Mutual fund

Table of Contents

Mutual fund

Mutual funds are a great way for individual investors to participate in and profit from the upward trends in the capital markets because they offer various investment options across corporate bonds, equity shares, money market instruments, and government securities.

Mutual funds also offer some clear benefits over investing in individual securities. The primary benefits are that you may invest in a range of assets for a fair amount of money and that you can leave the investing choices to an experienced manager.

What are mutual funds?

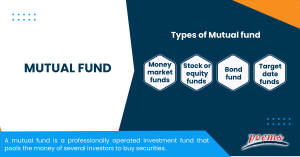

A mutual fund is a professionally operated investment fund that pools the money of several investors to buy securities. These securities may include stocks, bonds, and other assets.

The collective ownership of the fund is divided into shares, which are then bought and sold on a stock exchange. Mutual funds are among the most popular investments because they offer a wide range of benefits, including diversification, professional management, and liquidity.

Types of mutual funds

Although there are numerous types of mutual funds, most fall into one of four broad groups: money market funds, stock or equity funds, bond funds, and target-date funds.

- Money market funds

These funds invest in high-quality, short-term debt from governments, banks, and companies. They are fixed-income mutual funds.

These funds hold various assets, such as US Treasury securities, CDs, and commercial paper. According to the ICI, they account for 15% of the market for mutual funds and are one of the best and safest investments.

The capital is insured, but an investor won’t get significant profits. The average return is higher than the interest earned in a conventional savings or checking account and lower than the ordinary certificates of deposit (CDs).

- Stock or equity funds

These funds primarily invest in stocks or equities, as the name suggests. Equity funds have more growth potential and a greater risk for value volatility. Financial experts suggest that you include equity funds in your portfolio more when you are younger since you have time to withstand unavoidable market fluctuations.

Equity funds can also be divided into those that invest in US companies and those that do so outside the US. The following style box is an example of utilising one to comprehend the world of equity funds.

- Bond fund

The most popular class of fixed-income mutual funds is called a “bond fund,” It allows investors to get a set return on their original investment. These funds frequently employ active management and look to acquire reasonably discounted bonds to resell them for a profit.

While bond funds are not without risk, these mutual funds are expected to offer larger returns. For instance, a fund that focuses on high-yield junk bonds has a significantly greater risk than a fund that invests in government securities.

- Target-date funds

Investing in a single portfolio having an asset mix that grows more cautious as the target date approaches nearer is possible with target-date mutual funds. These investments, often referred to as asset allocation funds, are a mix of equities and fixed-income funds with a pre-determined ratio of investments, such as 60% equities and 40% bonds.

While saving for retirement, investors frequently use these funds as a single portfolio. Investors normally are not required to be concerned about re-balancing their portfolio as they mature.

Advantages of mutual funds

Mutual funds offer several advantages compared to other investment vehicles. They provide:

- Professional management

A professional investment manager does thorough research and executes trades expertly. They research, choose securities, and keep tabs on the fund’s performance.

- Diversification

One of the benefits of investing in mutual funds is diversification, which is the process of combining assets and investments inside a portfolio to lower risk.

- Economies of scale

This can help to mitigate risk and improve returns. Mutual funds offer economies of scale by avoiding the various commission fees required to build a diversified portfolio.

- Exposure to a variety of investing techniques

Additionally, mutual funds offer investors access to a wide range of investment strategies and styles, which can further help to meet their individual goals.

How to buy and sell mutual funds

A full-service broker, an internet discount broker, or a business running a mutual fund can purchase and sell it. Online financial firm websites, broker websites, and financial media websites all include the information you need to pick a fund.

How do mutual funds work?

Mutual funds operate by combining the funds of several investors. Then, stocks, bonds, and other securities are bought with that money. Mutual funds give investors immediate diversification (and a lowered risk level) since they invest in various businesses. Investors in mutual funds participate in the fund’s gains and losses.

The performance of a mutual fund is based on the performance of the securities in the fund’s portfolio. Mutual funds offer investors several benefits, including diversification, professional management, and liquidity.

Frequently Asked Questions

They do this because the funds invest across dozens, even hundreds, of different bonds, stocks, or other securities. Mutual funds aid in rapid diversification. Furthermore, historical evidence suggests that big groupings of equities typically handle market fluctuations better than single stocks.

These are the basic requirements needed to invest in mutual funds:

- Application form

- KYC compliance

- Identification documentation

- Proof of your address

- You may choose a SIP check or a lump cash payment

- Minor’s third-party statement.

Mutual funds offer several potential benefits, including professional management, diversification, and the potential for higher returns compared to other investments. However, there are some risks to consider before investing, such as the potential for loss, fees, and market fluctuations.

The fund’s net asset value (NAV) determines the price or cost of mutual funds. The NAV is calculated by subtracting the fund’s liabilities from its assets and dividing it by the number of outstanding shares. The NAV is typically calculated once a day after the markets close.

The price of a mutual fund share is simply the fund’s NAV divided by the number of outstanding shares. So, if a fund has a NAV of US$10 and has 1,000 shares outstanding, each share is worth US$10US.

The NAV can fluctuate daily, and the price of a mutual fund share will fluctuate along with it. However, the price of a mutual fund share will never be below the fund’s NAV.

Mutual funds only trade once daily, immediately following the markets’ clos, in contrast to stocks that can be sold at any period during normal trading hours. The next accessible net asset value, determined after the market closes, will be used to execute your trade if you enter it to sell or buy shares of a mutual fund.

Related Terms

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...