WACC

Table of Contents

WACC

A key idea in finance is the weighted average cost of capital, or WACC, which aids firms in estimating the cost of money required to finance their operations. It considers the split between equity and debt funding and the associated costs. By computing the weighted average, companies can determine the minimum return necessary to draw investors and make investment decisions. For effective financial planning and capital structure optimisation, WACC must be understood.

What is WACC?

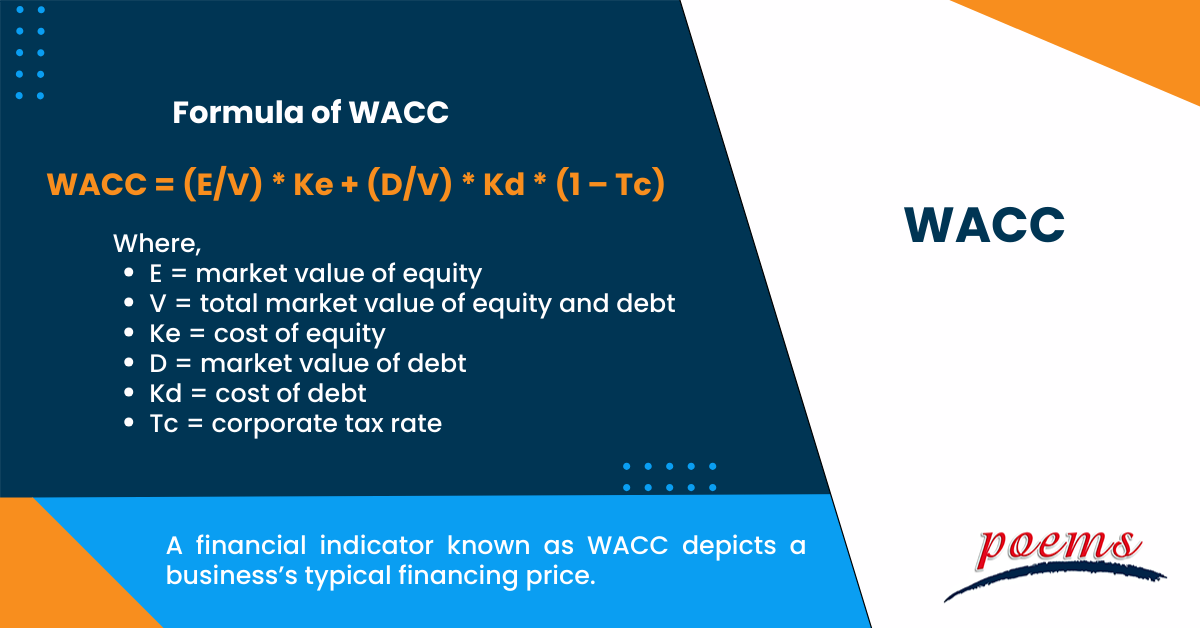

A financial indicator known as WACC depicts a business’s typical financing price. It calculates the combined cost of equity and debt capital based on the weights given to each in the organisation’s capital structure. WACC depicts the minimal rate of return needed by investors to offset the risk involved in their investment in the company. It is frequently applied as a discount rate for assessing investment opportunities and estimating a company’s value.

Understanding WACC

Analysts, investors, and firm management can all benefit from WACC and its formula; each uses it differently. Based on the ratio of equity, debt, and preferred stock a company possesses, the WACC’s goal is to calculate the cost of each component of the capital structure. Each element costs the company money.

WACC is a discount rate used in financial modelling to determine a business’s net present value. Businesses also use the hurdle rate when examining potential acquisition targets or new ventures. It is usually a good use of money if the company’s allocation can be projected to provide a return greater than its own cost of capital.

WACC formula and calculation

It is calculated by considering the proportion of debt and equity in a company’s capital structure and the cost of each component. The WACC is an important measure because it reflects the minimum rate of return that a company must earn on its assets to satisfy its investors. The following are the steps to flow to calculate WACC:

- Multiply the outstanding shares by the market price per share to get the market value of equity (E).

- Determine the market value of debt (D), which includes both short-term and long-term debt.

- Calculate the total market value of equity and debt (V) by adding the market value of equity (E) and the market value of debt (D).

- Determine the cost of equity (Ke) using methods such as the dividend discount model (DDM).

- Determine the cost of debt (Kd), the interest rate or yield to maturity on the company’s debt.

- Determine the corporate tax rate (Tc).

- Calculate the WACC using the provided formula.

The WACC is calculated using the following formula:

WACC = (E/V) * Ke + (D/V) * Kd * (1 – Tc)

Where,

- E = market value of equity

- V = total market value of equity and debt

- Ke = cost of equity

- D = market value of debt

- Kd = cost of debt

- Tc = corporate tax rate

What is WACC used for?

WACC is used for the following purposes:

- WACC is applied as a discount rate to determine an investment project’s net present value and viability.

- WACC assists in prioritising investment opportunities and capital expenditure decisions based on the prospective returns relative to the cost of capital.

- Discounted cash flow, or DCF analysis uses WACC to determine a company’s or its equity’s intrinsic value.

- WACC assists in establishing pricing strategies for goods and services and determines the lowest acceptable return for luring investors.

- WACC offers a standard for assessing a company’s financial performance and profitability by comparing the return on investment to the cost of capital.

WACC interpretation

The interpretation of WACC is contingent upon the company’s final period return. The company performs rather well if its return exceeds its weighted average cost of capital. But before investing in the company, investors should consider whether there will be a small or no profit. You can use two methods to figure out the weighted average cost of capital. The book value is the first, and the market value method is the second.

Interpreting the WACC can provide valuable insights into a company’s financial health and investment potential. If a company’s WACC is high, the cost of capital is high, which can be a red flag for investors. This could indicate that the company is not generating enough returns to cover its cost of capital, which may make it less attractive to potential investors.

On the other hand, if a company’s WACC is low, it can indicate that it is generating strong returns on its investments, making it more attractive to investors. A low WACC can also suggest that the company has a relatively low level of risk, which may make it more appealing to conservative investors looking for stable long-term investments.

Overall, interpreting the WACC requires understanding the factors that contribute to it and how these factors impact a company’s financial performance. By analysing the WACC, investors can gain valuable insights into a company’s financial health and investment potential, helping them make informed decisions about investing in a particular stock.

Frequently Asked Questions

The following are the limitations of WACC:

- It is predicated on hypotheses that might not precisely represent actual circumstances.

- Subjective decisions must be made to calculate the cost of equity and the relevant weights.

- WACC may alter due to market circumstances, making it less trustworthy for long-term projects.

Businesses, investors, and financial analysts use WACC to assess the appeal of investment prospects and choose the appropriate discount rate for valuation needs.

An example of WACC is when a company calculates its cost of debt, cost of equity, and the respective weights and then combines them to determine the overall weighted average cost of capital.

A 12% WACC means that the average company expects to generate a return of 12% to meet its cost of financing and satisfy investor expectations.

WACC) represents a company’s average cost of financing. Required rate of return, or RRR, refers to the minimum return investors demand from an investment.

Related Terms

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Hysteresis

- RevPAR

- REITS

- General and administrative expenses

- OPEX

- ARPU

- DCF

- NPL

- Capital expenditure (Capex)

- Balance of trade (BOT)

- Retail price index (RPI)

- Unit investment trust (UIT)

- SPAC

- GAAP

- GDPR

- GATT

- Irrevocable Trust

- Line of credit

- Coefficient of Variation (CV)

- Creative Destruction (CD)

- Letter of credits (LC)

- Statement of additional information

- Year to date

- Certificate of deposit

- Price-to-earnings (P/E) ratio

- Individual retirement account (IRA)

- Quantitative easing

- Yield to maturity

- Rights of accumulation (ROA)

- Letter of Intent

- Return on Invested Capital (ROIC)

- Return on Equity (ROE)

- Return on Assets (ROA)

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...