Dividend Yield

Table of Contents

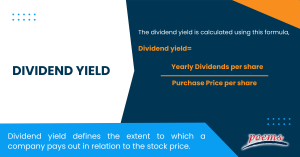

What Is Dividend Yield?

Dividend yield defines the extent to which a company pays out in relation to the stock price. This allows you analyze the companies that pay more dividends for every dollar you invest, and can give you a picture of the financial health of the company. Dividend yield is a financial ratio. It is an estimate of the dividend-only return for the stock investment.

Calculating Dividend Yield

The dividend yield is calculated using this formula,

Dividend yield = Yearly Dividends per share/ Purchase Price per share

The dividend yield can be evaluated from the financial report of the last full year. This is ideal in the first few months after the firm releases the annual report.

Dividends are usually paid out quarterly, so you can add a dividend payout for each quarter and find the yearly sum. If dividends are paid out monthly, then multiply the dividend by 12 to obtain a yearly dividend per share.

The dividend yield is expressed in percentage terms.

Advantages of Dividend Yields

Emphasizing on dividends can multiply returns instead of slowing them down. For instance, according to analysts at Hartford Funds, about 84% of the total returns from the Standard & Poors’ 500 Index are from the dividends.

Investors are likely to invest their dividends into the S&P 500, which results in their ability to gain more dividends in the future.

For instance, if an investor buys stock worth US$10,000 with a 4% dividend yield, and a share price of US$100 , this investor now owns 100 shares where everyone pays a dividend of US$4 per share ie 100 x 4 = US$400 in total.

Imagine that the investor utilises US$400 in dividends to buy four more shares. The purchase price would be adjusted based on the ex-dividend rate by US$4 per share to make it US$96 per share.

Reinvesting enables the purchase of (400/96) shares, ie 4.16 shares. And dividend investment programs facilitate fractional share purchases. If there are no other changes involved, then investors can hold (96+4+4.16) shares, ie 104.16 the next year, which is worth US$10,416.

Once the dividend is declared, this amount can be reinvested in more shares to compound gains similar to the savings account.

Disadvantages of Dividend Yields

Dividend yields may be impressive, but they are often at the expense of the overall growth of a company. This is because every dollar a firm pays in dividends to shareholders is assumed to be a dollar that a company does not reinvest to grow or earn more capital gains.

So, even if they don’t earn any dividends, shareholders can earn increased returns if the value of the stocks they hold increases as the company grows.

It is not advisable that investors evaluate a stock based only on dividend yield. This is because sometimes dividend data might be old or contain errors. Also, many firms often witness their stock price falling despite generating high yields.

Investors should also be cautious while evaluating a company which appears distressed or has an above-average yield. Since the stock price is the standard for calculating dividend yield, a huge downtrend can increase the quotient.

Dividend Yield Vs Dividend Payout Ratio

Dividend yield expresses how much a firm pays out in dividends per year, and is expressed as a percentage instead of a fixed dollar amount, which makes it easy to understand the returns shareholder can expect per dollar they invest. On the contrary, the dividend payout ratio is the measure of net earnings a company pays out in the form of dividends. Many believe that the dividend payout ratio is a great indicator of the ability of the company to ensure consistent dividend distribution. The dividend payout ratio is connected to the cash flow of a firm.

Example of Dividend Yield

If stock XYZ is trading at US$20 and pays an annual dividend of US$1 per share to the shareholders, and company ABC which trades at US$40, also has an annual dividend of US$1 per share, which one has a higher yield? The dividend yield of XYZ is (1/20=0.05) 5%, while for ABC, it is (1/40=0.025) only 2.5%. So, if all other things are equal, the investor would prefer XYZ over ABC since its dividend yield is double that of ABC.

Final thoughts

Dividend yield can be a good measure to evaluate stocks for investment needs. But this alone cannot be the only measure; so it is better to look beyond the numbers. With dividend yield, investors can evaluate the possible profit for every dollar invested, and analyze the potential risks of investing in a company. If you are into trading stocks, and shares, make sure to do it with a trading company with access to many global exchanges.

Frequently Asked Questions

A good dividend yield is anywhere between 2-6%, but various factors can influence it. Financial advisors can tell you if a specific dividend-paying stock is good. Dividend yields of 2-4% are good, and anything that exceeds this is great, but risky.

Dividend yields between 2-4% are good and safe options. However, when the dividend goes beyond 4%, and although the share may be a great purchase, this involves risk. So, it is recommended that you look at factors for business growth rather than going for only dividend yield.

Dividend yields can change every day since they are connected to the stock price. When stock prices increase, the yield falls, and vice versa. The dividend yield is the yearly payout divided by the stock price.

Related Terms

- Merger Arbitrage

- Intrinsic Value of Stock

- Callable Preferred Stock

- Growth Stocks

- Market maker

- Authorized Stock

- Dividend Discount Model

- Stock Shifts

- Seasoned Equity Offering

- Price to Book

- Stock Price

- Consumer Stock

- Undervalued Stocks

- Tracking Stock

- Income stocks

- Merger Arbitrage

- Intrinsic Value of Stock

- Callable Preferred Stock

- Growth Stocks

- Market maker

- Authorized Stock

- Dividend Discount Model

- Stock Shifts

- Seasoned Equity Offering

- Price to Book

- Stock Price

- Consumer Stock

- Undervalued Stocks

- Tracking Stock

- Income stocks

- Hang Seng Index

- Rally

- Ticker Symbol

- Defensive stock

- Earnings Guidance

- Wire house broker

- Stock Connect

- Options expiry

- Payment Date

- Treasury Stock Method

- Reverse stock splits

- Ticker

- Restricted strict unit

- Gordon growth model

- Stock quotes

- Shadow Stock

- Margin stock

- Dedicated Capital

- Whisper stock

- Voting Stock

- Deal Stock

- Microcap stock

- Capital Surplus

- Multi-bagger Stocks

- Shopped stock

- Secondary stocks

- Screen stocks

- Quarter stock

- Orphan stock

- One-decision stock

- Repurchase of stock

- Stock market crash

- Half stock

- Stock options

- Stock split

- Foreign exchange markets

- Stock Market

- FAANG stocks

- Unborrowable stock

- Joint-stock company

- Over-the-counter stocks

- Watered stock

- Zero-dividend preferred stock

- Bid price

- Authorised shares

- Auction markets

- Market capitalisation

- Arbitrage

- Market capitalisation rate

- Garbatrage

- Autoregressive

- Stockholder

- Penny stock

- Noncyclical Stocks

- Hybrid Stocks

- Large Cap Stocks

- Mid Cap Stocks

- Common Stock

- Preferred Stock

- Small Cap Stocks

- Earnings Per Share (EPS)

- Diluted Earnings Per Share

- Cyclical Stock

- Blue Chip Stocks

- Averaging Down

Most Popular Terms

Other Terms

- Real Return

- Protective Put

- Perpetual Bond

- Option Adjusted Spread (OAS)

- Non-Diversifiable Risk

- Liability-Driven Investment (LDI)

- Income Bonds

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Equity Carve-Outs

- Cost of Equity

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Earning Surprise

- Capital Adequacy Ratio (CAR)

- Bubble

- Beta Risk

- Bear Spread

- Asset Play

- Accrued Market Discount

- Ladder Strategy

- Junk Status

- Interest-Only Bonds (IO)

- Interest Coverage Ratio

- Inflation Hedge

- Industry Groups

- Incremental Yield

- Industrial Bonds

- Income Statement

- Holding Period Return

- Historical Volatility (HV)

- Hedge Effectiveness

- Flat Yield Curve

- Fallen Angel

- Exotic Options

- Execution Risk

- Exchange-Traded Notes

- Event-Driven Strategy

- Eurodollar Bonds

- Enhanced Index Fund

- Embedded Options

- EBITDA Margin

- Dynamic Asset Allocation

- Dual-Currency Bond

- Downside Capture Ratio

- Dollar Rolls

- Dividend Declaration Date

- Dividend Capture Strategy

- Distribution Yield

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Recognising Biases in Investing and Tips to Avoid Them

Common biases like overconfidence, herd mentality, and loss aversion influence both risk assessment and decision-making....

What is Money Dysmorphia and How to Overcome it?

Money dysmorphia happens when the way you feel about your finances doesn’t match the reality...

The Employer’s Guide to Domestic Helper Insurance

Domestic Helper insurance may appear to be just another compliance task for employers in Singapore,...

One Stock, Many Prices: Understanding US Markets

Why Isn’t My Order Filled at the Price I See? Have you ever set a...

Why Every Investor Should Understand Put Selling

Introduction Options trading can seem complicated at first, but it offers investors flexible strategies to...

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Effective stop-loss placement is a cornerstone of prudent risk management in forex trading. It’s not...

Boosting ETF Portfolio Efficiency: Reducing Tax Leakage Through Smarter ETF Selection

Introduction: Why Tax Efficiency Matters in Global ETF Investing Diversification is the foundation of a...

How to Build a Diversified Global ETF Portfolio

Introduction: Why Diversification Is Essential in 2025 In our June edition article (https://www.poems.com.sg/market-journal/the-complete-etf-playbook-for-singapore-investors-from-beginner-to-advanced-strategies/), we introduced...