Accelerated depreciation

Table of Contents

Accelerated depreciation

An important instrument in the financial management of firms is accelerated depreciation. This technique enables enterprises to lower their taxable revenue during the first few years of an asset’s useful life, freeing up cash flow for other costs. This strategy has important financial repercussions and can significantly affect a company’s bottom line.

What is accelerated depreciation?

Accelerated depreciation is an accounting strategy that allows firms to claim bigger tax deductions by depreciating assets more quickly in the early years of their useful life. With this approach, the tax deduction is higher in the early years and lower in the later years. It is called “accelerated” because the depreciation expense is greater than what would be calculated using the straight-line depreciation method. Accelerated depreciation methods are often used to encourage investment by reducing the tax liability of businesses.

Understanding accelerated depreciation

Compared to the straight-line method, the accelerated depreciation method calculates an asset’s depreciation expense more quickly, resulting in greater tax deductions in the first few years of an asset’s useful life. According to this methodology, a costlier asset will depreciate more quickly in the first few years of usage, necessitating a higher depreciation charge to be recorded in those years. This strategy offers the advantage of lowering taxable revenue and tax obligations during the first few years of an asset’s useful life, which can be advantageous for businesses wishing to reinvest those savings back into the company. The asset’s book value is also reduced using this strategy in the initial years, which may affect the company’s financial ratios and financial condition.

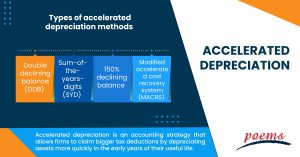

Types of accelerated depreciation methods

The types of accelerated depreciation methods are as follows:

- Double declining balance (DDB)

This method calculates depreciation by doubling the straight-line rate and applying it to the asset’s book value each year. The asset is depreciated faster in the early years of its useful life and slower in the later years.

- Sum-of-the-years-digits (SYD)

This method determines depreciation by multiplying the asset’s book value by a fraction based on the usable life of the asset’s components. The asset also depreciates more quickly in the initial years with this strategy.

- 150% declining balance

This method applies a depreciation rate of 1.5 times the straight-line rate to the asset’s book value each year. This method is also commonly used for tax purposes.

- Modified accelerated cost recovery system (MACRS)

This method is used for tax purposes and involves calculating depreciation using specific depreciation rates and recovery periods based on the asset’s classification.

Example of the double declining balance method

The double declining balance method is a depreciation method used to calculate the declining value of an asset over time. Suppose a company purchases a piece of machinery for US$100,000 with a useful life of 5 years and a salvage value of US$10,000.

The company uses the double declining balance method to depreciate the asset. First, the company calculates the depreciation rate, which is 40% (2 x 1/5). In the first year, the company would depreciate the asset by 40% of its current book value, US$40,000 (US$100,000 x 40%).

The new book value after the first year would be US$60,000. In the second year, the company would again apply the 40% depreciation rate to the new book value, which would be US$24,000 (US$60,000 x 40%). The process continues until the salvage value of US$10,000 is reached.

Financial statement impact of different depreciation methods

The impacts of different financial statements of different depreciation methods are as follows:

- Income statement

The depreciation expense is recorded on the income statement, reducing the company’s net income. The higher the depreciation expense, the lower the net income.

- Balance sheet

Accumulated depreciation is displayed as a contra-asset account on the balance sheet. The asset’s book value, which is the difference between its cost and accumulated depreciation, is decreased by accumulated depreciation.

- Cash flow statement

The depreciation expense is added to the net income when calculating the operating cash flow on the cash flow statement. This is because depreciation is a non-cash expense that reduces net income but does not require a cash outflow.

- Tax reporting

Different depreciation methods have different tax reporting impacts. Accelerated depreciation methods can result in a larger tax deduction in the early years and a smaller deduction in later years, reducing the tax liability of businesses.

Frequently Asked Questions

A bigger share of an asset’s depreciation expense can be taken by enterprises using accelerated depreciation methods in the first few years of the asset’s useful life, which lowers taxable income and boosts cash flow. Utilising depreciation techniques that front-load the depreciation expense allows for this.

Depending on the approach taken, accelerated depreciation is calculated differently. The double-decreasing balance method and the sum-of-the-years digits method are popular. The asset’s book value is depreciated at a rate that is double the straight-line rate at the start of each period when using the double declining balance technique. The “sum-of-the-years digits” method entails adding up all the years that an item will be useful before subtracting its cost base from that total.

Reduced tax savings in later years, a lower book value for the asset at the end of its useful life, and the requirement for more accurate record-keeping due to a larger depreciation expense in the early years are all drawbacks of accelerated depreciation. As the tax savings are already released in earlier years, accelerated depreciation may lead to decreased cash flows in subsequent years. Investing in new assets or starting capital improvement projects can make it challenging.

A larger depreciation expense in the early years of an asset’s life is one of the accelerated depreciation’s benefits because it can cut taxable income and the amount of taxes due. Businesses can free up cash flow and reinvest it as a result. Accelerated depreciation can better depict an asset’s value drop over time, especially for assets with a high predicted obsolescence or technical change rate.

Accelerated depreciation is typically not used for real estate assets, as they are subject to a different method called straight-line depreciation.

Related Terms

- Yield Pickup

- Contrarian Strategy

- Interpolation

- Intrapreneur

- Hyperledger composer

- Horizontal Integration

- Queueing Theory

- Homestead exemption

- The barbell strategy

- Retirement Planning

- Credit spreads

- Stress test

- Correlation coefficient

- Accrual accounting

- Growth options

- Yield Pickup

- Contrarian Strategy

- Interpolation

- Intrapreneur

- Hyperledger composer

- Horizontal Integration

- Queueing Theory

- Homestead exemption

- The barbell strategy

- Retirement Planning

- Credit spreads

- Stress test

- Correlation coefficient

- Accrual accounting

- Growth options

- Intrinsic Value

- Growth Plan

- Advance Decline Line

- Accumulation Distribution Line

- Box Spread

- Charting

- Advance refunding

- Amortisation

- Accrual strategy

- Hedged Tender.

- Value investing

- Capitalisation

- Long-term investment strategy

Most Popular Terms

Other Terms

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...