Retirement Planning

Table of Contents

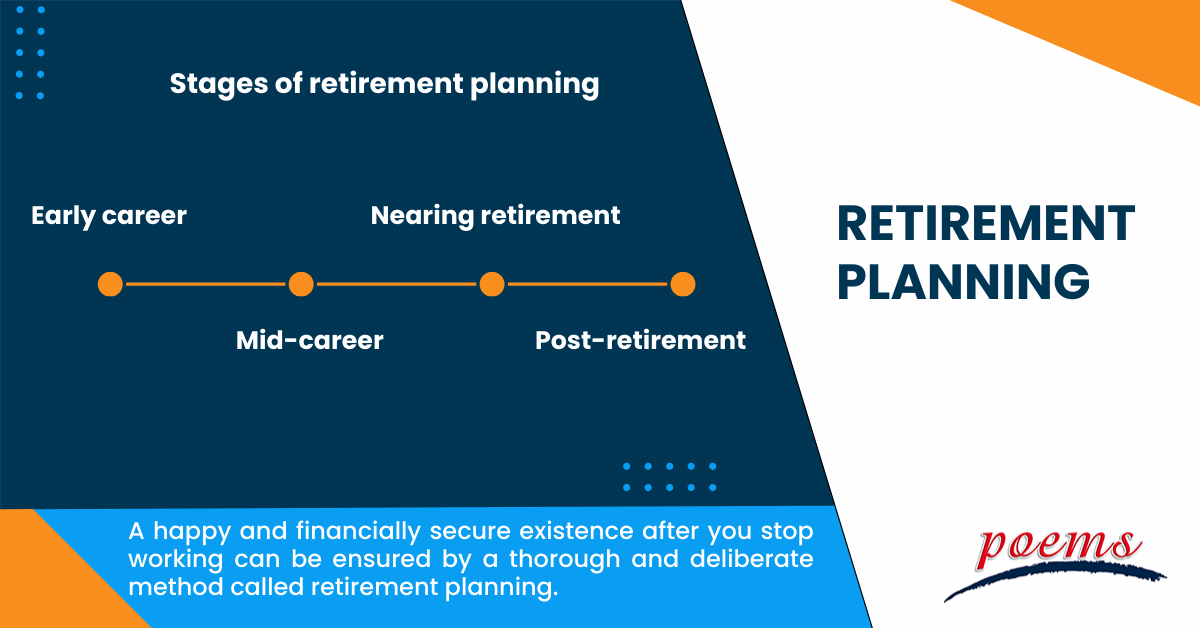

Retirement Planning

A happy and financially secure existence after you stop working can be ensured by a thorough and deliberate method called retirement planning. It entails identifying the financial resources you’ll require in your retirement years and creating a strategy to meet those objectives. A savings and investment strategy is often developed to help you reach your retirement goals after you have evaluated your present financial condition.

What is retirement planning?

Setting financial objectives and developing a plan for retirement is the process of making sure you have the resources you’ll need when you leave the workforce. This procedure usually includes evaluating your existing financial condition, deciding on your retirement goals, and creating a strategy to achieve those goals.

Understanding retirement planning

Retirement planning involves a combination of saving, investing, and managing your finances to ensure you maintain your desired standard of living once you’ve retired. Understanding retirement planning means grasping the various aspects that play a role in securing your financial future.

Assessing your current financial situation

It’s essential to assess your present financial situation before beginning to plan for retirement. This involves being aware of your earnings, outgoings, possessions, and responsibilities. You can make decisions about what needs to be done to prepare for retirement by understanding your financial status.

Setting retirement goals

One of the fundamental elements of retirement planning is setting clear and realistic retirement goals. This involves deciding when you want to retire, how you envision your retirement lifestyle, and the financial resources you’ll need to sustain it. Your goals can be tailored to your preferences, whether that’s a luxurious retirement or a more modest one.

Creating a financial plan

With your retirement goals in mind, you’ll need to create a comprehensive financial plan. This plan should include strategies for saving, investing, and managing your money to meet your retirement objectives. Your plan should also consider factors like inflation, taxes, and unexpected expenses.

Steps for retirement planning

- Calculate your retirement needs

To begin your retirement planning journey, you must determine how much money you will need in retirement. Factors such as your desired lifestyle, expected lifespan, and inflation will impact this calculation.

- Estimate your social security benefits

Planning for retirement in the UK sometimes requires taking into account your eligibility for State Pension. To obtain an idea of the benefits you’ll earn, you may verify your eligibility for State Pension on the government’s official website.

- Assess your current savings and investments

Use the stock of your remaining retirement savings and investments, including workplace pensions, individual savings accounts (ISAs), and other assets. This will give you a sense of your starting point.

- Develop a savings strategy

Determine how much you need to save and establish a systematic savings strategy. This might include setting aside a portion of your income each month and contributing to tax-advantaged retirement accounts.

Stages of retirement planning

Retirement planning can be divided into several stages, each with its unique considerations.

- Early career

At the beginning of your career, focus on building a strong financial foundation. This involves paying off debts, establishing an emergency fund, and setting up a workplace pension or other retirement accounts.

- Mid-career

In the middle stages of your career, increase your retirement savings as your income grows. Explore other investment opportunities, and continue to reduce your debts.

- Nearing retirement

As retirement approaches, fine-tune your retirement plan. Consider the specific age at which you plan to retire and start thinking about pension options, including annuities or drawdowns.

- Post-retirement

Your attention will turn when you retire to managing your investments and making sure your financial resources will last you through your retirement years. This phase calls for meticulous planning and ongoing financial plan evaluations.

Examples of retirement planning

Let’s look at a few hypothetical scenarios to illustrate how retirement planning can work in practice:

Example 1: Early career planning

Sophie is 25 and has just started her first job. She sets up a workplace pension, contributes 5% of her salary, and takes advantage of her employer’s matching contribution. She also opens an ISA and saves an additional 5% of her income. Her long-term goal is to retire at 65 with a comfortable lifestyle.

Example 2: Mid-career planning

David has been employed for 20 years and is 45 years old. He has boosted his pension payments to 15% of his salary and has paid off the majority of his obligations. To aid in the faster growth of his money, he also makes a combination of stock and bond investments. He plans to retire at age 60 and spend his golden years traveling widely.

Example 3: Nearing retirement

Sarah is 60 and plans to retire at 65. She begins exploring her pension options, including a combination of annuities and income drawdowns to ensure a stable income throughout her retirement. She also consults a financial advisor to fine-tune her plan.

Frequently Asked Questions

To start planning for retirement, assess your current financial situation, set clear retirement goals, create a comprehensive financial plan, implement your plan by saving and investing, and regularly monitor and adjust your strategy as needed.

Retirement planning is crucial because it ensures you have the financial resources needed to maintain your desired lifestyle during your retirement years, free from financial stress or dependency on others.

In addition to finances, consider your healthcare needs, social connections, and personal fulfilment. Health insurance, social activities, and hobbies can play a significant role in a satisfying retirement.

Retirement planning is essential to maintain financial stability and achieve your desired lifestyle during your retirement years. Without a plan, you risk running out of money and facing financial difficulties in your old age.

You may select the best investment plan for retirement based on your time horizon and risk tolerance. You may make wise investment choices by diversifying your holdings, using tax-advantaged accounts, and consulting a financial counsellor.

Related Terms

- Yield Pickup

- Contrarian Strategy

- Interpolation

- Intrapreneur

- Hyperledger composer

- Horizontal Integration

- Queueing Theory

- Homestead exemption

- The barbell strategy

- Credit spreads

- Stress test

- Correlation coefficient

- Accrual accounting

- Growth options

- Intrinsic Value

- Yield Pickup

- Contrarian Strategy

- Interpolation

- Intrapreneur

- Hyperledger composer

- Horizontal Integration

- Queueing Theory

- Homestead exemption

- The barbell strategy

- Credit spreads

- Stress test

- Correlation coefficient

- Accrual accounting

- Growth options

- Intrinsic Value

- Growth Plan

- Advance Decline Line

- Accumulation Distribution Line

- Box Spread

- Charting

- Advance refunding

- Accelerated depreciation

- Amortisation

- Accrual strategy

- Hedged Tender.

- Value investing

- Capitalisation

- Long-term investment strategy

Most Popular Terms

Other Terms

- Options expiry

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...