Racketeering

Table of Contents

Racketeering

Racketeering is the illegal practice of extorting money or other benefits from someone in return for protection or other favors. In the world of finance, racketeering can take many forms, from insider trading and fraud to money laundering and embezzlement.

Racketeering is a serious problem in the financial world, and it can have devastating consequences for individuals and businesses. Victims of racketeering can lose their life savings, and companies can be forced into bankruptcy. Racketeers often operate in the shadows, making their activities difficult to detect and prosecute.

What is racketeering?

The use of force, deception, or intimidation to gain money is referred to as racketeering. It includes setting up, overseeing, or maintaining a dishonest business that commits crimes (a “racket”). Identity theft, cyber extortion, and credit card fraud are all examples of modern-day racketeering operations.

Racketeering is a legal word for activities performed as part of a continuing criminal business. The phrase is most frequently connected with the actions of organized criminal groups, such as the Mafia, although it has recently been extended to any persistent unlawful activity or plan.

Coming to the financial industry, racketeering encompasses the purchase, operation, or use of a business for unlawful conduct. Operators on Wall Street have been accused of racketeering for fraud and insider trading.

Understanding racketeering

Organized groups can run rackets—illegal companies. A coordinated group may steal money from a legitimate company for illicit purposes. Rackets are generally operated in blatantly unlawful fields, such as prostitution, human trafficking, drug trafficking, the sale of illegal weapons, or counterfeiting.

Additionally, accusations of racketeering frequently target labor unions. Organized crime groups often employ one or more labor unions (s) to demand money from a business or contractor. In other instances, organizations use unions to control employees.

How does racketeering work?

In general, “racketeering” refers to a pattern of engaging in illegal behavior as a component of a broader criminal organization, be it a legitimate company or an illicit organized crime group like a gang. Racketeering involves profit-generating illegal actions like extortion, bribery, and the threat of violence but might appear as normal economic activity.

Numerous crimes are classified as racketeering under the US Racketeer Influenced and Corrupt Organizations (RICO) Act. RICO was enacted in 1970 to deal with organized crime’s invasion of respectable businesses. All actions or threats involving the following are considered to be the most serious crimes:

- Murder

- Kidnapping

- Arson

- Robbery

- Bribery

- Gambling

- Extortion

- Dealing in obscene matter

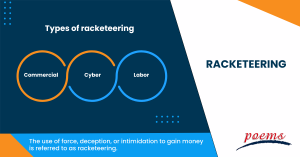

Types of racketeering

The types of racketeering are listed as follows:

- Commercial racketeering

A nightclub or store might be compromised by organized crime, which would then utilize it as a front for crimes including gambling, extortion, money laundering, and loan sharking. For instance, an organized crime figure may intimidate a business owner into selling it to a criminal, who will then use it for loan-sharking or predatory lending, or a drug dealer may use the earnings from drug sales to run a legal business.

- Cyber racketeering

Online racketeering is also possible. Criminal groups frequently use technological hacking techniques to steal money and information from people, companies, and government institutions when committing cyber-racketeering crimes. People who have utilized phishing emails, fraudulent online auctions, spyware, or impersonated customer service on websites like eBay have been charged with federal racketeering.

- Labor racketeering

Criminals that engage in labor racketeering do so to manipulate workforces, employee benefit schemes, or labor unions for their own financial or personal gain. Employer extortion through picketing, sabotage, or work stoppages is one of the crimes committed. They might also entail asking the employer for money in exchange for disobeying the collective bargaining agreement with the union. Benefit plan fraud may also be considered a form of labor espionage.

Example of racketeering

To better understand racketeering, let’s look at the following example:

In the late 1980s, Michael Milliken was accused of racketeering. The case marked one of the first times racketeering charges were brought against a person unrelated to organized crime.

Managing the division for high-yield bonds at Drexel Burnham Lambert, Milliken worked there on Wall Street.

He was a significant contributor to the market for trash bonds. After a nearly 10-year FBI investigation, Milliken was charged in 1989 with insider trading and securities fraud offenses.

Frequently Asked Questions

The term “racketeering activity” refers to various offenses that entail committing, conspiring to commit, trying to commit, or knowingly encouraging, coercing, soliciting, or threatening another person to commit one of several crimes. Gambling, drug and weapon offenses, murder, extortion, assault, prostitution, breaches of securities laws, coercion, arson, money laundering, bribery, and forgery are a few examples of felonies.

Racketeering is often used interchangeably with money laundering, but the two activities differ. Money laundering conceals the origins of illegally obtained money, while racketeering uses illegal activities to generate income. While money laundering is criminal, racketeering is often considered a white-collar crime.

Racketeering activity under the RICO statute includes a wide range of criminal activity, including everything from bribery and extortion to money laundering and trafficking in narcotics. To be convicted of racketeering under RICO, the government must prove that the defendant participated in at least two instances of racketeering activity and that those activities were part of a criminal enterprise. RICO convictions carry stiff penalties, including lengthy prison sentences and significant fines.

Charges may be brought against someone who allegedly took part in at least two instances of racketeering. The prosecution must demonstrate that the defendant took part in a criminal operation. The business must also impact interstate commerce, or the exchange of goods, services, or money across state lines.

The Racketeer Influenced and Corrupt Organizations Act (RICO) is a federal law in the United States that targets white-collar and organized crime. It has been effectively applied to prosecute hundreds of people and organizations in the US since its enactment in 1970.

RICO offers a feasible way to prove that organized crime has infiltrated labor unions and removed dishonest union leaders from their positions of authority.

Related Terms

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Leverage

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Consensus Estimate

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Notional Value

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...