Umbrella Funds

Table of Contents

Umbrella Funds

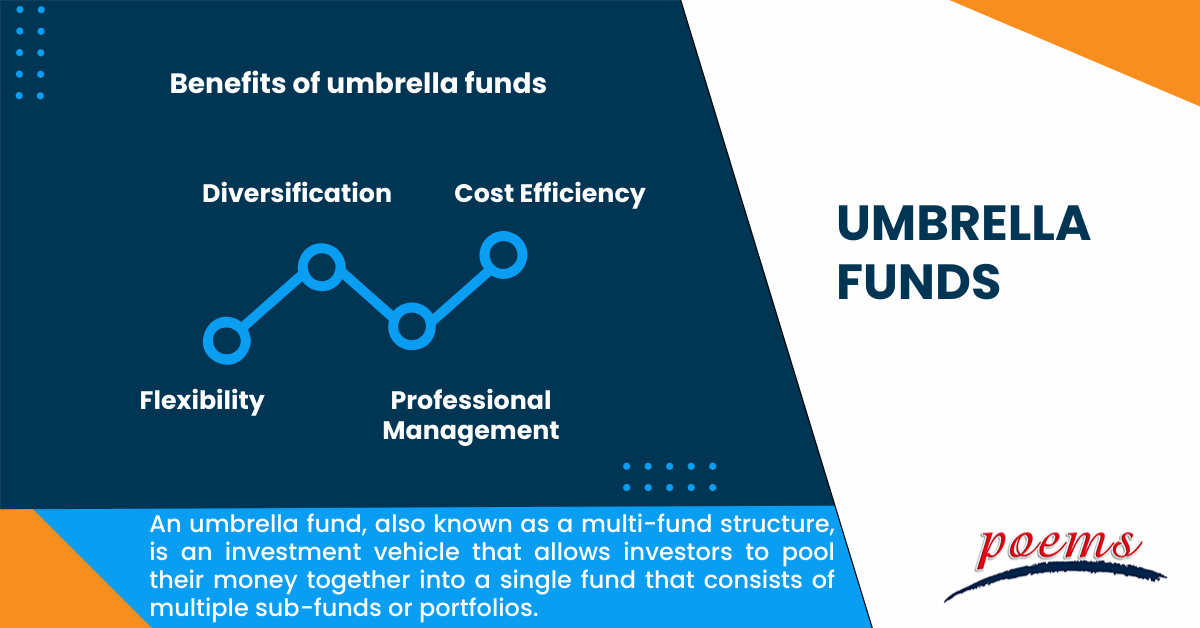

Investors now-a-days are increasingly seeking diversified and efficient investment solutions. One such solution gaining popularity is the umbrella fund. Designed to meet the needs of both individual and institutional investors, umbrella funds offer a range of benefits, including diversification, cost efficiency, and professional management. Umbrella funds serve as a versatile investment vehicle that caters to the needs of diverse investors. With the ability to choose from a range of sub-funds, investors can customise their portfolios to align with their financial goals and risk preferences.

What is an umbrella fund?

An umbrella fund, also known as a multi-fund structure, is an investment vehicle that allows investors to pool their money together into a single fund that consists of multiple sub-funds or portfolios. Each sub-fund operates as a separate entity with its own investment objectives, strategies, and asset allocation. The umbrella fund structure provides investors with the flexibility to choose from a variety of investment options based on their risk appetite and financial goals.

The umbrella fund structure is managed by experienced professionals who oversee the sub-funds, ensuring regulatory compliance and conducting thorough research to optimise returns. This concept allows investors to access a comprehensive investment solution that combines diversification, expertise, and cost efficiency under a single umbrella

Understanding umbrella funds

Umbrella funds are typically managed by professional asset management firms or financial institutions. These managers oversee the various sub-funds within the umbrella, implementing investment strategies and making decisions to optimise returns. Investors can select the specific sub-funds that align with their investment preferences, such as equities, bonds, money market instruments, or a combination of these asset classes.

In an umbrella fund, investors pool their money together into a single fund, while each sub-fund within the umbrella operates as a separate entity with its own investment objectives, strategies, and asset allocation. This structure provides investors with the flexibility to choose from various investment options based on their risk appetite and financial goals. Managed by professional asset management firms or financial institutions, umbrella funds ensure that each sub-fund is managed by experts with specialised knowledge of different asset classes. These experienced managers conduct thorough research and analysis to make informed investment decisions, aiming to optimise returns for investors.

Working of umbrella funds

When investors contribute funds to an umbrella fund, their money is allocated to the respective sub-funds they have chosen. Each sub-fund operates independently and is subject to its own set of investment guidelines and regulations. This structure allows investors to diversify their investments across various asset classes and regions, reducing the risk associated with investing in a single fund or asset class.

The umbrella fund’s management team handles administrative tasks, such as accounting, legal compliance, and reporting, on behalf of the sub-funds. This centralised approach streamlines the operational processes, resulting in cost savings that are passed on to investors. The umbrella fund structure allows investors to select the sub-funds that align with their investment preferences, providing them with flexibility and diversification. The fund managers handle administrative tasks and ensure compliance with regulatory requirements, while investors benefit from cost efficiencies and access to professional management.

Benefits of umbrella funds

- Diversification: Umbrella funds enable investors to diversify their investments across multiple asset classes, sectors, and geographical regions. By spreading risk, investors can potentially reduce the impact of any single investment’s performance on their overall portfolio.

- Cost Efficiency: Pooling investments in an umbrella fund allows investors to benefit from economies of scale. The collective buying power of the fund can lead to lower transaction costs, management fees, and administrative expenses. This cost efficiency enhances the overall returns for investors.

- Professional Management: With umbrella funds, investors gain access to professional fund managers who possess expertise in different asset classes. These experienced managers conduct thorough research and analysis to make informed investment decisions, helping investors achieve their financial goals.

- Flexibility: Umbrella funds offer a range of sub-funds with varying investment strategies and risk profiles. This flexibility allows investors to align their investment choices with their specific goals, time horizons, and risk tolerance.

Examples of umbrella funds

1. LionGlobal Investors Global Umbrella Fund

The LionGlobal Investors Global Umbrella Fund is a well-established investment vehicle that caters to investors. It offers a range of sub-funds focused on various asset classes, including equities, fixed income, and multi-asset strategies. Investors have the flexibility to choose the specific sub-funds that align with their investment goals and risk appetite. This umbrella fund provides diversification across global markets, allowing investors to benefit from international opportunities while managing risks effectively.

2. Vanguard Target Retirement Funds

Vanguard, a renowned investment management company, offers the Vanguard Target Retirement Funds as an umbrella fund solution for investors. These funds provide a simplified investment approach, catering to investors planning for retirement. The umbrella structure consists of a series of target-date funds, each designed to match a specific retirement year. Investors select the fund with the target retirement date closest to their own, benefiting from a diversified portfolio that automatically adjusts asset allocation over time to become more conservative as retirement approaches.

Frequently Asked Questions

Yes, an umbrella fund can be considered a type of mutual fund. However, unlike traditional standalone mutual funds, an umbrella fund consists of multiple sub-funds that operate independently within a single structure.

One potential disadvantage of an umbrella fund is the risk of cross-contamination between sub-funds. If one sub-fund experiences losses or faces regulatory issues, it can affect the overall performance of the other sub-funds within the umbrella.

The advantages of an umbrella fund include diversification, cost efficiency, professional management, and flexibility. These benefits make umbrella funds an attractive investment option for both individual and institutional investors.

An umbrella fund structure consists of multiple sub-funds operating within a single entity. Each sub-fund has its own investment objectives, strategies, and asset allocation. The umbrella fund provides administrative support and operational efficiencies to the individual sub-funds.

The key difference between an umbrella fund and a standalone fund lies in the structure. An umbrella fund encompasses multiple sub-funds, each with its own investment strategy, whereas a standalone fund operates as a single entity with a specific investment focus. The umbrella fund offers greater diversification and cost efficiency, while a standalone fund may provide a more focused investment approach.

Related Terms

- Settlement currency

- Federal funds rate

- Sovereign Wealth Fund

- New fund offer

- Commingled funds

- Taft-Hartley funds

- Late-stage funding

- Short-term fund

- Regional Fund

- In-house Funds

- Redemption Price

- Index Fund

- Fund Domicile

- Net Fund Assets

- Forward Pricing

- Settlement currency

- Federal funds rate

- Sovereign Wealth Fund

- New fund offer

- Commingled funds

- Taft-Hartley funds

- Late-stage funding

- Short-term fund

- Regional Fund

- In-house Funds

- Redemption Price

- Index Fund

- Fund Domicile

- Net Fund Assets

- Forward Pricing

- Mutual Funds Distributor

- International fund

- Balanced Mutual Fund

- Value stock fund

- Liquid funds

- Focused Fund

- Dynamic bond funds

- Global fund

- Close-ended schemes

- Feeder funds

- Passive funds

- Gilt funds

- Balanced funds

- Tracker fund

- Actively managed fund

- Endowment Fund

- Target-date fund

- Lifecycle funds

- Hedge Funds

- Trust fund

- Recovering funds

- Sector funds

- Open-ended funds

- Arbitrage funds

- Term Fed funds

- Value-style funds

- Thematic funds

- Growth-style funds

- Equity fund

- Capital preservation fund

Most Popular Terms

Other Terms

- Options expiry

- Adjusted distributed income

- International securities exchanges

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...