Asset

Table of Contents

Asset

When managing a company or a business, you must keep a close eye on the business’ profit and loss. This profit and loss are affected by several variables. An asset is one of these factors that matters the most. It is a resource purchased primarily to raise the company’s value. The term, however, denotes much more than this, helping us comprehend the vital role various types of assets play in businesses and their distinctive value.

What is an asset?

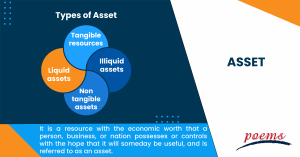

It is a resource with the economic worth that a person, business, or nation possesses or controls with the hope that it will someday be useful, and is referred to as an asset. In general, an asset is something valuable and useful.

But in business, assets must develop or produce something that the corporation can sell for money or have resale value to have positive economic value. The majority of the things that a firm controls or possesses are assets in some sense.

Employees are an example of an asset because businesses need people to operate, produce goods, or provide services. Along with equipment, machinery, and any inventory produced or used by employees, the building they operate from is likewise a resource.

Understanding an asset

An asset is an economic resource owned or under an entity’s control, such as a business. A scarce resource that has the potential to benefit the economy by increasing cash inflows or decreasing cash outflows is referred to as an economic resource. An asset can also represent access that other people or companies do not have.

Additionally, a right or another type of access may be legally enforceable, meaning a company may use financial resources as it sees fit. An owner may restrict or prohibit their use. As of the company’s financial statements’ date, a company must have a right to something to be counted as an asset.

To accurately portray major financial measures like cash flow and working capital, the firm’s management must properly identify assets. The classification of an organisation’s assets can also assist it in qualifying for loans (by giving the bank a better understanding of the risk it is accepting), navigating bankruptcy, and determining its tax obligations.

Organisations may see how each asset category affects overall revenue by separating operational from non-operating assets.

Types of assets

When it comes to businesses, assets are typically classified into the following categories:

- Liquid assets

Liquid assets can be rapidly and readily turned into cash, such as bank accounts, certificates of deposit (CDs), stocks, or bonds. As not all of your assets can be sold immediately for cash without suffering some loss or fee on the sale, liquid assets are special in this regard.

- Illiquid assets

These include real estate, antiques, and collectables because they take longer to convert to cash. Even if you have a lot of equity in your home, the sale might take some time, depending on the state of the local market, making it an illiquid asset.

- Tangible resources

Physical possessions are referred to as tangible assets. Cash in your bank account, your car, and the furniture in your house are all examples of tangible assets. You can touch and measure a tangible asset with your hands.

- Non-tangible assets

Non-physical items of value are known as intangible assets. They include trademarks, patents, copyrights, intellectual property, and internet domain names. Although you cannot physically touch them, they are worth something and can be exchanged for money.

Examples of asset

Examples of assets include:

- Investments

- Cash and cash equivalents

- PPE (property, plant, and equipment)

- Vehicles

- Marketable securities

- Product designs

- Trademarks

- Accounts receivable

- Inventory

- Computers

- Furniture

- Patents (intangible asset)

How do assets work?

Asset accumulation is a strategy used by individuals, companies, and the government to generate future short-term or long-term financial gains. An asset’s value can rise (or increase) or fall (or decrease), affecting the overall solvency of the person or business.

A company is said to be solvent if its assets are sufficient to satisfy its debts. A balance sheet, a financial statement that lists a company’s current assets, liabilities, and stockholders’ equity, can be used by businesses to monitor how its assets compares with its liabilities. This is a useful method for determining a company’s general financial health.

Frequently Asked Questions

The things that your business has and can provide future financial gain are called assets. Liabilities are the debts you owe to other people. In other words, assets increase your wealth while liabilities decrease it.

Short-term assets are current assets that can be quickly liquidated and used for a company’s immediate needs. Non-current assets are long-term and have an operational life of over a year. Cash, marketable securities, inventory, and accounts receivable are a few current assets.

An asset that is not physical is referred to as non-physical or intangible. Intangible assets include goodwill, brand recognition, and intellectual property like patents, trademarks, and copyrights. They are in contrasting with tangible assets like real estate, automobiles, machinery, and stock.

The three key properties of assets are:

- A company must first possess ownership or control over the asset.

- Additionally, an asset must have economic value.

- An asset must also be a resource, which means it can be used to create future economic value.

The following are some of the main reasons for their popularity:

- Businesses can easily track their liquid and fixed assets. The company’s owners know the location of the assets, how they have been used, and whether any alterations have been made. Additionally, they can analyse any debts, long or short-term.

- Since items are frequently verified, the asset management approach ensures that assets are accurately recorded in the financial statements.

- Identification and management of risks related to the use and ownership of specific assets are part of asset management. A business will always be prepared to manage any risks that might occur.

- In some instances, assets are stolen, lost, or damaged have been incorrectly recorded on the books. Using a strategic asset management strategy, the company’s owners will be aware of the lost assets and remove them from the books.

Related Terms

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...