Distribution schedule

Table of Contents

Distribution schedule

A distribution typically occurs when a large number of shareholders want to sell their shares at the same time. This can lead to a decline in the security price, as there is more supply than demand.

Distribution can also be caused by a company issuing new shares. This can lead to an increase in the security price, as there is more demand than supply.

What is the Distribution schedule?

A distribution schedule is a timetable that shows when and how often a financial asset will be distributed. This schedule can be set up by the asset’s issuer, such as a company, or by a third party, such as an investment fund. The distribution schedule will specify the dates when payments will be made and the amount that will be distributed.

For investors, the distribution schedule is essential information when considering an investment. It can provide insight into the cash flow of the asset, as well as the level of risk associated with the investment. For example, an asset with a more frequent distribution schedule may be less risky than one with a less regular schedule.

Understanding Distribution schedule

When investing in the stock market, one of the most important things to understand is how the distribution schedule works. This schedule dictates when companies are allowed to distribute their shares, which can significantly impact a stock’s price.

The distribution schedule is important for investors to understand so they can know when to expect payments and how much they will receive. The distribution schedule is also critical information for financial planners, who use it to help make recommendations about investing in a fund.

The exchanges set the distribution schedule. For example, the New York Stock Exchangehas a distribution schedule for the first Monday of every month. This schedule allows investors to buy and sell shares before the distribution date.

Distribution scheduling methods

The stock market has two main distribution scheduling methods: the first-in, first-out (FIFO) method and the weighted average cost (WAC) method.

The FIFO method is the most commonly used method, and it simply means that the first shares purchased are the first shares sold. This is straightforward and easy to keep track of, but it may not be the most effective way to minimize taxes.

The WAC method is a more sophisticated distribution scheduling method that takes into account the different costs of the shares that have been purchased. This can be more effective in minimizing taxes, but it is more complicated to keep track of.

Both methods have their pros and cons, and it ultimately depends on the individual investor’s goals and preferences as to which method is best.

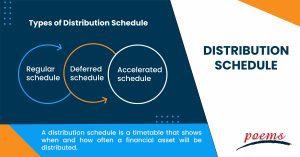

Types of Distribution Schedule

There are three types of distribution schedules in the stock market. They are:

- Regular schedule

In this type of schedule, the distribution is done on a regular basis. This type of schedule is followed by most companies.

- Accelerated schedule

In this type of schedule, the distribution is done at a faster rate. This is done in order to attract more investors.

- Deferred schedule

In this type of schedule, the distribution is done at a later date. This is done in order to keep the investors invested for a longer period of time.

Role of Distribution schedule in Mutual Funds

A mutual fund’s distribution schedule is essential to consider when investing. This schedule dictates when the fund will distribute dividends and capital gains to shareholders. It’s important to note that a fund’s distribution schedule can vary from year to year, so it’s important to stay up-to-date on the fund’s current distribution schedule.

For example, a fund that typically distributes dividends quarterly may switch to a monthly distribution schedule. This change could impact your investment strategy, so it’s essential to be aware of it.

The distribution schedule can also affect the taxability of your investment. For instance, if you’re investing in a mutual fund that distributes capital gains on a yearly basis, you may be subject to capital gains taxes each time the fund distributes those gains. Therefore, it’s very important to understand the distribution schedule before investing in a mutual fund.

Frequently Asked Questions

The Distribution Schedule template is used by stock market traders to help them plan their trading activities around the release of important economic data. The template provides a list of key dates when economic data is released, along with the expected release time and the impact that the data is likely to have on the markets. This information can help traders to plan their trading strategies and make informed decisions about when to buy or sell stocks.

Distribution in the stock market refers to the process of selling shares of a security, typically by a brokerage firm. The term can also refer to the distribution of new shares by a company.

There are two types of distribution channels in the stock market: primary and secondary markets. The primary market is the market where new securities are issued and sold to investors. The secondary market is the market where existing securities are bought and sold among investors.

A lump sum distribution is a type of distribution where the investor receives the entire proceeds of the sale in one lump sum payment. Lump sum distributions are typically made when an investor sells his entire stake in a security, such as when a company is acquired and the shareholders receive the proceeds from the sale.

A deed that binds the trustees and orders them to transfer all or a portion of the trust’s assets to specified beneficiaries is known as an irreversible deed of distribution. Typically, the distribution date falls on the same day as the settlor’s demise.

Related Terms

Most Popular Terms

Other Terms

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...