatically when I make a full redemption of my holdings?

- What will happen if my Unit Trust RSP fund is temporarily suspended or closed to subscriptions?

- Who can I contact if I would like to enquire about Unit Trust or Unit Trust RSP matters?

Did this answer your question?