Cash Flow

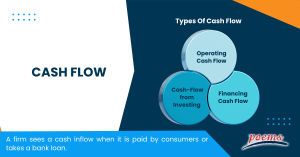

There are several ways to measure a company’s cash flow. A firm sees a cash inflow when it is paid by consumers or takes a bank loan. To put it another way, when it invests in business equipment or stock, it takes money from the company’s bank account.

Table of Contents

Types of Cash Flow

#1 – Operating Cash Flow

Regular business operations are included in a company’s operating activities. Selling commodities or providing services, as well as the collection of various debts, generates inflows.

Financial outflows cover purchases of merchandise, wages and tax payments as well as miscellaneous operational expenditure (Op Ex). Buying and selling trading securities is also part of this process.

#2 – Cash-Flow from Investing

Investing is the process of using money to buy or sell stocks or assets. The purchase of property, plant, and equipment (PPE) and other investment instruments results in a cash outflow.

Selling securities you own generates cash flow. In these exchanges, securities held for dealing and trading purposes are not included in the trade.

#3 – Financing Cash Flow

Any capital-related revenues and payments come under the purview of financing activities. Capital raised through stock or long-term debt constitutes the inflow of funding. There are a variety of short- and long-term borrowings and cash receipts from the issuance of common stock, preferred stock, and other securities. Thus, there are two major sources of financing—shareholders and debtors.

The repayment of loans, the redemption of bonds, the buyback of Treasury stock, and the payment of dividends all fall under the category of money outflow. Using accounts payable as a source of operating cash flow rather than financing operations is the correct classification.

Methods for calculating the flow of funds

The net income of a corporation is adjusted by increasing or lowering the disparities between the income statements and balance sheets in credit transactions, costs, and revenue. As non-cash items are included in the net income on the income statement and the total obligations and assets are on the balance sheet, these adjustments are essential. Non-cash transactions affect cash flow in a different way than cash transactions.

There are two ways to figure out how much money you have coming in:

- Straightforward: All cash transactions, including wages, customer payments and vendor expenditures, are included in the direct method. The opening and closing balances of company accounts are used in this manner to assess the net declines or gains for each account.

- To begin with, the company’s net income from the income statement is used in the indirect approach. Due to the limitations of an income statement, you must make modifications to reflect EBIT (earnings before interest and taxes). Calculating operating cash flow requires adjusting for non-operating costs including depreciation, inventories, accounts receivables and payables, and accumulated expenses.

Cash Flow vs Income

In accounting, a company’s profit or net income is the total of all of the company’s transactions for a given period of time. When all costs are subtracted from revenue, this is the value that is left. Cash flow, on the other hand, refers to the movement of funds in and out of a firm. After subtracting all money outflows from money inflows, it produces the firm’s final cash balance.

Money flow measures the business’s ability to effectively manage money, whereas profits show how well the company is doing in terms of sales. It is not necessary that these two measurements yield comparable outcomes. Low profitability can be achieved by a corporation with a positive cash flow situation. A negative cash flow might also be generated by a corporation that has made more money.

These two measurements are also used for quite different objectives. On the one hand, a company’s ability to make a profit is critical to its success. A measure of short-term liquidity, on the other hand, ensures seamless operations without a financial constraint.

Cash Flow Generation Strategies

- Send invoices as soon as possible.

- Make any necessary adjustments to your inventory.

- Vendors should be asked to extend more advantageous payment arrangements.

- Purchase orders can be financed.

- Marginally expand

- Sell or rent out unused equipment and machinery.

- Purchase the right to future profits.

What is cash flow analysis?

You may use a cash flow analysis to track your company’s income and expenses over a defined period of time. Tracking where your money is going and how much you have at any one time might help you better understand your financial situation. Doing this at least once each month will guarantee that your company’s cash budget is in good shape.

A monthly cash flow analysis is critical to the success of a small company owner. One of the most prevalent causes of business failure in the small-enterprise sector is cash flow issues. The good news is that regular cash flow analysis can help you avoid this error and run your organisation successfully.

Frequently Asked Questions

Negative cash flow occurs when a company spends more money than it generates in a given time. Following the payment of operational expenditures, a company’s free cash flow is a measure of the amount of cash it has available. A corporation has negative free cash flow if there is no money left over after all of the costs have been paid.

A company’s net cash and cash equivalents coming in and going out during a certain period is known as its cash flow. In the event that a corporation has positive cash flow, its liquidity is improving. The amount of money a firm has left over after all of its expenditures have been done, is called net income.

Six of the most typical reasons are as follows:

- Inadequate budgeting.

- A decrease in revenue or profit.

- Late payments from clients are a regular occurrence.

- Inventory control that is not up to par.

- Funding options that are too rigid.

- Variation throughout the seasons.

Only an approximate estimate may be provided by a cash flow projection. However, this disadvantage also illustrates that some organizations may not have the ability to see certain account payments through their crystal ball which might have a negative influence on the business in the future.

Getting better deals from suppliers by paying early. Use longer payment terms to your advantage while you are short on funds. Payment terms can be negotiated with vendors through contract negotiations and supplier relationship management (strategic partnerships).

Related Terms

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Leverage

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Consensus Estimate

- Cash Settlement

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Notional Value

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

- Prepayment risk

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...