Capital expenditure (Capex)

Table of Contents

Capital expenditure

Capital expenditure (capex) spending is a vital indicator of a company’s growth potential and financial health. Thus investors and analysts pay close attention to it. While a business that significantly reduces or cuts its capex spending may be seen as facing difficulties or being more cautious in its expansion plans, one that invests heavily in capex may be seen as having a positive outlook for future growth. Capex, which refers to investments in long-term assets intended to support a company’s long-term growth and profitability, is crucial in corporate finance and accounting.

What is capex?

Investments made by a business in long-term assets essential to its operations are referred to as capex. Infrastructural elements such as structures, machinery, equipment, and other tools might be considered among these assets. Contrary to operating expenses, which are one-time payments necessary to keep a firm afloat, capex is a one-time payment made to increase the overall productivity and efficiency of the business.

Capex is a crucial component of a business’s financial planning process, and to make sure that the investments align with the organisation’s long-term objectives, it requires thorough analysis and budgeting. Companies can improve their competitive advantage, grow their business, and eventually boost their revenue and profitability by making strategic capex.

Understanding capex

A company’s financial planning and analysis must consider capex because it entails sizable investments in long-term assets that will provide future economic gains. As capex decisions frequently involve balancing potential returns on investment against the risks and uncertainties of future cash flows, they can significantly impact a company’s future growth and profitability.

Acquiring new machinery, building structures, or R&D investments are a few examples of capex. These investments are frequently required to maintain and grow a business, but they can also be dangerous because the expected returns on investment might not occur.

Types of capex

Businesses can undertake several types of capex, depending on their needs and goals.

- Expansion capex

One type of capex is expansion capex, which involves investing in new assets to expand a company’s operations or market reach. For example, a retailer might open a new store, or a manufacturer might purchase additional machinery to increase production capacity. Expansion capex can be risky, as it requires a significant upfront investment and may take time to generate returns.

Maintenance capex

Another type of capex is maintenance capex, which involves repairing or replacing existing assets to keep them in good working condition. This type of capex is important to ensure that a business’s operations run smoothly and efficiently. For example, a transportation company might replace an ageing fleet of vehicles to avoid breakdowns and delays. Maintenance capex is typically less risky than expansion capex since it does not involve significant changes to a company’s operations.

- Regulatory capex

This involves complying with government regulations or industry standards. For example, a power plant might invest in pollution control equipment to meet environmental regulations. Regulatory capex can be costly but is necessary for businesses that operate in heavily regulated industries.

- Discretionary capex

It includes investments in assets that are not strictly necessary for a business’s operations but may provide long-term benefits. For example, a technology company might invest in research and development to create new products or acquire intellectual property. Discretionary capex can be risky since it involves investing in uncertain outcomes.

Formula and calculation of capex

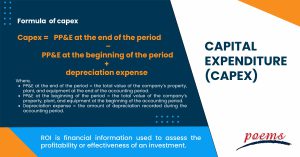

The formula for calculating capex is as follows:

Capex = PP&E at the end of the period – PP&E at the beginning of the period + depreciation expense

Where,

- PP&E at the end of the period = the total value of the company’s property, plant, and equipment at the end of the accounting period.

- PP&E at the beginning of the period = the total value of the company’s property, plant, and equipment at the beginning of the accounting period.

- Depreciation expense = the amount of depreciation recorded during the accounting period.

Capex is calculated by adding depreciation expenses to the difference between the entire value of PP & E at the start and end of the period. Businesses can use this strategy to estimate the amount they will spend over a given period on long-term assets.

Examples of capex

Capex for a manufacturing company could be acquiring new equipment, such as a new assembly line, expected to last several years and improve productivity and efficiency. Suppose the corporation invested US$1,000,000 in the latest equipment’s procurement and installation. Assume that the PP&E value was US$5,000,000 at the beginning of the period and US$6,500,000 at the conclusion. The business also spent US$100,000 on depreciation over the same frame.

Using the capex formula, we can calculate the capex for this investment:

Capex = PP&E at the end of the period – PP&E at the beginning of the period + Depreciation Expense

= US$ 6,500,000 – 5,000,000 + 100,000 = 1,600,000

Therefore, the capex for this investment is US$1,600,000, the same as the amount the company spent on purchasing the new equipment.

Frequently Asked Questions

Revenue expenditures are costs during regular business operations, while capital expenditures are long-term asset investments. Revenue expenses are reported on the income statement, whereas capital expenditures are shown on the balance sheet.

Uncertainty regarding future returns on investment, the danger of paying too much or too little attention to costs, and the possibility of unforeseen project delays or adjustments are all challenges associated with capital expenditures.

Capital investments are significant because they show a company’s long-term commitment to its business operations, property, and expansion. They can also substantially impact the company’s financial situation and prospects.

Due to the cash inflows required to purchase or improve long-term assets, capital expenditures hurt free cash flow. However, capital expenditures can also enhance a company’s potential for future cash flows and growth. When assessing a firm’s financial stability and growth prospects, investors should consider the relationship between capex and free cash flow.

Efficient capital expenditure budgeting practices include careful planning and analysis, setting clear priorities and objectives, regularly reviewing and adjusting budgets, monitoring actual spending against budgets, and prioritising projects based on their potential for generating long-term returns on investment.

Related Terms

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Hysteresis

- RevPAR

- REITS

- General and administrative expenses

- OPEX

- ARPU

- WACC

- DCF

- NPL

- Balance of trade (BOT)

- Retail price index (RPI)

- Unit investment trust (UIT)

- SPAC

- GAAP

- GDPR

- GATT

- Irrevocable Trust

- Line of credit

- Coefficient of Variation (CV)

- Creative Destruction (CD)

- Letter of credits (LC)

- Statement of additional information

- Year to date

- Certificate of deposit

- Price-to-earnings (P/E) ratio

- Individual retirement account (IRA)

- Quantitative easing

- Yield to maturity

- Rights of accumulation (ROA)

- Letter of Intent

- Return on Invested Capital (ROIC)

- Return on Equity (ROE)

- Return on Assets (ROA)

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...