Return on Invested Capital (ROIC)

Table of Contents

- What is ROIC?

- Formula and Calculation of ROIC

- Calculating NOPAT

- Calculating invested capital

- Determining the Value of a Company

- Determining a Company’s Competitiveness

- Relevance and Uses of Return on Invested Capital Formula

- How to Use ROIC

- ROIC vs WACC

- Value Drivers of ROIC

- Components of ROIC

- Limitations of ROIC

- Frequently Asked Questions

What is ROIC?

Return on Invested Capital (ROIC) is the amount of money a company makes that is above the average cost of its debt and equity capital. ROIC can also be assessed or used to determine the value of other businesses or rival companies.

Formula and Calculation of ROIC

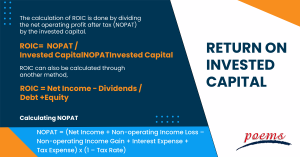

The calculation of ROIC is done by dividing the net operating profit after tax (NOPAT) by the invested capital.

ROIC = NOPAT /Invested CapitalNOPATInvested Capital

ROIC can also be calculated through another method,

ROIC = Net Income − Dividends/ Debt +Equity

Calculating NOPAT

NOPAT is a financial measure that shows the performance of the company net of taxes. It can be calculated using the following formula;

NOPAT = (Net Income + Non-operating Income Loss – Non-operating Income Gain + Interest Expense + Tax Expense) x (1 – Tax Rate)

Calculating invested capital

Invested Capital is the total amount invested by shareholders, debt holders, and other lenders. It can be calculated by:

Invested Capital = Net Working Capital + Net Fixed Assets + Net Intangible Assets

Determining the Value of a Company

Determining the value of a company is very important to ensure proper valuation. There are various methods through which one can determine the value of a company. Some of them are:

- Asset Approach: It calculates all the assets and liabilities of a company. Then the liabilities are subtracted from the assets.

- Market Approach: It makes use of the company’s position in the stock market.

- Income Approach: It is determined by dividing the annual earnings of the company by the current capitalization rate.

Determining a Company’s Competitiveness

A company is considered to be a strong competitor if it earns more profits than its rivals. A company’s competitiveness can be determined by its market profile, customer segments, strengths, weaknesses, and position in the landscape, and method for delivering value. These aspects than can be compared with the same aspects of other companies to determine its position. Its position in the market, including respect, prices and stocks, can also be used as competitive measures

Relevance and Uses of Return on Invested Capital Formula

The ROIC formula is used in various sectors to assess how well the company has used its resources to yield maximum profit. It also has great relevance as it helps to compare the competitiveness and position of the company against its rival and how well it is doing in the sector. The formula can also be used to measure the amount of money that the company makes from its investment.

How to Use ROIC

Let’s take the example of a company UVC. If the company has generated $1,00,00,000 in profits and has invested an average of $10,00,00,000, then ROIC is said to be equal to 10%. This means that the company generates $10 of net earnings for every $100 invested in the company.

ROIC vs WACC

ROIC is the amount of money a firm makes that is above the average cost of its debt and equity capital. Weighted Average Cost of Capital (WACC) represents a company’s total cost of capital, including common stock, preferred stock, bonds, and other types of debt. If a firm is generating more ROIC than WACC, then it means that the company is creating value, and if a firm is generating more WACC than ROIC, then it means that the company is destroying value.

Value Drivers of ROIC

The value of ROIC is the product of invested capital turnover (revenue generated by each dollar spent), and margins (how much profit is retained after deducting costs). These two factors are important drivers of value when it comes to ROIC, to optimally assess profit.

Components of ROIC

ROIC has the following components:

ROIC Components = Revenue / Average Invested Capital × NOPAT / Revenue

Limitations of ROIC

While ROIC helps assess a company’s profit, it has some downsides to it. It tells us nothing about which part of the business is generating profit. It also does not take into account the holding periods of investment. There are also various possibilities of the measure being manipulated if the expected costs are not met.

Frequently Asked Questions

A good ROIC ratio is 2% or more as it indicates that the company is producing value. A score of less than 2% shows that the company is destroying value and is not utilising capital optimally.

The basic difference between ROI and ROIC is that ROIC takes into consideration every aspect of the company, including its activities. On the other hand, ROIC uses only a single activity based on cash flow and has no fixed time.

As a lower ROIC indicates an unsustainable business model, a higher ROIC is always better. A high ROIC ratio indicates that the industry is growing positively and in the right direction.

Net Income = $3,75,00,000

Total Debt = $2,50,00,000

Shareholder Equity = $65,00,000

The ROIC will be:

ROIC = 3,75,00,000 − 0/2,50,00,000 +65,00,000

= 3,75,00,000/3,15,00,000

= 1.19%

In the stock market, ROIC indicates the profits a firm has earned above the expenditures. It indicates how well a firm has used its resources or assets to generate profits.

This is because it represents recurrent core operational profits and is an unlevered measure. NOPAT is commonly employed in the numerator and is thus unaffected by the capital structure.

Related Terms

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Hysteresis

- RevPAR

- REITS

- General and administrative expenses

- OPEX

- ARPU

- WACC

- DCF

- NPL

- Capital expenditure (Capex)

- Balance of trade (BOT)

- Retail price index (RPI)

- Unit investment trust (UIT)

- SPAC

- GAAP

- GDPR

- GATT

- Irrevocable Trust

- Line of credit

- Coefficient of Variation (CV)

- Creative Destruction (CD)

- Letter of credits (LC)

- Statement of additional information

- Year to date

- Certificate of deposit

- Price-to-earnings (P/E) ratio

- Individual retirement account (IRA)

- Quantitative easing

- Yield to maturity

- Rights of accumulation (ROA)

- Letter of Intent

- Return on Equity (ROE)

- Return on Assets (ROA)

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...