Earnings Per Share (EPS)

Earnings per share is a term that reveals the profit made by a company that gets distributed to the stocks. As it is a crucial financial parameter, earning per share is an effective way to determine a company’s financial health. For instance, if a particular company has a high EPS, it can drive profitability. On the other hand, a low EPS means that the company is not profitable enough.

Table of Contents

What is Earnings Per Share (EPS)?

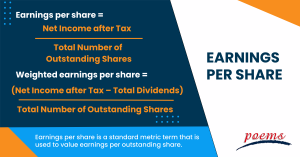

Simply put, earnings per share is a standard metric term that is used to value earnings per outstanding share. It indicates how much money a business will make for one share. In general, it is a term that divides the net worth of a company by the outstanding common stock.

Earnings Per Share Formula

The simple formula to calculate earnings per share is to divide the total net income each year by the number of outstanding shares. The two best formulas for EPS calculation are:

- Earnings per share = Net Income after Tax/Total Number of Outstanding Shares

- Weighted earnings per share: (Net Income after Tax – Total Dividends)/Total Number of Outstanding Shares

Earnings Per Share Formula Example

If company ABC has 10,00,000 as net income, and the company has common shares outstanding of 4,00,000 and needs to pay a dividend of 2,00,000, let us apply the EPS formula:

Weighted earnings per share = (Net Income after Tax – Total Dividends)/Total Number of Outstanding Shares

= (10,00,000 – 2,00,000) / 4,00,000

= 2 per share

The company’s income statement and balance sheet are reflected with EPS calculation.

What Are the Types of EPS?

Mainly, there are five types of EPS that you need to know about. Here, are the five types along with a brief explanation.

- Reported EPS or GAAP EPS

Based on Generally Accepted Accounting Principles, this type of EPS is revealed in the SEC filings. To know about the type of EPS further, let’s understand its effect on EPS.

The EPS can go up if the earnings from one-time machinery sales are treated as GAAP operating income. Similarly, when a business venture transforms regular expenses into unusual expenses, it helps improve earnings per share.

- Ongoing EPS or Pro Forma EPS

Ongoing EPS excludes unusual one-time events from expenses based on ordinary net income. Here, the word Pro Forma means that the computing is based on certain assumptions.

- Retained EPS

This type of EPS relates to the earnings or profit that a company holds rather than distributing it to shareholders. The main motive of retained EPS is to pay existing debts in order to meet the specific needs and requirements of the business.

- Cash EPS

It is one of the most basic EPS. It reflects a company’s financial health. It is the exact amount of cash that the company will earn in a specific period.

- Book Value EPS

In this type of EPS, the current balance sheet of a company is taken into account. The EPS is the carrying value per share and solely focuses on the balance sheet.

Importance of Earnings Per Share

- It is helpful for investors to know whether or not they should invest in a particular company.

- It assists investors in comparing the performance of the top companies and then picking the one that will give them maximum benefit.

- It helps determine the existing and future stock value of a company.

Limitations of EPS

- Many company owners show altered EPS to gain potential investors.

- The growth indicated by EPS is not always precise and accurate as it does not consider inflation.

- EPS calculation does not include the cash flow.

Basic EPS vs diluted EPS

Basic EPS doesn’t consider the dilution effect of shares that might be issued by a company, whereas diluted EPS assumes all the outstanding shares that a company will issue. Basic EPS always contains the net income of a company when divided by outstanding shares. Diluted EPS is lower or equal to basic EPS that incorporates claims with no current outstanding shares.

What is the difference between EPS and adjusted EPS?

Adjusted EPS is when an analyst makes numerator adjustments. It can add or remove the net income components. In general, the basic EPS is always higher than the adjusted EPS.

What is a good EPS?

A good EPS depend on factors that include:

- Current company’s performance

- Competitor’s performance

- Analysts’ expectations when they follow a stock

Frequently Asked Questions

P/E ratio is defined as the stock price divided by earnings per share (EPS).

EPS is the net income divided by outstanding shares.

Yes, EPS means that the company will make a profit in the upcoming years. It is a positive sign for investors as they can invest in the company to gain profit in the long run.

The range of the average EPS of the S&P 500 varies from 13 to 15. The higher the multiple is, the more are the chances of overall market growth of a particular company.

Though EPS can give an idea of how well a company will perform in the upcoming years, it is not a good performance measure. The reason is that it does not consider the cost of capital. It is often manipulated with short-term actions and without considering cash flow.

Related Terms

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Diluted Earnings Per Share

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...