Over-the-counter stocks

Table of Contents

Over-the-counter stocks

Unlisted stocks are another name for over-the-counter (OTC) stocks. In contrast to stock exchanges such as the New York Stock Exchange or Nasdaq, they are often supplied by small businesses and exchanged by market makers.

Bonds, stocks, and other financial instruments can be exchanged directly between two parties through the OTC (over-the-counter) market rather than on a public stock exchange like the NYSE or Nasdaq. A benefit of investing in OTC securities is that you can buy a successful stock early.

What are OTC stocks?

Over-the-counter (OTC) stocks are not traded on a formal exchange like the New York Stock Exchange (NYSE). Instead, they are traded through a network of broker-dealers who directly negotiate with one another over the phone or electronically.

Whether or not investing in OTC markets is right for you will come down to your investment goals and risk tolerance. If you are comfortable with a bit more risk and are looking for more flexibility in your investment strategies, OTC markets may be worth considering. However, traditional exchanges may be better if you prefer a more stable and regulated environment.

Understanding OTC stocks

OTC stocks often trade for less per share than corporations whose shares are listed on an exchange. Many OTC companies, sometimes referred to as penny stocks or micro-cap stocks, trade for less than 5 USD per share. The low cost may make them appealing to individual investors. These cheap shares, however, can be dangerous and extremely speculative.

Several electronic platforms are used for OTC transactions. The US’ Financial Industry Regulatory Authority (FINRA) ran one of the most well-known ones, the OTC Bulletin Board (OTCBB), until selling it to the investment bank Rodman & Renshaw.

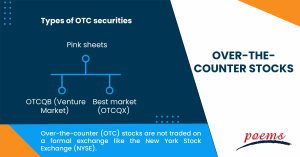

Types of OTC securities

There are three major types of over-the-counter (OTC) stocks in the United States:

- Pink sheets

The Pink Sheets are stocks not listed on a major exchange, such as the Nasdaq or the New York Stock Exchange.

- OTCQB (Venture Market)

The intermediate tier, the OTCQB, has a high proportion of emerging businesses and is sometimes referred to as the “venture market”. OTCQB companies are subject to monitoring and must disclose their financial information.

- Best market (OTCQX)

This is the pickiest. Only 4% of the OTC equities listed on this exchange are traded here. It typically consists of international firms that list on significant overseas exchanges and certain US companies that want to someday list on the NYSE or the Nasdaq and have the highest reporting criteria and toughest scrutiny.

How to buy OTC stocks?

You can sell and purchase OTC stocks using most top online brokers because they trade similarly to most other equities. You must be aware of the corporation’s ticker symbol and also have sufficient funds in your brokerage account to purchase the necessary number of OTC shares.

OTCs cannot be bought directly through the OTC Markets Group or the Over-the-Counter Bulletin Board (OTCBB). Instead of using individual investors, market makers handle all transactions.

It’s critical to remember that all investments have risk and that investors should carefully evaluate their investment objectives before investing.

When finding a reputable broker, it is important to look for a member of FINRA. Finding a broker with experience trading OTC stocks is also important.

How are OTC stocks different?

The volume of publicly available corporate information is the primary distinction between an OTC and a listed stock. It can be challenging to discover information on OTC companies, which leaves investors more open to investing in fraud schemes and reduces the likelihood that reported market values are based on accurate and comprehensive data on the company.

A company might choose to list its stock on an OTC exchange instead of a formal exchange because it may not meet the listing requirements of a formal exchange. For example, the NYSE requires a company with a minimum market capitalisation of 100 million USD and that it has been profitable for at least four of the past five years.

Another reason a company might choose to list on an OTC exchange is that it may be a start-up or small company that cannot afford the high listing fees of a formal exchange.

Generally speaking, OTC stocks are riskier than stocks listed on a formal exchange. This is because there is less information available about OTC stocks and because they are not subject to the same level of regulation.

Frequently Asked Questions

You can purchase and sell OTC stocks if you use a full-service brokerage in the real world. For the stock you want to purchase or sell, the broker must place an order with the market maker. The OTCBB allows for continuous monitoring of bid and ask prices.

OTC stocks have lower volatility than their exchange-traded counterparts, lower trading volume, wider gaps between the bid and ask prices, and less information available to the general public. As a result, they are risky investments that are frequently speculative.

Pros of OTC markets:

- On the plus side, OTC markets tend to be much less regulated than traditional exchanges.

- Additionally, OTC markets often have lower costs associated with trading since there are no listing fees or other exchange-related charges.

Cons of OTC markets:

- One is that OTC markets can be more volatile and less liquid than traditional exchanges, making buying and selling securities more difficult.

- Additionally, OTC markets can be more susceptible to fraud and manipulation since regulatory bodies have less oversight.

For instance, you may frequently locate foreign equities on the OTC markets, including those of several significant corporations. One suitable illustration is Nestle (OTC: NSRGY). The food and beverage corporation, which has its headquarters in Switzerland, principally trades on the SIX Swiss Exchange.

However, it also offers its shares on the Euronext and OTC markets to make it easier for investors to purchase shares without convenient access to the Swiss stock exchange.

A few things to remember when selling OTC stocks.

- First, it’s important to know the difference between OTC and exchange-traded stocks. OTC stocks are not traded on exchanges like the New York Stock Exchange (NYSE) or the Nasdaq.

- Instead, they are traded through networks of brokers and dealers. This means that the prices of OTC stocks can be more volatile and less transparent than exchange-traded stocks.

- Second, OTC stocks are often less liquid than exchange-traded stocks. This means that it may be more difficult to find buyers for OTC stocks and that the prices of OTC stocks can be more volatile.

- Finally, OTC stocks are often penny stocks, which trade for less than 5 USD per share. Penny stocks are generally riskier than exchange-traded ones and are often subject to manipulation by insiders.

For all these reasons, it’s important to be careful when selling OTC stocks. Make sure you understand the risks involved, and consult with a financial advisor if you have any questions.

Related Terms

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Diluted Earnings Per Share

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

With the Federal Reserve (FED) finally indicating rate cuts in 2024, we witnessed a significant...