Orphan stock

Table of Contents

Orphan stock

In the financial world, orphan stock is a fascinating phenomenon relevant beyond its basic characteristics. Orphan stock refers to shares not covered by any analyst or brokerage firm. This lack of coverage can make it difficult for investors to understand these stocks’ potential and associated risks. Understanding the significance and ramifications of an orphan stock helps clarify the difficulties experienced by shareholders and the intricacies of a corporate reorganisation. Orphan stocks remind owners of the importance of understanding dispersed shares and taking the proper measures to prevent being left with unusable or potentially worthless assets.

What is orphan stock?

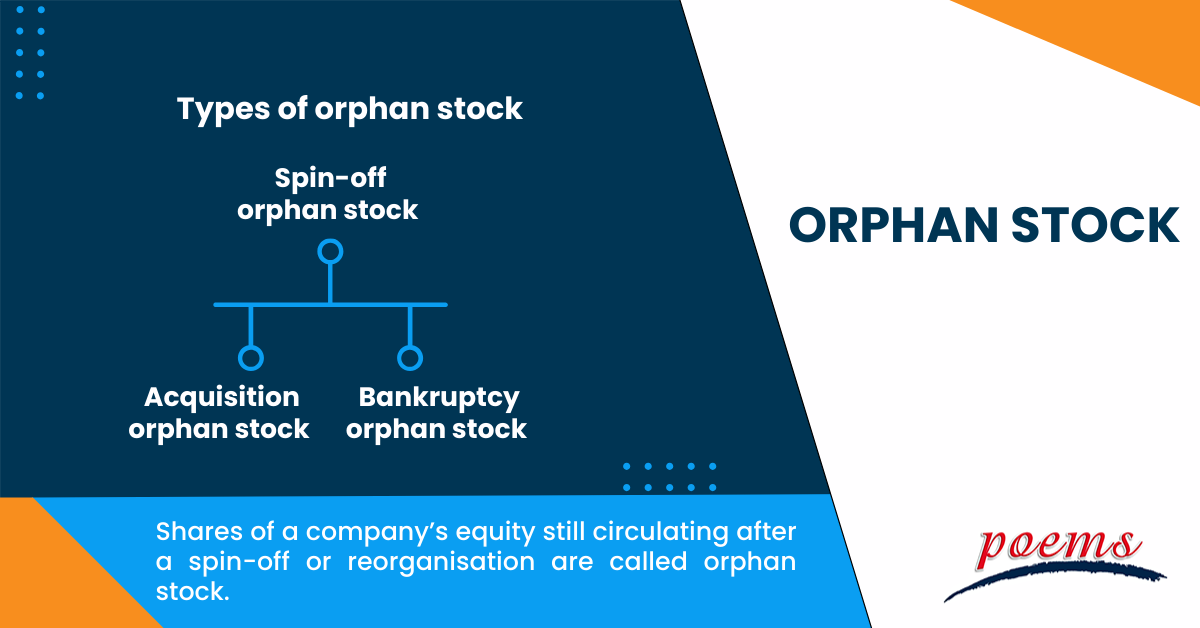

Shares of a company’s equity still circulating after a spin-off or reorganisation are called orphan stock. It happens when a parent firm transforms a subsidiary or division into a standalone business, giving current shareholders shares in the new business. Shares that have been distributed but have yet to be claimed or sold by certain shareholders are known as orphan stock. These shares often have a dormant market and may be worth little. The orphan stock might result when stockholders fail to act on their shares or do so voluntarily after learning of the distribution.

Understanding orphan stock

Orphan stocks are typically those of smaller companies that are not well-known or frequently traded. As such, they may receive extra attention than larger, more established companies.

Orphan stock is created when shares are issued to current owners due to company events like spin-offs or mergers. Shares that have been distributed but have yet to be claimed or sold by certain shareholders are known as orphan stock.

These stocks typically have no active market and little demand, which can make them illiquid or cause their value to be unknown. Shareholders with orphan stock may need to take proactive measures to ascertain its value or look for options for selling or redeeming the shares.

Investors looking to invest in orphan stocks should conduct their research, including analysing financial statements, market trends, and industry news. They should also stay up-to-date with any changes in the company’s management or ownership structure.

Additionally, it is important to be aware that orphan stocks may have lower liquidity and higher volatility than mainstream stocks, leading to greater price fluctuations.

Despite the potential challenges associated with investing in orphan stocks, they can offer opportunities for investors seeking higher returns. With careful analysis and attention to market trends, investors can identify undervalued companies and capitalise on their potential for growth. However, it is important for investors to approach orphan stocks with caution and to always conduct thorough due diligence before making any investment decisions.

Types of orphan stock

The following are the types of orphan stocks:

- Spin-off orphan stock

When a parent firm spins off a subsidiary or division into a distinct, independent entity, spin-off orphan stock results, and shares of the new firm are given to parent company shareholders. If shareholders fail to reclaim or dispose of their distributed shares, they become orphan stock.

- Acquisition orphan stock

If certain owners do not swap their shares or the acquiring firm gives cash or other shares as part of the deal, the orphan stock may be generated when two businesses combine, or one company buys another.

- Bankruptcy orphan stock

If a firm is dissolved and stockholders are left with shares with little to no value, they may become orphaned in circumstances of corporate bankruptcy.

Advantages of orphan stock

The following are the advantages of orphan stocks:

- Even though the orphan stock may initially have little value or none, it may increase in value over time. Shareholders holding orphan stock may reap future rewards if the underlying firm has favourable developments or if a market for the shares ultimately develops.

- For investors or other businesses, orphan stocks may provide strategic possibilities. For instance, a business could pay less for orphan stock and buy it because it sees future worth that others might have missed. Opportunities for upcoming alliances, mergers, or acquisitions may result from this.

- Owning orphan stock may have certain tax advantages. Shareholders may be able to claim tax deductions or offset gains from other investments against any losses related to orphan stock, depending on the jurisdiction and unique circumstances.

Example of orphan stock

The following example will help to understand orphan stock. Consider ABC Corp., a huge multinational. The parent company ABC Corp chooses to split XYZ Corp from itself. ABC Corp gives out shares of XYZ Corp to its current shareholders as part of the spin-off.

However, some stockholders need to claim their allotted shares or opt not to sell them for various reasons. These XYZ Corp. unclaimed or unsold shares are now considered orphan stock. The shareholders who took no action regarding their shares are left with possibly worthless or illiquid assets since they may need an active market or have little demand.

Frequently Asked Questions

Widow and orphan stocks are often characterised by consistent dividends and minimal volatility, making them suited for cautious investors like widows and orphans who depend on the income from their assets for financial security.

Despite their modest appeal, orphan stocks might remind owners and investors of the possible dangers and challenges of company spin-offs and restructurings. They emphasise how crucial it is to comprehend dispersed shares and take the proper action to prevent ending up with worthless or illiquid assets.

Assuming there is an active market for them, the market value or price at which orphan stocks are traded is referred to as the orphan stock price.

A mutual fund or investment vehicle abandoned or ended by the fund management business is known as an orphan fund. It usually happens when a fund closes or is combined with another fund due to low assets or subpar performance.

Like any other mutual fund or investment instrument, an orphan fund is started and operates similarly. Shares in the fund are available to investors, and a qualified portfolio manager oversees the management of the fund’s assets. The management firm may shut the fund or combine it with another fund if it is abandoned or discontinued. Investors in the orphan fund may be offered to redeem their shares in such circumstances or have their shares automatically transferred to the acquiring fund.

Related Terms

- Options expiry

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Options expiry

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Diluted Earnings Per Share

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...