REITS

Table of Contents

REITS

Real estate financial trusts, or(REITs, have revolutionised the world of investing by giving people access to the real estate market without owning any real estate directly. The distinctive benefits of these investment vehicles have helped them become more popular. REITs provide diversification, expert management, and the opportunity for revenue through rent or property sales. There is potential for long-term capital appreciation for investors thanks to several REIT types that cater to particular real estate sectors.

What are REITs?

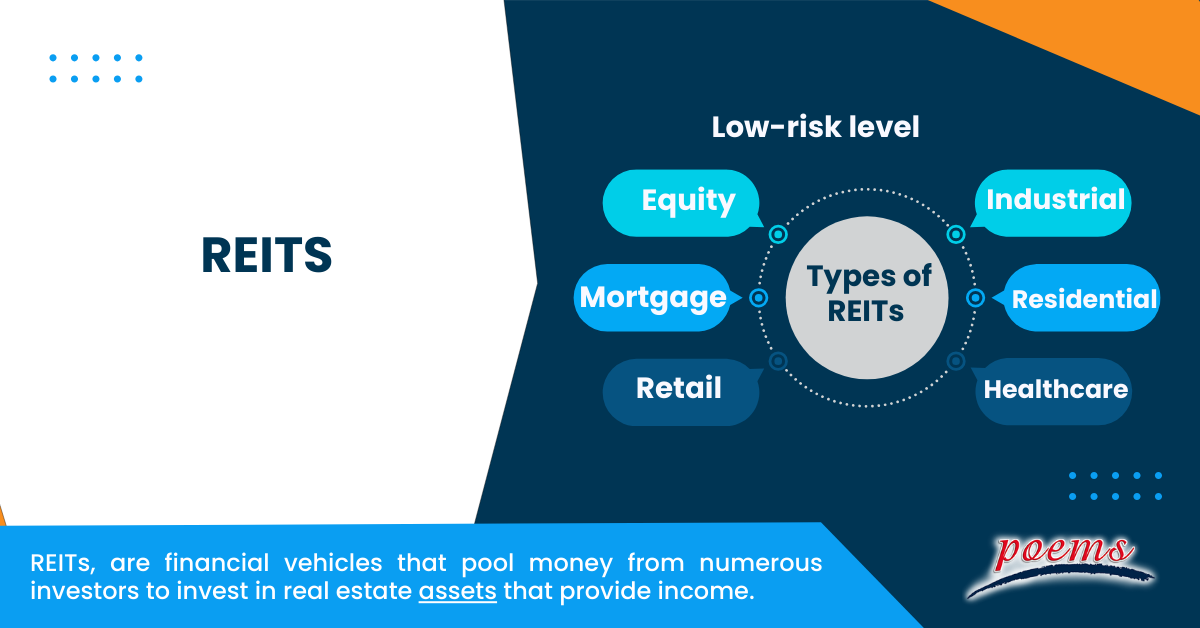

REITs, are financial vehicles that pool money from numerous investors to invest in real estate assets that provide income. Like mutual funds, REITs concentrate on real estate assets, including office buildings, residential complexes, retail locations, and industrial facilities, rather than equities or bonds.

Individual investors can own real estate through REITs and share the income from property sales or rental payments. They provide the advantages of diversity, expert management, and the possibility of consistent income distributions. REIT regulations include mandates to pay shareholders a sizable amount of their revenues as dividends.

Understanding REITs

In 1960, Congress amended the Cigar Excise Tax Extension to create REITs. The clause allows investors to purchase shares in commercial real estate portfolios, previously only possible for highly affluent people and through big financial intermediaries.

A REIT’s portfolio of properties includes apartment buildings, data centres, hospitals, hotels, infrastructure (such as fibre cables, cell towers, and energy pipelines), office buildings, retail spaces, self-storage facilities, timberland, and warehouses. REITs are experts in a particular area of real estate. Diversified and speciality REITs, on the other hand, could include a variety of property kinds in their portfolios, such as a REIT that owns both office and retail assets.

Types of REITs

The following are the types of REITs:

- Equity REITs

They invest primarily in income-generating properties such as office buildings, retail centres, apartments, hotels, or industrial properties. They generate income from rental payments and property appreciation.

- Mortgage REITs

They are also known as mREITs, and invest in mortgages and mortgage-backed securities. They generate income through interest earned on mortgage loans or mortgage-related investments.

- Retail REITs

They focus on investing in retail properties like shopping centres, malls, or standalone retail buildings.

- Residential REITs

They primarily invest in residential properties, including apartment buildings, single-family homes, or student housing.

- Industrial REITs

They specialise in industrial properties like warehouses, distribution centres, or manufacturing facilities.

- Healthcare REITs

They focus on investing in healthcare-related properties, such as hospitals, medical office buildings, or senior living facilities.

Benefits and risks of REITs

The following are the benefits of REITs:

- REITs allow investors access to a comprehensive portfolio of real estate assets across several sectors and geographical areas while lowering the risk of investing in a single property.

- Due to the requirement that a significant amount of REIT earnings be distributed as dividends, investors have access to a consistent income stream that is frequently higher than that of traditional equities or bonds.

- Investors are relieved of day-to-day operational obligations by REITs, managed by seasoned professionals handling property acquisition, leasing, and management.

- Since REITs are traded on stock exchanges, investors can access liquidity and straightforward buying and selling options.

- Due to rising real estate values and rental incomes, REITs may see long-term capital growth.

The following are the risks of REITs:

- REITs are prone to market volatility, and things like interest rates, the status of the economy, and the real estate market’s performance could impact their value.

- Rising interest rates can harm REITs since they may raise borrowing costs and influence property values.

- REITs with a specialised industry emphasis, like retail or hotel, may be more susceptible to risks and market trends that are unique to that industry.

- A high vacancy rate or tenant defaults can impact cash flow and dividends because REITs rely on tenants to generate rental income.

- Regulation adjustments and legal duties, such as tax laws and compliance standards, apply to REITs.

Understanding fees and taxes

Depending on the investment vehicle and management structure, REIT fees can change. Operational costs and management fees, which cover managing the portfolio, are included in standard prices. When purchasing or selling REIT shares, brokerage fees could be applicable. Investors should read the prospectus or offering materials to understand the fee schedule and related fees.

REITs are set up to benefit from specific tax advantages. If they transfer at least 90% of their taxable income to shareholders, they are often exempt from corporate income tax. Shareholders must pay taxes on their dividends, typically taxed at standard income rates, unless eligible dividend rates apply. Capital gains taxes may apply when selling REIT shares for a profit. Investors should consult a tax professional for specific tax implications related to their REIT investments.

Frequently Asked Questions

Diversification of portfolios, expert management, access to real estate investments without direct property ownership, and the chance for long-term capital appreciation are the reasons for investing in REITs.

Individuals can often purchase and sell REITs through brokerage accounts. They can select a particular REIT that piques their interest, place an order with their broker, and execute the transaction depending on the market price.

REITs primarily own income-generating real estate assets. This can include various property types such as office buildings, retail centres, apartments, hotels, industrial facilities, healthcare facilities, and other real estate properties that generate rental income or appreciate over time.

REITs make money from the income produced by their real estate assets, tenant rent, sales proceeds, and interest from mortgages or mortgage-backed securities. They give shareholders a sizable amount of their profits through dividends.

A business must fulfil specific criteria established by tax laws in the nation where it conducts business to be eligible to become a REIT. These prerequisites often involve investing in qualifying real estate assets, paying out a sizable amount of their taxable revenue as dividends to shareholders, and fulfilling confident ownership and operational standards stipulated in the tax legislation.

Related Terms

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Mark-to-market

- Federal Open Market Committee

- FIRE

- Applicable federal rate

- Assets under management

- Automated teller machine

- Central limit theorem

- Balanced scorecard

- Analysis of variance

- Annual percentage rate

- Double Taxation Agreement

- Floating Rate Notes

- Average True Range (ATR)

- Constant maturity treasury

- Employee stock option

- Hysteresis

- RevPAR

- General and administrative expenses

- OPEX

- ARPU

- WACC

- DCF

- NPL

- Capital expenditure (Capex)

- Balance of trade (BOT)

- Retail price index (RPI)

- Unit investment trust (UIT)

- SPAC

- GAAP

- GDPR

- GATT

- Irrevocable Trust

- Line of credit

- Coefficient of Variation (CV)

- Creative Destruction (CD)

- Letter of credits (LC)

- Statement of additional information

- Year to date

- Certificate of deposit

- Price-to-earnings (P/E) ratio

- Individual retirement account (IRA)

- Quantitative easing

- Yield to maturity

- Rights of accumulation (ROA)

- Letter of Intent

- Return on Invested Capital (ROIC)

- Return on Equity (ROE)

- Return on Assets (ROA)

Most Popular Terms

Other Terms

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...