Diluted Earnings Per Share

Diluted Earnings Per Share is the distribution of net profit earned by a company to each share of the total outstanding amount. It can impact the amount each share will receive. People often use the terms EPS and Diluted EPS interchangeably, yet they are significantly different. EPS considers only ordinary shares, whereas diluted EPS takes common shares along with employee stock options, convertible securities, and secondary offerings into account.

Table of Contents

- What are Diluted Earnings per Share (Diluted EPS)?

- Interpreting Diluted EPS – Higher or Lower?

- Basic Earnings per Share vs Diluted Earnings

- Calculating Basic Earnings per Share

- Calculating Diluted Earnings Per Share

- Diluted EPS Formula

- Diluted EPS Example Calculation

- What are Fully Diluted Shares?

- Stock-Based Compensation

- Authorised vs outstanding vs fully diluted shares

- Frequently Asked Questions

What are Diluted Earnings per Share (Diluted EPS)?

Unlike basic EPS, diluted earnings per share give detailed information about the firm’s price-to-earnings ratio. However, the current outstanding shares are not considered dilutive securities. But, they can become outstanding shares in the future.

Interpreting Diluted EPS – Higher or Lower?

The EPS figure faces downward pressure when the net dilutive impact from dilutive securities is significant. The more the EPS, the more are the chances of profitability in the long run.

Basic Earnings per Share vs Diluted Earnings

Basic earnings per share is the company’s net income divided by the outstanding number of shares. On the other hand, diluted earnings per share include all the potential dilution in the case of conversions. The conversions can be security conversions or conversions of different options into the stock. Even though both these types of EPSs are used to determine the net profit of a company, there is one significant difference between the two. Diluted EPSs takes into account common shares and convertible securities like warrants, options, and convertible debt.

Calculating Basic Earnings per Share

To calculate the basic earnings per share of a company, you need to subtract preferred dividends from the net income of the company. Then, the resultant figure is divided by the weighted average of outstanding share numbers.

Calculating Diluted Earnings Per Share

Similar to the basic earnings per share, you need to subtract the preferred stock dividends from the net income. Then, you need to divide the result by the sum of an average number of outstanding shares along with other dilutive shares that include options, warrants, and convertible debt.

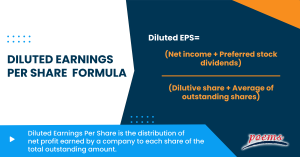

Diluted EPS Formula

Diluted EPS = (Net income + Preferred stock dividends) ÷ (Dilutive shares + Average of outstanding shares)

Diluted EPS Example Calculation

Now that you know the formula for Diluted EPS, let us look at an example. Let us assume that company XYZ had a net income of $50 million in the past year.

However, the company hasn’t paid any dividends to the shareholders and now has 15 million outstanding shares. Further, the company has stock options of 1 million that they can convert into common shares of approximately 3 million.

Based on this information, the resulting diluted earnings per share will be:

Diluted EPS = ($50,000,000 – $0) ÷ (15,000,000 + 1,000,000 + 3,000,000) = $2.63 per share.

What are Fully Diluted Shares?

Fully Diluted Shares are the total number of outstanding shares that are available to trade in the open market. This is achieved when all the dilutive securities like employee stock options and convertible bonds are exercised.

Diluted Shares – Impact on EPS

Diluted EPS is always lower as compared to basic EPS. The reason for this is that when all the dilutive securities are converted, it leads to a decrease in EPS. Hence, we can say that diluted shares negatively affect/impact the earnings per share of a company.

Stock-Based Compensation

Stock-based compensation, also known as share-based compensation, is a simple way that a company uses to pay compensation to directors, employees, and executives. Some of the most common types of stock-based compensation include stock options, shares and restricted share units.

Authorised vs outstanding vs fully diluted shares

There are three main types of claims that companies often prioritise. To help you get a better idea, here is a brief description of the three types of claims.

- Authorised shares: These are the maximum legal claims that a particular company can issue to shareholders.

- Outstanding shares: These are the current shares that shareholders hold.

- Fully diluted shares: The addition of issued, outstanding shares and the shares that a company will get through conversions.

Frequently Asked Questions

A fully-diluted basis refers to a particular company’s shares given to the shareholders. Here, all the other claims that come from the conversions of securities are also calculated.

A fully-diluted valuation means that all the obligations and plans (both potential and outstanding) are calculated before issuing the shares.

A high, fully diluted market cap ensures that there will be more circulation of tokens in the future. It is a good metric, especially for a long-term investor who wishes to judge how profitable a particular project is for investment.

Yes, diluted EPS is much better than basic EPS as it takes all the potential dilutions into account during calculation. In short, the diluted EPS can offer a comprehensive view of potential earnings and profit per share.

Yes, during the calculation of the P/E ratio, diluted EPS is taken into consideration. The general definition of the P/E ratio is the price of the stock divided by the diluted EPS (earnings per share).

Related Terms

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Dividend Yield

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...