Obligation bond

Table of Contents

Obligation bond

Obligation bonds, also called revenue bonds, are essential components of municipal finance. They act as a tool for governments to raise money and finance vital community-benefitting projects. Obligation bonds are more potent than general obligation bonds, which rely on a municipality’s taxing power because they are funded by revenue from specific projects.

Due to this quality, they become a unique and strategic tool for governments to carry out projects like infrastructure development, public utilities, transit networks, and more. Understanding how obligation bonds function is essential for investors, decision-makers, and the general public because it clarifies the financial underpinnings of these investments and their effects on society.

What is an obligation bond?

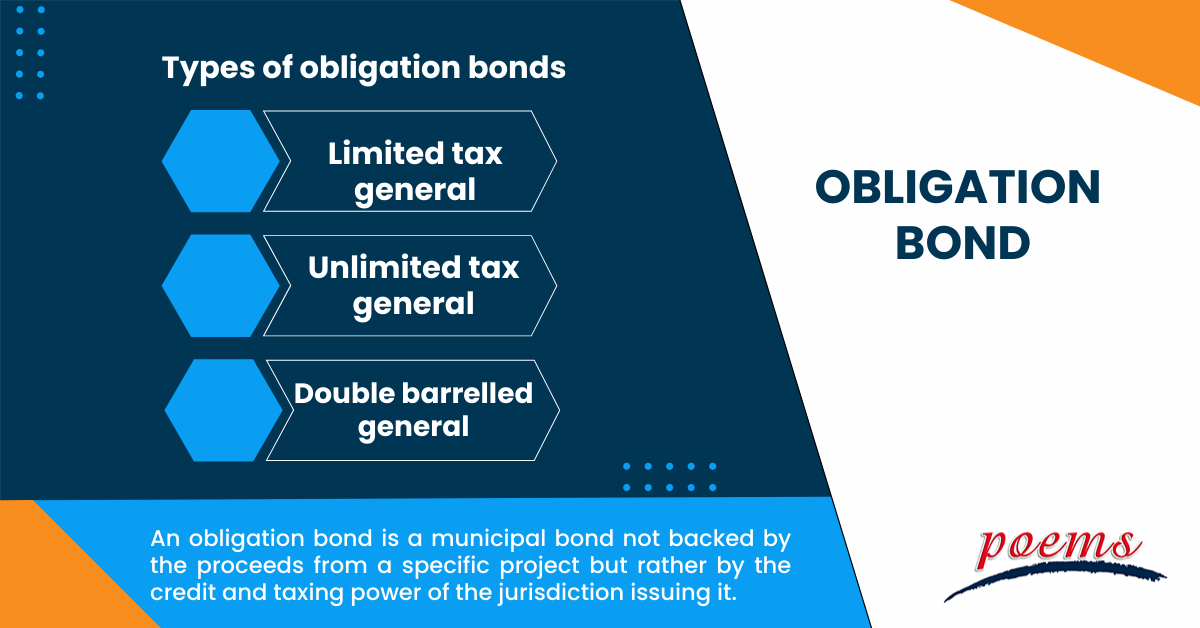

An obligation bond is a municipal bond not backed by the proceeds from a specific project but rather by the credit and taxing power of the jurisdiction issuing it. Municipalities issue general obligation bonds to repay the debt through taxes or project revenues. There are no assets pledged as security.

Local and state governments can finance public projects by issuing general obligation bonds, which are debt securities. They are supported by the issuing government’s full faith and credit, guaranteeing it will utilise its taxing authority to pay back investors.

Bonds with a general obligation serve as a crucial source of finance for infrastructure initiatives, including building roads, schools, and public utilities. Governments can spread the expense of expensive projects over a more extended period by issuing these bonds, making them more affordable and manageable.

Understanding an obligation bond

Obligation bonds are essential to public finance because they allow governments to finance critical infrastructure projects. They provide many advantages, including reduced borrowing rates, excellent credit scores, and tax advantages.

Investors buy obligation bonds when released, lending money to the government. The government uses the money to pay for the project, such as building a stadium, a bridge, or a better utility system. The bondholders are repaid using the project’s earnings, such as tolls, fees, or user charges.

The project’s success is essential to the bonds’ repayment. If the project makes enough money, bondholders will get regular interest payments and their principal investment back at maturity. However, the bondholders can be at risk of missed or reduced payments if the project needs to bring in more money.

Types of obligation bonds

The following are the types of obligation bonds:

- Limited tax general obligation bonds

A specified, constrained tax revenue source supports limited tax general obligation bonds. The amount of tax that can be imposed is capped, but the issuer promises to utilise a specific tax, such as property tax, to pay back the bonds.

- Unlimited tax general obligation bonds

General obligation bonds with unlimited taxation have no restriction on the amount of taxes that can be collected to pay off the bond. Taxes may be raised by the issuer if necessary to guarantee prompt bond repayment.

- Double-barrelled general obligation bonds

General obligation bonds with double barrels combine aspects of revenue and general obligation bonds. They offer additional protection to bondholders by carrying the full faith and credit of the issuer and are primarily backed by a specified revenue source.

Benefits of obligation bond

The following are the benefits of obligation bonds:

- It is regarded as a very safe investment choice by investors.

- It encourages investors to put money into these kinds of bonds because it is tax-exempt.

- Since municipalities can request higher taxes than usual to pay the dues, the investors will receive total repayments from the tax authorities in the event of any default.

- Investors are encouraged to purchase general obligation bonds since these bonds are publicly issued and substantially increase capital.

- Issuing bonds in the market aids the towns in finishing the project.

- The municipality must pay off the debts with the proceeds when a project fails in the worst-case scenario or due to a financial shortfall.

Example of an obligation bond

Municipal bonds are an example of an obligation bond. State and local governments issue municipal bonds to finance public infrastructure projects like building schools, hospitals, roads, or bridges.

As a result of the issuing government’s legal requirement to repay the borrowed money to the bondholders with regular interest payments, these bonds are regarded as obligations. Investors effectively lend money to the government organisation issuing the bond when they buy municipal bonds. In exchange, the government guarantees to pay the bondholders interest regularly and to repay the principal sum when the bond matures.

Frequently Asked Questions

Obligation bonds are supported by the full faith, credit, and taxing power of the issuer. Revenue bonds are backed by specific revenue streams from a particular project or source.

The two significant obligations associated with bonds are the monthly interest payments to bondholders and the eventual repayment of the principal balance at maturity. These liabilities represent the financial responsibilities of the bond issuer to the bondholders.

Yes, a bond obligation is a liability for the bond’s issuer. A company or the government effectively borrows money from investors when they issue bonds. Therefore, they must pay back the money borrowed and regular interest payments. This obligation is listed as a liability on the issuer’s balance sheet. It reflects the sum that must be paid by the issuer to bondholders when the bond reaches maturity.

Bond obligations are frequently long-term and can significantly affect the issuer’s financial situation. To guarantee they can fulfil their repayment obligations, it is crucial for businesses and governments to manage their bond obligations properly.

The issuer’s faith, credit, and taxing authority are pledged as security for general obligation bonds. Revenue earned from particular projects or sources, such as tolls, taxes, or lease payments, serves as the security for revenue bonds.

Due to their reliance on particular revenue streams, like tolls or fees, for repayment, revenue bonds are typically viewed as riskier than general obligation bonds.

Related Terms

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Bullet Bonds

- Constant prepayment rate

- Covenants

- Companion tranche

- Savings bond calculator

- Variable-Interest Bonds

- Warrant Bonds

- Eurobonds

- Emerging Market Bonds

- Serial bonds

- Equivalent Taxable Yield

- Equivalent Bond Yield

- Performance bond

- Death-Backed Bonds

- Joint bond

- Bond year

- Overhanging bonds

- Bond swap

- Concession bonds

- Adjustable-rate mortgage

- Bondholder

- Yen bond

- Liberty bonds

- Premium bond

- Gold bond

- Reset bonds

- Refunded bond

- Additional bonds test

- Corporate bonds

- Coupon payments

- Authority bond

- Clean price

- Secured bonds

- Revenue bonds

- Perpetual bonds

- Municipal bonds

- Quote-Driven Market

- Debenture

- Fixed-rate bond

- Zero-coupon bond

- Convexity

- Compounding

- Parallel bonds

- Junk bonds

- Green bonds

- Average maturity

- Investment grade bonds

- Convertible Bonds

Most Popular Terms

Other Terms

- Options expiry

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Stock symbol

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

- Prepayment risk

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...