Compounding

Table of Contents

Compounding

As an investor, time is your most powerful asset. This is because the longer you want to invest, the more your investment will compound or rise in value. Many of us may remember learning about compound interest in school. However, it is not until we begin handling our finances as working professionals that we realize the significance and power of compounding.

Compounding is a financial concept in which time is used to your advantage. It occurs when your investment profits are applied to your principal, creating a greater foundation for future earnings. And it can grow quicker as your investment portfolio grows greater.

What is compounding?

Compounding occurs when you gain interest in your investment over time, increasing your earnings. The power of compounding allows your profits to rise in tandem with your assets. Here’s how to comprehend it better. Compound interest is the addition of interest to the original investment (principal amount). As the amount is added to the initial investment and the latest interest is determined on this value, the investment would then continue to rise as this process is repeated throughout the investment period.

Understanding compounding

Compounding works by reinvesting your earnings and allowing them to grow over time. The more you reinvest, the greater the growth potential. This is because each reinvestment earns interest on the original investment plus any accumulated earnings. Over time, this can lead to exponential growth.

To take advantage of compounding, it’s important to start investing early and reinvest your earnings. The sooner you start, the more time your money has to grow. And the more you reinvest, the greater the growth potential.

Compounding is a powerful tool that can help you build wealth over time. By starting early and reinvesting your earnings, you can take advantage of this concept and potentially achieve significant growth in your investment portfolio.

Concept of compounding

The concept of compounding in finance refers to reinvesting earnings and allowing them to generate additional revenues. This process can be used to grow an investment over time.

The key to successful compounding is reinvesting earnings at a rate higher than the inflation rate. This will allow the investment to keep pace with the rising cost of living and maintain its purchasing power. Compounding can be a powerful tool to grow wealth over time, but it requires patience and a long-term view.

Investing in dividend growth shares on top of reinvesting dividends adds a layer of compounding to this technique, which some investors describe as double compounding. In this situation, dividends are reinvested to acquire new shares, and these dividend growth firms also boost their per-share distributions.

Increased compounding periods

The compounding period is the length of time between interest payments. The longer the compounding period, the greater the amount of interest that will accrue. This is because each interest payment will be based on a higher principal balance, including the interest accrued since the last payment.

For example, let’s say you have a loan with a 10% annual interest rate and a monthly compounding period. If you make no additional payments, the interest you will owe at the end of the year will be $1,000. However, if the compounding period were quarterly, the interest you would owe at the end of the year would be $1,025.

While a longer compounding period may not seem like a big deal, it can significantly impact the total amount of interest you will pay over the life of a loan. For instance, a 30-year mortgage with monthly compounding will accrue more interest than a 30-year mortgage with quarterly compounding.

If you’re considering taking out a loan, ask about the compounding period and how it will impact the total interest you will pay.

Future value of investment through compounding

The future value of an investment is determined by the interest rate, the length of time the investment is held, and the initial investment. The higher the interest rate, the longer the investment is held, and the higher the initial investment, the higher the future value of the investment.

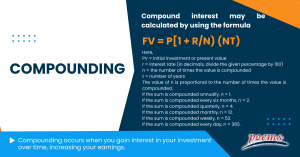

Compound interest may be calculated by using the formula FV = P[1 + R/N) (NT)

Here,

PV = initial investment or present value

r = interest rate (in decimals, divide the given percentage by 100)

n = the number of times the value is compounded

t = number of years

The value of n is proportional to the number of times the value is compounded.

If the sum is compounded annually, n = 1.

If the sum is compounded every six months, n = 2.

If the sum is compounded quarterly, n = 4.

If the sum is compounded monthly, n = 12.

If the sum is compounded weekly, n = 52.

If the sum is compounded every day, n = 365.

Frequently Asked Questions

Some of the best examples of compounding are:

- Savings, checking accounts, and certificates of deposit (CDs).

- Accounts for retirement and investing. Your 401(k) and investment account earnings also compound over time.

- Mortgages, student loans, and other personal loans

- Cards with credit

Simple interest is calculated on the primary or loan amount. In contrast, compound interest is calculated on the principal amount and the interest accrued for a specific period or preceding period.

The rule of 72 is a rule in finance that calculates the time required for an investment to increase in value while receiving a fixed yearly rate of return. The rule is a quick, back-of-the-envelope calculation that determines how long it takes for an investment to double in valuation. Divide 72 by the yearly interest rate.

For modest rates of return, the rule of 72 is fairly accurate. The graph below contrasts the numbers provided by the rule of 72 with the real number of years required to double an investment. The rule of 72, while giving an estimate, becomes less exact as the return rates grow.

Compound interest accelerates the growth of your money. It grows more quickly than simple interest since you get yields on the amount you invest and returns at the conclusion of each compounding period. This implies you won’t need to save as much money to achieve your goals.

The power of compounding is simply an act of “adding interest on interest”, which means that the money you invest will create returns based on both the initial principal amount and the collected earnings from previous compounding periods.

Thus, the force of compounding eventually contributes to the growth of your wealth over time. Compounding grows your money enormously. It adds the profit gained back to the initial value and reinvests the total amount to expedite the profit-making process.

By putting your money into an investment plan immediately after you begin earning, you may allow your savings to increase exponentially over time due to the power of compounding.

Related Terms

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Eurobonds

- Emerging Market Bonds

- Serial bonds

- Equivalent Taxable Yield

- Equivalent Bond Yield

- Performance bond

- Death-Backed Bonds

- Joint bond

- Obligation bond

- Bond year

- Overhanging bonds

- Bond swap

- Concession bonds

- Adjustable-rate mortgage

- Bondholder

- Yen bond

- Liberty bonds

- Premium bond

- Gold bond

- Reset bonds

- Refunded bond

- Additional bonds test

- Corporate bonds

- Coupon payments

- Authority bond

- Clean price

- Secured bonds

- Revenue bonds

- Perpetual bonds

- Municipal bonds

- Quote-Driven Market

- Debenture

- Fixed-rate bond

- Zero-coupon bond

- Convexity

- Parallel bonds

- Junk bonds

- Green bonds

- Average maturity

- Investment grade bonds

- Convertible Bonds

Most Popular Terms

Other Terms

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Stock symbol

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

- Prepayment risk

- Interpolation

- Homemade leverage

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...