Authorised shares

Table of Contents

Authorised shares

Authorised shares allow a company to raise new equity capital when needed. For instance, a corporation might issue new shares to raise funds to finance a new project.

Issuing new shares is generally overseen by a company’s board of directors. They will set a price for the shares and approve the terms of the issue. The shares are then sold to investors, typically through an investment bank.

Once issued, authorised shares are traded on the stock market like any other. Investors can buy and sell them, and their prices fluctuate based on supply and demand.

What are authorised shares?

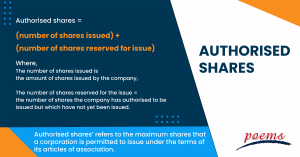

The term “authorised shares” refers to the maximum shares that a corporation is permitted to issue under the terms of its articles of association. This number may be increased or decreased by a resolution of the company’s shareholders. The authorised share capital of a business is the maximum amount of share capital the company authorised to issue, as set out in its articles of association.

Understanding authorised shares

An authorised share is a share that a company’s board of directors has approved for issuance. The number of authorised shares is set out in a company’s articles of association. A company can issue new shares up to the limit set by its authorised share capital.

The number of authorised shares is important because it limits the amount of dilution that can occur in a company. When a corporation issues new shares, there is dilution since each existing share loses value. By limiting the number of authorised shares, a company can help prevent its stock from becoming too diluted.

Once a company has issued all of its authorised shares, it can’t issue any more without getting approval from its shareholders. As a result, shareholders have a significant amount of influence over how quickly the business may expand. An organization must win the support of shareholders if it wishes to issue new shares.

Overall, the number of authorised shares is a key part of a company’s equity and can greatly impact its stock price.

Reasons for limiting authorised shares

One of the key reasons for limiting the number of authorised shares is to prevent dilution of ownership. If a company has too many outstanding shares, it can be difficult for any shareholder to have a significant impact or ownership stake. This can lead to a lack of control and influence over the company’s direction.

Another reason for limiting authorised shares is to create scarcity, which can drive up the price of the shares. If a company only has a limited number of shares available, this can make them more valuable and sought-after. This can be a good way to generate interest and excitement surrounding a company’s stock.

Finally, authorised shares can also be used to raise capital. If a company has only a certain number of shares available, it cannot be easy to raise money by selling new shares. This can limit a company’s ability to grow or expand.

Authorised shares formula

The authorised shares of a company are the total number of shares the company is authorised to issue. This number is set out in the company’s articles of association and can be increased or decreased by a resolution of the shareholders. The formula for authorised shares is as follows:

Authorised shares = (number of shares issued) + (number of shares reserved for issue)

Where,

The number of shares issued is the amount of shares issued by the company,

The number of shares reserved for the issue = the number of shares the company has authorised to be issued but which have not yet been issued.

Increasing the number of authorised shares

The number of authorised shares refers to the total amount of shares a corporation can issue. This number is set by the company’s articles of incorporation and can be increased by amending the articles.

At the company’s annual shareholder meetings, the company’s shareholders can raise the number of authorised shares, providing a majority of the current shareholders approve the move.

Increasing the number of authorised shares can benefit a company because it allows it to raise additional capital by selling new shares. This can be helpful if the company needs to finance new projects or expand its operations.

Additionally, increasing the number of authorised shares can make it easier for the company to issue them as part of a compensation plan.

Frequently Asked Questions

A company may issue either authorised shares or issued shares, which are both different types of shares. The number of shares that a business is permitted to issue under the terms of its articles of association are known as authorised shares. Shares that have been issued to shareholders are referred to as issued shares. A company may have authorised shares but not issued shares if it has not yet issued any shares to shareholders.

Yes, a company can change its authorised shares. A company’s authorised shares are the maximum number of shares that the company can issue. A company can increase or decrease its authorised shares by amending its articles of incorporation. A company might do this to raise capital or to decrease the number of outstanding shares.

Yes, a company can issue more shares than authorised. However, the company must first obtain approval from its shareholders. The shareholders must then agree or approve an amendment to the company’s articles of association. Once the amendment is approved, the company can issue the additional shares.

Many experts advise starting with 10,000 shares, although businesses can allow as little as one. Owners can apply for more approved shares later, even if 10,000 is reasonable. Business owners should often pick a number that comprises both the stocks that will be issued and those that will be reserved.

- One reason could be that the company does not need all of the funds that it would raise by issuing the shares.

- Another reason why a company could choose not to issue its entire authorised shares is because it wants to keep some of the shares as “reserve” shares. For example, the company may issue these shares later to raise additional funds or give them to employees as part of a bonus or incentive program.

- A company may not issue all of its authorised shares because it wants to maintain a certain level of control over the company. If the company issued all of its shares, they would be owned by many shareholders, each of whom would have a small stake in the company.

- By not issuing all of its authorised shares, the company can have a smaller number of shareholders, making it easier to make decisions.

Related Terms

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Diluted Earnings Per Share

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...