Convertible Bonds

Table of Contents

What Is a Convertible Bond?

A bond is a fixed income instrument that represents a loan made by an investor or investors to a borrower. So a convertible bond is a corporate debt security with interest payments on the fixed income, and has the option to be converted into a predetermined number of common stock, shares or cash of equal value. This conversion is done at the discretion of the bondholder only and can be done at specific times during the lifetime of the bond. Companies issue bonds on the basis of their creditworthiness and the overall bond market determines the yield and term of the bond.

Since convertible bonds possess the nature of both a debt (interest payments) and equity (option to own underlying stock), they are known as a hybrid security. They are considered debt security as issuing companies also give fixed or floating interest rates as is given on common bonds. The convertible bonds price is sensitive to the issuer’s creditworthiness, the price of the stock and rapid changes in interest rates. Companies with a low credit rating and high growth potential tend to issue such bonds as they are a flexible financing option.

What is Conversion Ratio?

The conversion price of a bond is the price per share at which the bond can be converted into common stock. The conversion ratio set for the convertible bond decides the conversion price of the bond.

The conversion ratio, also known as the conversion premium of a bond, is the ratio which determines the number of stocks borrowers will receive from converting one bond. The bond indenture usually contains the conversion price and ratio of the bond along with other provisions. For instance, a 50:1 ratio of bond denotes that conversion of one bond with a $1,000 par value can be exchanged for 50 shares of common stock. If the bond is specified at a 50% premium, then the investor would have to pay the price of the common stock at the time of issuance with an additional 50% at the time of conversion.

When is the Right Time to Convert?

The right time to convert bonds to shares is when the profits from the sale of the stock exceed the face value of the bond including the interest payments. In the case of mandatory convertible bonds, they are required to be converted by the investor when they reach a particular conversion ratio and price level.

Usually when companies issue convertible bonds, their stock price is lower than the conversion price at that time. That particular period of time benefits the bondholders more as they enjoy a steady stream of interest income. But when the market price of the company’s stock exceeds the conversion price, the option to exercise the conversion becomes highly attractive. Sometimes, bondholders hold off on the conversion hoping to increase their gains on the basis of the significant growth potential of the share price. If the stock does poorly and the price fails to rise above the conversion price, the investor can also hold the bond and continue to benefit from the income stream. The bond can also be held to maturity without exercising the conversion option, after which the bondholders receive face value of the bond.

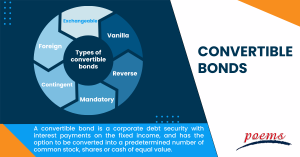

Types of convertible bonds

- Vanilla convertible bond is the most common type of convertible bond where the investor has the choice to hold the bond until maturity or convert it to stock during a certain time in its lifetime. The bond can be converted or kept on hold in case the stock price increases or decreases respectively. The bonds can also be sold at the investor’s discretion. Vanilla convertible bonds have plain convertible structures which grant the holder the right to convert to a specific number of shares as per pre-determined conditions. They offer regular fixed income over a period of time with a fixed maturity date and the nominal value of the bond can be redeemed by the holder.

- Mandatory convertible bonds as the name suggests are type of bonds which are required to be converted by the investor at a particular conversion ratio at maturity. These bonds are a slight variation of the vanilla bonds and can be compared to forward selling of equity at a premium. They often bear two conversion prices; one where investors receive value equal to the par value in shares and second is where investors earn more than the par value.

- Reverse convertible bonds are a less commonly issued convertible bond and are opposite to vanilla bonds. It gives the company the right to convert the bond to equity shares during a specific time in its lifetime or hold the bond as a fixed income investment until its maturity. In case the bond is converted, it is done so at a predetermined price and conversion ratio.

- Contingent convertible bonds are a variation of the mandatory convertible bonds where they are automatically converted into equity if a predetermined trigger event like value of assets falling below the guaranteed debt, takes place.

- Foreign currency convertible bonds are bonds whose face value is issued in a foreign currency which is different from the issuing company’s currency.

- Exchangeable convertible bonds are bonds where the issuing company and the underlying stock company are different entities. This difference is understood in terms of equity and credit risk being correlated.

Benefits and Disadvantages of Convertible Bonds

Benefits of Convertible Bonds

- Investors receive a fixed income regularly via interests with the option to convert to stock and benefit from appreciation in the value and retain their voting power.

- Bondholders are paid before common stockholders so they have security from any kind of risks.

- Convertible bonds help companies in minimizing negative investor sentiment around issuing equity shares.

- Companies can raise capital without immediately diluting their stock shares in the short or medium term which isn’t possible in equity financing.

- Issuing companies save money on their interest payments as convertible bonds are issued on lower interest.

- Issuing companies benefit from interest tax savings as interest payments are tax deductible.

Disadvantages of Convertible Bonds

- Convertible Bonds have a lower coupon rate due to the option of conversion of bonds into equity.

- Startups and low income companies issue bonds for capital but it also creates an additional risk for investors.

- When bonds are converted to stock, shares are diluted leading to a reduced share price and EPS dynamics.

- Forced conversion is also done by issuing companies sometimes when the price of the stock is higher than the amount in case the bond is redeemed.

- Most convertible bonds are considered to be riskier than typical fixed-income instruments.

- Since they have the characteristics of both bonds and stocks, they end up confusing the investors.

- Poor performance of the stock leads to investors not being able to convert the security to stock and they only have the yield to show for their investment.

- Value of convertible bonds is highly sensitive to movement in the equity markets and rising interest rates.

- Companies that issue convertible bonds usually have weaker credit ratings.

- Convertible bonds have a lower priority than straight bonds and investors may lose money in case a company goes bankrupt.

Frequently Asked Questions

XYG issued a convertible bond with a $1,000 face value that pays 4% interest with a maturity of 10 years and a convertible ratio of 100 shares for one convertible bond.

If the investors hold the bond until maturity without converting it, they are liable to receive $1,000 in principal plus $40 interest for the year of maturity. But if the company’s shares start trading at $11 per share, then the value of those 100 shares of stock would become $1,100 which exceeds the value of the bond. The investor can then decide to convert the bond into stock and receive $1,100 in total or hold it if they believe that the share prices could rise higher.

Companies issue convertible bonds, firstly to reduce the coupon rate on debt and secondly to delay dilution of their equity. Due to the conversion features and benefits, investors accept a lower coupon rate on a convertible bond, when compared to regular bonds. Thus companies are able to save on interest expenses which could be huge in case of large bond issues.

Companies also choose convertible bonds as the interest expenses are tax deductible and it would lead to equity dilution in the long term and not short or medium term. The company does this in the hope that its net income, profits and share price will grow substantially in the future.

Bonds are debt agreements which are used by companies for raising capital. When a person purchases a bond from a company, he becomes a bondholder who is promised an interest payment and repayment of the principal amount after maturity of the bond. The bondholder is issuing a loan to the bond issuer after purchasing the bond and hence is the creditor of the company.

Convertible bonds give the bondholders the option to convert the bond into shares of the company at maturity or at a specific period of time during the lifetime of the bond. After conversion, the bond holders forgo the principal amount and the interest, and instead gain stock ownership in the company. This offers a better return than a normal bond without risks associated with the stock market.

- Investors enjoy a fixed income stream via interest.

- At maturity, investors are able to recoup most of their original investment.

- The hybrid security adds value to a diversified or fixed income portfolio by reducing risk of equities while maintaining expected interest as income.

- Appreciation is higher than ordinary corporate bonds due to stock price gains.

- Investors have some protection in case of winding up of a company as bondholders are paid before stockholders.

Mandatory convertible bonds as the name suggests are type of bonds which are required to be converted by the investor at a particular conversion ratio at maturity. These bonds are a slight variation of the vanilla bonds and can be compared to forward selling of equity at a premium. They often bear two conversion prices; one where investors receive value equal to the par value in shares and second is where investors earn more than the par value.

Related Terms

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Eurobonds

- Emerging Market Bonds

- Serial bonds

- Equivalent Taxable Yield

- Equivalent Bond Yield

- Performance bond

- Death-Backed Bonds

- Joint bond

- Obligation bond

- Bond year

- Overhanging bonds

- Bond swap

- Concession bonds

- Adjustable-rate mortgage

- Bondholder

- Yen bond

- Liberty bonds

- Premium bond

- Gold bond

- Reset bonds

- Refunded bond

- Additional bonds test

- Corporate bonds

- Coupon payments

- Authority bond

- Clean price

- Secured bonds

- Revenue bonds

- Perpetual bonds

- Municipal bonds

- Quote-Driven Market

- Debenture

- Fixed-rate bond

- Zero-coupon bond

- Convexity

- Compounding

- Parallel bonds

- Junk bonds

- Green bonds

- Average maturity

- Investment grade bonds

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Stock symbol

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

- Prepayment risk

- Interpolation

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...