Being Bearish

Table of Contents

Being Bearish

Bearish traders aim to profit from a market’s fall because they predict it will soon collapse in value. They are now competing with bulls, who might purchase a market in the hope of making a profit. A “bear” is an investor who is pessimistic about the market and believes that prices will fall.

What is being bearish?

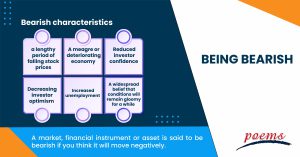

A market, financial instrument or asset is said to be bearish if you think it will move negatively. In finance, a “bearish trend” is a downward trend in the stock prices of a sector or a general decline in broad market indexes.

To be bearish in the stock market means to believe that stock prices will fall in the future. This can be based on several factors, such as economic indicators or company-specific news. Bearish investors may take several different actions, such as selling stocks, shorting stocks, or buying put options.

Understanding the term bearish

A bearish investor expects a widespread decline in stocks, bonds, commodities, currencies, or alternate investments like collectables. This investor expects a big and continuous decline.

The bears and their upbeat counterparts, the bulls, battle it out for dominance of the stock market, which is always in flux. On average, the US stock market has grown by around 10% annually, including dividends, during the last hundred years or so.

A person may have bearish viewpoints on a particular business or various assets. A trader with negative thoughts can decide whether or not to act on them. If the trader takes action, they can go short or sell the shares they already possess. Since market attitude is a significant driver of how the financial markets move, traders must be able to spot bearish trends.

Traders who are bearish on an asset predict a decline in its price. These investors may choose to act on this conviction. They can sell their shares or trade a stock short if they decide to take action. In other words, they borrow shares from their broker, sell them on the open market, and then plan to purchase them back at a lower price when the market recovers.

Bearish behaviour

When there is a lot of bearish behaviour in the stock market, some investors get concerned that this could signal a market crash. However, it is crucial to remember that the stock market is notoriously volatile, and there are always ups and downs. While a market crash is always a possibility, it is no certainty. So, the best action is to keep a close eye on the market and see how it develops.

Fear is the main emotion felt by investors who anticipate a bear market. That particular worry is that wealth will be destroyed by an approaching downturn.

Due to their gloomy outlook on the market, bears employ several approaches that, in contrast to conventional investment strategies, benefit when the market declines and incur losses when it rises. Short selling is the most popular of these strategies.

The buy-low, sell-high philosophy of conventional investing is the opposite of this technique. Short sellers, who think the price will fall, purchase cheap and sell higher, but in reverse, selling first and purchasing later.

Bearish characteristics

Bearish characteristics include:

- a lengthy period of falling stock prices (often by at least 20% and lasting at least two months)

- A meagre or deteriorating economy

- Reduced investor confidence

- Decreasing investor optimism

- Increased unemployment

- A widespread belief that conditions will remain gloomy for a while

An example of being bearish

A good example of a bear in the stock market is someone who sold his stocks in February 2020 before the COVID-19 pandemic caused the market to crash. This person would have bought stocks in March or April when the market was at its lowest point.

One of the most famous examples includes The “great bear of Wall Street” in the 1920s, a famous stockbroker named Jesse Livermore. His most well-known investment was a short position he took during the 1929 stock market crisis, which brought him 100 million US$.

Frequently Asked Questions

There are several potential causes of bearishness in the stock market. One is that stock prices are inherently volatile and can go down and up. Another potential cause is that investors may be concerned about the economy’s overall health and may choose to sell off stocks. Additionally, political or geopolitical instability can also lead to bearishness in the stock market, as investors may be concerned about the potential for instability and uncertainty.

When the price of stocks on the market falls steadily over time, it is said to be in a bear market. Typically, a bear market is deemed to exist when an investment’s price declines by at least 20% from its peak.

It is believed that the words “bear” and “bull” came from how each animal attacked its prey. More elaborately, a bull will raise its horns in the air, but a bear will lower them. The behaviour of a market was then symbolically compared to these actions.

Bear markets can have disastrous effects on the country’s wealth, although they typically only last a short while. In reality, a bear market only lasts 9.6 months on average. The stock market decline often ends in less than a year.

US bear markets have typically lasted 289 days which is around 9.50 months. In comparison, bull markets typically continue for two years and eight months.

When bearish, there are a few things to consider before investing in the stock market. First, it is important to understand the current market conditions clearly. It is also crucial to have a clear investment strategy. Additionally, it is necessary to diversify your portfolio and to have patience.

Don’t forget to focus on the following points:

- Invest in industries that do well during economic downturns.

- Consider the long term.

- Become friends with dollar-cost averaging.

Related Terms

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Leverage

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Consensus Estimate

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Notional Value

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...