Operating expenses

Table of Contents

Operating expenses

Businesses and organisations utilise various terminologies and metrics in finance and accounting to gauge their financial performance and make informed decisions. One vital aspect of this evaluation is understanding and analysing operating expenses. Operating expenses, often abbreviated as OpEx, are significant in determining a company’s profitability and efficiency. This formal introduction will provide an extensive overview of operating costs, their significance, types, and examples, along with addressing some common questions related to this financial term.

What are operating expenses?

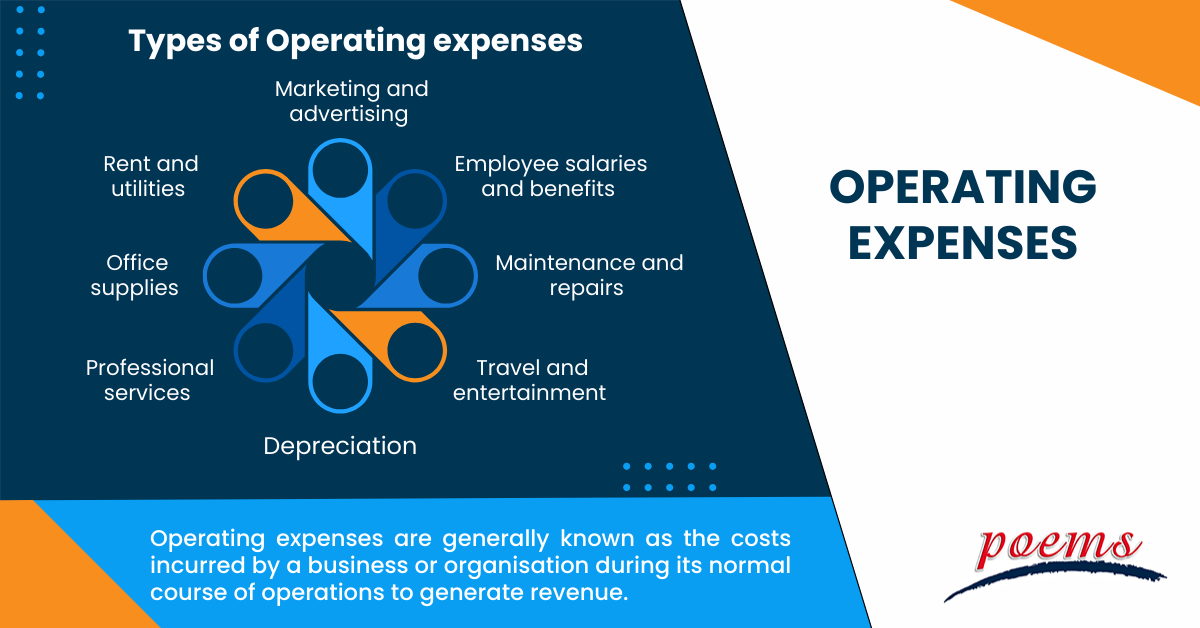

Operating expenses are generally known as the costs incurred by a business or organisation during its normal course of operations to generate revenue. These expenses are essential for running day-to-day activities and sustaining the business’s core operations. Operating expenses can vary from industry to industry, but they typically encompass a wide range of expenditures necessary to maintain the company’s ongoing functions.

Understanding and managing operating expenses is critical for organisations to analyse their financial health, enhance profitability, and make educated decisions regarding resource allocation and cost-cutting methods. By properly working these expenditures, businesses may improve their competitive position and assure long-term growth.

Understanding operating expenses

Operating expenses are necessary for the company’s effective operation, but they do not include costs associated with long-term investments or the acquisition of assets. Employee salary, utilities, rent, marketing, office supplies, travel, and insurance are all examples of operating expenses.

Understanding operating expenses is crucial for companies to maintain their financial health efficiently. Controlling and optimising operating expenses may directly influence a company’s profitability. Businesses may enhance their bottom line and stay competitive by cutting unwarranted expenditures, optimising operations, and negotiating better contracts. Thus, lowering operating expenses while maintaining or increasing revenue can lead to improved profitability and enhanced competitiveness in the market.

Analysing operating expenses over time enables companies to discover trends, distribute resources efficiently, and make educated budgeting and financial planning decisions. Operating expense ratios, such as the operating expense ratio, or OER, assist analyse a company’s efficiency by comparing operating expenses to revenue. Lower OER suggests greater cost management and, perhaps, increased profitability.

Benefits of operating expenses

Understanding and managing operating expenses offer several benefits to businesses:

- Profitability assessment

Businesses can determine their profitability margins and gauge their financial health by comparing operating expenses to revenue.

- Cost control

Identifying and controlling operating expenses can help organisations reduce unnecessary expenditures and enhance overall cost management.

- Decision-making

Knowledge of operating expenses aids in making informed decisions, such as pricing strategies, budget allocation, and investment opportunities.

- Investor confidence

Investors and stakeholders often scrutinise operating expenses to look into a company’s financial stability and potential for long-term growth.

- Competitive advantage

Lowering operating expenses may give a company an edge over competitors by selling products or services at lower rates or investing in sectors that improve the customer experience.

- Stability of cash flows

Lowering operational expenses can increase cash flow, giving the organisation greater financial security and flexibility.

Types of operating expenses

Operating expenses encompass various categories of expenditures incurred in day-to-day business activities. Common types of operating expenses include:

- Employee salaries and benefits

Employee compensation includes wages, salaries, bonuses, health benefits, and retirement contributions.

- Rent and utilities

Expenses related to office space, warehouses, utilities (electricity, water, etc.), property taxes, and insurance.

- Marketing and advertising

Costs associated with promoting products or services, including advertising campaigns, market research, and public relations.

- Office supplies

Expenditures on essential office supplies such as stationery, printer ink, and other consumables.

- Depreciation

The allocation of the cost of tangible assets (e.g., machinery, equipment) over their useful life.

- Maintenance and repairs

Costs for regular equipment, machinery, and facilities maintenance and repairs.

- Professional services

Fees paid to external consultants, legal services, accounting, and auditing firms.

- Travel and entertainment

Expenses related to business travel, client meetings, and entertainment for business purposes.

Examples of operating expenses

Here are some practical examples of operating expenses:

- Employee salaries and wages for the company’s workforce.

- Rent and utilities for office spaces and facilities.

- Marketing expenses for advertising campaigns and promotional activities.

- Office supplies and consumables are required for daily operations.

- Depreciation of machinery and equipment.

- Maintenance and repair costs for equipment upkeep.

- Legal and accounting fees for professional services.

- Travel expenses for business-related trips.

Frequently Asked Questions

As explained above, operating expenses are incurred during regular business operations to generate revenue. On the other hand, operating income (also known as operating profit or EBIT – earnings before interest and taxes) is the revenue remaining after deducting operating expenses from total revenue. Operating income represents a company’s core profitability before accounting for interest expenses, taxes, and other non-operating items.

Yes, employee salaries and wages are considered operating expenses because they are necessary for running a business’s day-to-day operations. These expenses directly relate to the workforce responsible for generating revenue and conducting core business activities.

As discussed earlier, operating expenses are incurred during regular business operations to generate revenue. On the other hand, non-operating expenses are expenditures that do not directly relate to the company’s primary business activities. Non-operating expenses include interest expenses on loans, losses from the sale of assets, and one-time charges or gains that are not part of the core operations.

Cost and operating expenses are related but distinct concepts. Cost generally refers to the monetary value of goods or services required to produce a particular item or perform an activity. In a business context, costs can include direct costs (e.g., materials and labour) and indirect costs (e.g., overhead expenses). Operating expenses, as explained before, are specifically about the ongoing expenditures necessary for the daily functioning of a business.

OpEx in accounting refers to the day-to-day expenses incurred by a business or organisation to maintain its operations and generate revenue. These expenses are essential for the regular functioning of the company and do not include costs associated with capital investments or non-recurring transactions. OpEx is a critical metric to assess a business’s financial performance and efficiency.

Related Terms

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Leverage

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Consensus Estimate

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- Options expiry

- Adjusted distributed income

- International securities exchanges

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Margin Requirement

- Mark-to-market

- Pledged Asset

- Yield Pickup

- Subordinated Debt

- Treasury Stock Method

- Stochastic Oscillator

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Notional Value

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...