Penny stock

Table of Contents

Penny Stocks Definition

Generally, penny stocks trade at or below US$5 per share. Even though some penny stocks are shares on the New York Stock Exchange (NYSE), most are traded over the counter (OTC) and through the digital OTC Bulletin Board (OTCBB) or the privately-owned OTC Markets Group. OTC trades don’t take place on a trading floor at all. Quotations are also completed entirely by computer.

Stocks under US$5 in the United States and £1 in the United Kingdom are included. Singapore’s penny stock market deals in pennies. These stocks were valued less than 20 cents each.

Singapore’s penny stocks have a market value of less than US$10 million.

If a stock was trading for less than a dollar a share in the past, it was considered a “penny stock”. Now, the SEC has expanded the term which entails stocks less than US$5. The responsibility of the Securities and Exchange Commission (SEC) is to safeguard investors while maintaining order and fairness in the securities markets.

Penny stocks are typically from businesses with low trading volumes, indicating an absence of liquidity or available consumers in the market. Since there might be no buyers, investors may have a tough time selling the stock. And investors may struggle to get an accurate market price because of the lack of liquidity.

Smaller firm sizes and lack of liquidity make penny stocks very speculative in the eyes of most investors. On the other hand, investors could lose a significant portion of their money or entire investments.

Catalyst Pharmaceuticals Inc (CPRX), a Coral Gables, Florida-based biopharmaceutical business, is an example of a Nasdaq penny stock. Currently, the stock is trading at US$3.55 per share. The stock price has recently moved between US$2 to US$5. The stock ended at US$4.26 on August 10, 2020, but the following day it plunged to US$3.34, a roughly 22% decline.

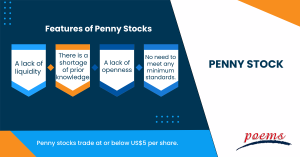

Features of Penny Stocks

To avoid losing money, a prospective investor should know the following aspects of these investments:

1. A lack of liquidity

The poor liquidity of penny stocks is due to many being traded over the counter. If an investor can’t sell the shares at the correct time, they may lose money. Low trade volumes are another consequence of the market’s lack of liquidity. As a result, even tiny transactions can significantly impact the stock’s price.

2. There is a shortage of prior knowledge.

There are many equities of relatively new companies with little historical data. Most of these businesses have no previous history of successful activities, products, assets, or income to draw on. Due to this, investment in such companies carries a high level of risk.

3.A lack of openness

The regulatory authorities do not require penny stocks to file reports (e.g., SEC). In addition to that, professional stock analysts working for certified financial institutions do not cover these equities. As a result, prospective investors might not locate enough materials to make an educated investment selection.

4.No need to meet any minimum standards.

To be listed on a significant exchange, penny stocks must meet specific minimal requirements, although this isn’t always the case.

Benefits of Investing in Penny Stocks

Penny stocks, despite their tremendous volatility, offer exceptional returns.

Investors are drawn to them because of their potential for rapid growth, making them a popular choice.

Investing a tiny amount of money can yield enormous returns. Pennny stocks begin modestly, as their name implies. And because of this, they have the potential to become quite successful.

Risks of Investing in Penny stocks

Price Fluctuations

It’s not uncommon for developing companies with little financial resources to list their stock as a penny stock on the open market. As penny stocks tend to be issued by smaller companies, they are best suited for high-risk investors.

If you’re a novice, you’ll want to avoid penny stocks because they tend to be more volatile and riskier. Penny stock investors may spend their entire investment or more if they buy on margin, meaning they borrowed money from a bank or broker.

Investors should take extra safeguards in light of the high risk of penny stock investments. A prevent order before starting trade is essential so that if the market turns against you, you know exactly where to get out. Stop-loss orders have a price limit at which the shares will automatically be sold.

Penny stocks can yield quick profits but are high-risk investments with limited trading volumes.

Lack of information available

In order to make an educated investment decision, gathering as much information as possible is critical. Corporate performance data can be hard to come by for some penny stocks. As a result, there may be inconsistencies in the data presented.

The suffix “OB” is appended to the symbol of shares traded on the OTCBB. The SEC requires these companies to submit financial reports. Pink-sheet companies, on the other hand, are exempt from the SEC’s filing requirements. Such companies don’t face as much examination or regulation as those traded on the New York Stock Exchange (NYSE), Nasdaq (NASDAQ), and Singapore Exchange (SGX).

How to find penny stocks?

Before making any investments in penny stocks, here are some key considerations to keep in mind:

Choose equities in firms that are traded on the OTC markets.

Steer clear of the stocks listed on the pink sheets.

Steer clear of stocks that are being pumped and dumped.

Avoid investing in penny stocks because of their low liquidity.

Frequently Asked Questions

These are good-to-buy investments. Small investors love penny stocks because of the enormous profits that may be made. You might take anywhere from 300 to 500 percent on this trade.

Penny stocks are high-risk, low-priced assets with modest market capitalizations. Penny stocks are more dangerous because of the lack of context and information and the limited liquidity. Penny stock scams are out there, and they’re out to steal your money.

Related Terms

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Diluted Earnings Per Share

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...