Zero-coupon bond

Table of Contents

Zero-coupon bond

Bonds with zero coupons are fixed-income investments that bear no interest. Investors receive their face value or par value at maturity. These bonds have a maturity of 10 to 15 years. As a result, they are heavily discounted. The cost of bonds changes as they near maturity.

The investor will be willing to pay less the closer the date of maturity gets. These bonds are best suited for long-term financial objectives like retirement. But investors can sell these bonds before they mature since they are traded on the stock market.

What is a zero-coupon bond?

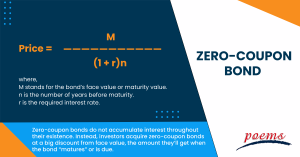

Zero-coupon bonds do not accumulate interest throughout their existence. Instead, investors acquire zero-coupon bonds at a big discount from face value, the amount they’ll get when the bond “matures” or is due.

Zero-coupon bonds typically have long maturity dates; many are delayed by 10, 15 or more years. These lengthy maturity dates enable an investor to prepare for a distant objective. An investor can use the substantial discount to invest a small sum of money that will rise over many years.

In the secondary markets, investors can buy several zero-coupon bond types that a range of issuers have issued.

Understanding zero-coupon bonds

A zero-coupon bond trades at a discount to its face value because it doesn’t issue regular coupons.

Money is worth more now than it will be at some point in the future, according to the idea of the time value of money. For example, an investor would rather get $100 today than $100 in a year. The investor can receive interest on $100 by depositing it into a savings account today.

Extending the previous concept to zero-coupon bonds, a bond buyer today must receive compensation in the form of a greater future value. A zero-coupon bond must be traded at a discount since the issuer must give the investor a return on their investment.

Pricing a zero-coupon bond

The price of a zero-coupon bond can be calculated as follows:

Price = M ÷ (1 + r)n

where,

M stands for the bond’s face value or maturity value.

n is the number of years before maturity.

r is the required interest rate.

The bond price decreases as the remaining time to maturity increases, and vice versa. Zero-coupon bonds often have long maturity dates, with initial maturities of at least ten years. Investors can plan for long-term objectives using these long-term maturity dates, such as saving for a child’s college education. An investor can make a tiny initial investment that will rise over time thanks to the bond’s substantial discount.

Importance of zero-coupon bonds

Many investors find zero-coupon bond funds unattractive since they do not provide a consistent yield. Others believe it is appropriate for achieving long-term investing goals. It enables long-term risk-free interest to be earned by investors.

If purchased at a time when interest rates are high, zero-coupon bonds can be quite advantageous. Buying municipal zero-coupons, which are tax-free, can be a terrific method to save money on taxes. This only applies to investors residing in the state where the bond was issued.

Zero-coupon bonds have both advantages and disadvantages. The effects of the characteristics, however, may vary depending on the investor. This bond is appropriate for investors with long-term goals, but investors with short-term goals could disagree. Therefore, investors should choose whether to purchase zero-coupon bonds depending on their investing goals.

Advantages of zero-coupon bonds

The following are some benefits of a zero coupon bond:

- Investors cannot receive bond cash flow at the same pace as the investment’s necessary rate of return with other coupon bonds. But the reinvestment risk is eliminated by zero-coupon bonds. Because zero-coupon bonds do not permit periodic coupon payments, a stable interest rate is guaranteed.

- For people who want a long-term investment and a large sum of money, the zero- coupon bond is the best option. The guarantee of a guaranteed return, provided the investment is held until maturity, is the driving force behind this.

- Long-term investors benefit greatly from the zero-coupon bond’s extended time horizon. A fixed amount can be obtained through long-term investment without being concerned about market volatility.

Frequently Asked Questions

A regular bond differs from a zero-coupon bond by paying interest, which is also known as a coupon. In contrast to conventional bonds, which do, zero-coupon bonds do not pay interest to bondholders. Zero-coupon bond investors receive the bond’s face value when it matures. Regular bonds commonly referred to as coupon bonds, accrue interest for the bond’s existence before returning the principal.

The price of a zero-coupon bond is determined by its face value, or par value, and the interest rate, or coupon rate that the bond pays. The face value implies the amount of money the bond will be worth when it matures. The coupon rate is the interest the bond pays each year.

To calculate the price of a zero-coupon bond, the investor must first determine the face value of the bond. The investor must then determine the coupon or interest rate the bond pays each year. Finally, the investor must calculate the present value of the bond, which is the value of the bond today.

Bond sales resulting in short-term capital gains are subject to taxation at the applicable slab rate, ranging from 5% to 30% plus surcharge and cess. If zero-coupon bonds result in long-term gain, the investor will be required to pay capital gains tax when the bonds mature.

People who want to invest long-term and receive their return in one lump amount are the best candidates for zero-coupon bonds. People should choose zero-coupon funds if they need the money at a precise moment or are investing for any future occasion, such as a child’s education or a business.

The equation for determining a bond’s present value with no coupons is shown below:

Price = M / (1 + r)n,

where M is the maturity date. n = Years Until Maturity, and r = Interest Rate.

Related Terms

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Eurobonds

- Emerging Market Bonds

- Serial bonds

- Equivalent Taxable Yield

- Equivalent Bond Yield

- Performance bond

- Death-Backed Bonds

- Joint bond

- Obligation bond

- Bond year

- Overhanging bonds

- Bond swap

- Concession bonds

- Adjustable-rate mortgage

- Bondholder

- Yen bond

- Liberty bonds

- Premium bond

- Gold bond

- Reset bonds

- Refunded bond

- Additional bonds test

- Corporate bonds

- Coupon payments

- Authority bond

- Clean price

- Secured bonds

- Revenue bonds

- Perpetual bonds

- Municipal bonds

- Quote-Driven Market

- Debenture

- Fixed-rate bond

- Convexity

- Compounding

- Parallel bonds

- Junk bonds

- Green bonds

- Average maturity

- Investment grade bonds

- Convertible Bonds

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Stock symbol

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

- Prepayment risk

- Interpolation

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...