Collateral

Table of Contents

Collateral

You might need a loan if you’re a small business owner to finance your enterprise. A business loan is difficult to obtain. Secured loans and unsecured loans are the two types of loans that financial organisations give. The key distinction between the two is the collateral requirement for fast loans.

An asset known as collateral lowers the risk for a lender by shielding him from potential borrower default. Lenders can recover losses by selling the collateral.

What is collateral?

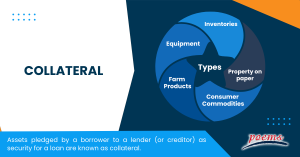

Assets pledged by a borrower to a lender (or creditor) as security for a loan are known as collateral.

Generally speaking, loans with collateral have lower interest rates than loans without. The lender’s risk of default is decreased when business loans are secured. The borrower is also more inclined to repay the loan if they know they could lose their collateral.

Borrowers generally look for credit on factors like commercial real estate, residential or transportation equipment, manufacturing supplies, or even intangibles (like intellectual property) for businesses. If a loan exposure is supported by collateral, it is referred to as a secured credit; otherwise, it is referred to as an unsecured exposure.

Understanding collateral

The interest rates on loans with collateral are typically substantially lower than those on unsecured loans. A lien is a legitimate claim by a lender against a borrower’s property to settle a debt. The borrower has a strong incentive to repay the loan because he risks losing his home or other assets used as collateral if he does not.

The lender may seize collateral—a valuable item—from the borrower if he fails to repay a loan according to the terms stipulated in the agreement. One such example is when you take out a mortgage. The bank will typically require your home as collateral.

This implies that the bank has the authority to seize your property if you are unable to meet the conditions of your mortgage repayment. Collateral guarantees that the lenders will still receive their money even if the borrower defaults on the loan, allowing the bank to sell your home in order to collect the loaned money.

How collateral works

The financial organisation assesses your ability to repay the loan before approving it. It needs some sort of security, which lowers its danger. The lender may seize and sell the deposit if you’re unable to make your loan payment. The potential loss of your asset ensures that you make your loan repayments on time, and the collateral depends on the loan’s terms.

For instance, the collateral for a home loan would be the house itself. Similarly, the car serves as security when you obtain a vehicle loan. A variety of assets can also back other forms of borrowing.

Types of collateral

Consumer commodities, equipment, farm products, inventories, and property on paper are the five basic categories of collateral.

- Customer goods, such as cars, are items that the average consumer buys.

- Items primarily employed in commercial or governmental operations are considered equipment.

- Crops and cattle are examples of farm products.

- Work in progress or raw materials makes up inventory.

Examples of collateral

The following are typical collateral examples:

- Mortgages for homes

A loan with a mortgage uses the home as collateral. The loan servicer may begin legal action if the homeowner misses at least 120 days of mortgage payments. By completing these steps, the lender may eventually be able to foreclose on the property and seize control. Once the property has been transferred to the lender, the remaining principal on loan may be repaid by selling the property.

- Loans for a home equity

A house may also be collateral for a second mortgage or home equity line of credit. The amount of the loan in this situation won’t be greater than the equity that is accessible. For instance, if a home is worth 200,000 US$ and the original mortgage has a balance of 125,000 US$, only 75,000 US$ will be accessible for a second mortgage.

Frequently Asked Questions

Each Family Member of a Requesting Party, SNH, RMR LLC, and any other Person who Constructively Owns Common Shares as a result of attribution under the Code from one or more of the Requesting Parties (or their estates or spouses), SNH, or RMR LLC are all considered “Collateral Persons” (other than SNH and the Requesting Parties, and, upon the death of any Requesting Party who is an individual, their estates and spouses).

Cash and Non-Cash Collateral Management, Swap Agent Operations, Collateral Client Services, Reconciliations, and Change Management make up the Collateral Operations team.

Three factors—the desire to reduce counterparty risk, the ability to enable more favourable pricing of credit risk, and improved market access— contribute to the growing significance of collateral management.

A valuable item is pledged as security for a loan. Collateral reduces the risk to lenders. If a borrower defaults on the loan, the lender has the right to sell the collateral to recoup losses.

Collateral can reduce risk to lenders by providing them with an asset they can seize if the borrower defaults on the loan. This can provide security for the lender and help them recoup their losses if the loan goes bad.

However, it is important to note that collateral is not a fool-proof way to reduce risk, as there is always the possibility that the collateral itself may not be worth enough to cover the loan. In addition, even if the collateral is valuable, the borrower may still default on the loan, in which case the lender would still suffer a loss.

Four qualities of high-quality collateral are:

- Being easily quantifiable and having a value adequate to pay off the loans it is securing.

- Holding its worth for the whole loan term.

- Being easily susceptible to foreclosure or having its ownership changed.

- Being in a liquid state.

Related Terms

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Devaluation

- Grading Certificates

- Distributable Net Income

- Cover Order

- Tracking Index

- Auction Rate Securities

- Arbitrage-Free Pricing

- Net Profits Interest

- Borrowing Limit

- Algorithmic Trading

- Corporate Action

- Spillover Effect

- Economic Forecasting

- Treynor Ratio

- Hammer Candlestick

- DuPont Analysis

- Net Profit Margin

- Law of One Price

- Annual Value

- Rollover option

- Financial Analysis

- Currency Hedging

- Lump sum payment

- Annual Percentage Yield (APY)

- Excess Equity

- Fiduciary Duty

- Bought-deal underwriting

- Anonymous Trading

- Fair Market Value

- Fixed Income Securities

- Redemption fee

- Acid Test Ratio

- Bid Ask price

- Finance Charge

- Futures

- Basis grades

- Short Covering

- Visible Supply

- Transferable notice

- Intangibles expenses

- Strong order book

- Fiat money

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Consensus Estimate

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- Bond Convexity

- Compound Yield

- Brokerage Account

- Discretionary Accounts

- Industry Groups

- Growth Rate

- Green Bond Principles

- Gamma Scalping

- Funding Ratio

- Free-Float Methodology

- Foreign Direct Investment (FDI)

- Floating Dividend Rate

- Flight to Quality

- Real Return

- Protective Put

- Perpetual Bond

- Option Adjusted Spread (OAS)

- Non-Diversifiable Risk

- Merger Arbitrage

- Liability-Driven Investment (LDI)

- Income Bonds

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Equity Carve-Outs

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Earning Surprise

- Bubble

- Beta Risk

- Bear Spread

- Asset Play

- Accrued Market Discount

- Ladder Strategy

- Junk Status

- Intrinsic Value of Stock

- Interest-Only Bonds (IO)

- Inflation Hedge

- Incremental Yield

- Industrial Bonds

- Holding Period Return

- Hedge Effectiveness

- Flat Yield Curve

- Fallen Angel

- Exotic Options

- Execution Risk

- Exchange-Traded Notes

- Event-Driven Strategy

- Eurodollar Bonds

- Enhanced Index Fund

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Elite UK REIT Shows Strong Performance with Successful Lease Regearing

Company Overview Elite UK REIT is a real estate investment trust focused on UK commercial properties, with a significant portfolio concentration in assets leased to the Department for Work and Pensions (DWP). The REIT manages a diversified property portfolio valued at £424.6 million, comprising large, medium, and smaller-sized commercial assets across the United Kingdom. Strong Financial Performance Driven by Strategic Initiatives Elite UK REIT delivered impressive results for the second half and full year 2025, with distribution per unit (DPU) reaching 1.49 pence for 2H25 and 3.03 pence for FY25, representing year-over-year growth of 1.4% and 5.6% respectively.The full-year DPU met Phillip Securities Research’s FY25 forecast, while the 2H25 contribution accounted for 49% of the projected total. The growth was primarily attributed to interest savings from a reduced cost of debt, which decreased from 4.9% in FY24 to 4.7% in FY25, alongside contributions from newly acquired assets. These factors contributed to a substantial 7.4% year-over-year increase in distributable income, reaching £18.3 million in FY25. Major Lease Regearing Success Addresses Key Risk The REIT achieved a significant milestone by successfully regearing approximately 70% of its DWP portfolio, representing £24.3 million in rent, well ahead of the 2028 lease expiry deadline. This strategic accomplishment increased the weighted average lease expiry (WALE) dramatically from 2.4 years to 7.2 years, with leases primarily regeared for longer tenors of 7 and 10 years. The regeared leases feature CPI-linked rent reviews scheduled for 2033, with compounded annual rent increases ranging between 1% and 5% and notably contain no lease break clauses. Additionally, the Peel Park asset received planning approval for data centre facility use, potentially unlocking significant divestment value. Investment Recommendation and Outlook Phillip Securities Research upgraded Elite UK REIT to BUY with a higher target price of S$0.41, increased from the previous S$0.39, based on a dividend discount model approach. The REIT offers an attractive FY26 dividend yield of approximately 8.9%, considerably higher than the broader S-REITs market distribution yield of around 6% in 2025. A potential upside catalyst includes a DPU-accretive divestment of Peel Park, which currently represents approximately 10% of the total portfolio value and stands as the largest asset by value. Key Takeaways Q: What drove Elite UK REIT's improved financial performance in FY25? A: The 5.6% year-over-year growth in FY25 DPU was driven by interest savings from a lower cost of debt (decreasing from 4.9% to 4.7%) and contributions from newly acquired assets, resulting in 7.4% growth in distributable income to £18.3 million. Q: How successful was the lease regearing with DWP? A: Elite successfully regeared around 70% of the DWP portfolio representing £24.3 million in rent, significantly ahead of the 2028 lease expiry. This increased WALE from 2.4 years to 7.2 years with leases regeared for 7 and 10-year tenors. Q: What is Phillip Securities Research's recommendation and target price? A: Phillip Securities Research upgraded Elite UK REIT to BUY with a target price of S$0.41, increased from the previous S$0.39, based on a dividend discount model approach. Q: How does Elite's dividend yield compare to the broader market? A: Elite offers an FY26 dividend yield of approximately 8.9%, which is considerably higher than the S-REITs market distribution yield of around 6% in 2025. Q: What are the key features of the regeared leases? A: The regeared leases have no break clauses, feature CPI-linked rent reviews in 2033 with compounded annual rent increases of 1-5% and include renewal options for DWP extending leases by five years for 2035 expiries and three years for earlier expiries. Q: What potential upside catalyst exists for the REIT? A: A potential DPU-accretive divestment of Peel Park, which represents approximately 10% of total portfolio value and is the largest asset by value, especially after receiving planning approval for data centre facility use. Q: How did the portfolio valuation perform? A: The latest portfolio valuation showed an uplift of approximately 2% year-over-year to £424.6 million, with 72% of large assets appreciating in value and 43% delivering double-digit valuation gains, offsetting declines in smaller assets. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Alphabet Posts Strong Q4 Results with Record Cloud Growth

Company Overview Alphabet Inc., the parent company of Google, operates as a leading technology conglomerate with core business segments spanning search advertising, YouTube, and cloud computing services. The company's primary revenue drivers include Google Search, YouTube advertising, and Google Cloud Platform (GCP), positioning it as a dominant player in the digital advertising and cloud infrastructure markets. Q4 2025 Financial Performance Exceeds Expectations Alphabet reported impressive fourth-quarter 2025 results that surpassed analyst forecasts, with total revenue climbing 18% year-over-year to US$114 billion and net income surging 30% to US$34.5 billion. The robust performance was primarily driven by strong execution across both advertising and cloud segments, with full-year revenue and net income reaching 97% and 108% of forecasted levels, respectively. Core Business Segments Drive Growth The company's advertising business demonstrated remarkable resilience, with Google Search revenue posting its fastest growth in four years at 17% year-over-year to US$63 billion. This acceleration was fuelled by retail vertical strength and enhanced ad efficiency through Gemini 3 integration. YouTube advertising revenue maintained solid momentum with 9% growth to US$11.4 billion, supported by increased political advertising spending during the election period and continued expansion of Shorts and Living Room monetisation. Cloud Business Achieves Milestone Growth Google Cloud delivered exceptional results, recording its fastest revenue growth since 2021 with a 48% year-over-year increase to US$17.7 billion, establishing an annual run rate exceeding US$70 billion. This outstanding performance was underpinned by a doubled client base, significant large-scale customer commitments with billion-dollar deals surpassing the previous three years combined, and existing customers expanding usage by over 30% beyond initial contracts. Revenue from GenAI-based products experienced explosive growth of nearly 400% year-over-year. Research Recommendation and Outlook Phillip Securities Research downgraded Alphabet to an ACCUMULATE rating following recent price appreciation but raised the DCF target price to US$395 from US$340. The revised valuation reflects confidence in Alphabet's competitive positioning through continuous Gemini upgrades and AI integration capabilities. Looking ahead to fiscal 2026, analysts project advertising segment growth of approximately 16% year-over-year, while the cloud segment is expected to maintain strong momentum with anticipated 45% growth. Key Takeaways Q: What were Alphabet's key financial highlights for Q4 2025? A: Alphabet reported revenue of US$114 billion (up 18% YoY) and net income of US$34.5 billion (up 30% YoY), with performance exceeding expectations across both advertising and cloud segments. Q: How did Google's advertising business perform? A: Google Search revenue grew 17% YoY to US$63 billion, marking the fastest growth in four years, while YouTube advertising revenue increased 9% YoY to US$11.4 billion, driven by retail vertical strength and election-related spending. Q: What drove Google Cloud's exceptional performance? A: Cloud revenue surged 48% YoY to $17.7 billion, driven by a doubled client base, billion-dollar deals exceeding the previous three years combined, and existing customers expanding usage by over 30% beyond initial commitments. Q: How significant was GenAI revenue growth? A: Revenue from GenAI-based products grew nearly 400% year-over-year in Q4 2025, compared to 200% growth in the previous quarter, demonstrating strong monetisation of AI capabilities. Q: What is Phillip Securities Research's recommendation and target price? A: The firm downgraded Alphabet to ACCUMULATE due to recent price performance but raised the target price to US$395 from US$340, citing confidence in the company's AI integration and competitive positioning. Q: What are the growth projections for fiscal 2026? A: Analysts forecast advertising segment growth of approximately 16% year-over-year and cloud segment growth of 45% year-over-year for fiscal 2026. Q: What factors support the cloud business outlook? A: The cloud segment is supported by strong demand, Alphabet's ability to monetise its GenAI portfolio, expanding operating margins, and a cloud backlog that grew 55% sequentially to US$240 billion. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

AMD Posts Strong Q4 Results on Clear GPU Roadmap, Rising CPU Demand

Company Overview Advanced Micro Devices Inc. (AMD) is a leading semiconductor company that designs and manufactures high-performance computing processors, graphics processing units (GPUs), and related technologies. The company serves multiple markets including data centres, personal computers, gaming, and artificial intelligence applications, competing directly with industry giants like Intel and Nvidia. Strong Financial Performance Drives Upgrade AMD's fourth quarter 2025 results exceeded expectations, with revenue meeting forecasts at 100% of projected levels while profit after tax and minority interest (PATMI) surpassed expectations at 112% of forecasts. This outperformance was primarily driven by robust sales of Instinct MI350 series GPUs and EPYC CPUs. The company's data centre segment emerged as the primary growth driver, with revenue accelerating 39% year-over-year to US$5.4 billion, representing 52% of total quarterly revenue compared to 47% in the previous quarter. Investment Merits and Future Outlook AMD's strategic positioning in the data center market appears particularly compelling. Management expressed confidence in achieving annual data center segment revenue growth exceeding 60% over the next three to five years, supported by strength in both Instinct GPU and EPYC CPU product roadmaps. The company's GPU development timeline shows clear progression, with MI400 series GPUs and Helios products scheduled to ramp in the second half of 2026, followed by MI500 series GPUs featuring advanced 2nm-process technology and HBM4E memory launching in 2027. Margin Expansion and Market Share Gains The higher proportion of data centre revenue drove significant margin expansion, with gross and net margins increasing 360 and 130 basis points year-over-year respectively. Data centre operating margins reached 32.6%, the highest level since the first quarter of 2022. AMD continued gaining server CPU market share from Intel, whose performance was constrained by supply issues. The client PC segment also maintained momentum with ten consecutive quarters of growth, achieving 34% year-over-year revenue increase to US$3.1 billion. Research Recommendation Based on these strong fundamentals and clear growth trajectory, Phillip Securities Research upgraded AMD to BUY from ACCUMULATE, maintaining a target price of US$280. The upgrade reflects confidence in AMD's competitive positioning and execution capabilities across both GPU and CPU product lines. Key Takeaways Q: What were AMD's key financial highlights for Q4 2025? A: AMD's Q4 2025 revenue met expectations at 100% of forecasts, while PATMI exceeded expectations at 112% of projections. Data center revenue grew 39% year-over-year to $5.4 billion, representing 52% of total quarterly revenue. Q: What is AMD's growth outlook for the data center segment? A: AMD expects to grow data center segment revenue by more than 60% annually over the next 3-5 years, driven by strength in its Instinct GPU and EPYC CPU roadmap. Q: What new GPU products does AMD have planned? A: AMD's GPU roadmap includes MI400 series GPUs and Helios ramping in the second half of 2026, followed by MI500 series GPUs with advanced 2nm-process technology and HBM4E memory launching in 2027. Q: How did AMD's margins perform in Q4 2025? A: Gross and net margins increased 360 and 130 basis points year-over-year respectively, driven by higher MI350 GPU sales and increased data center revenue mix. Data center operating margins reached 32.6%, the highest since Q1 2022. Q: What is Phillip Securities Research’s recommendation? A: Phillip Securities Research upgraded AMD to BUY from ACCUMULATE while maintaining the target price at US$280, reflecting confidence in the company's growth trajectory and competitive positioning. Q: How did AMD's client PC business perform? A: Client PC revenue rose 34% year-over-year to $3.1 billion, marking the tenth consecutive quarter of growth. Ryzen CPU sell-through grew by more than 40% year-over-year with major customer wins across multiple industries. Q: What contributed to AMD's market share gains? A: AMD gained server CPU market share from Intel, whose performance was constrained by supply issues. In the data center, hyperscalers like AWS and Google launched more than 230 new AMD instances compared to 100 instances in the previous year. Q: Were there any notable regional sales? A: Yes, AMD recorded US$390 million of MI308 sales to China, representing 4% of Q4 2025 revenue, which was previously not included in company guidance. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

First REIT Faces Currency Headwinds Despite Stable Operations

Financial Performance Overview First REIT (FIRT) reported its 2H25/FY25 distribution per unit (DPU) results of 1.04 and 2.17 Singapore cents representing declines of 10.3% and 8.1% year-on-year respectively. Theese figures were in line with market expectations, accounting for 48% and 100% of FY25 forecasts. The year-on-year decline was primarily attributed to the depreciation of the Indonesian Rupiah (IDR) and Japanese Yen (JPY) against the Singapore Dollar, though this was partially mitigated by increased local-currency rental income and reduced finance costs. Strategic Developments and Portfolio Changes FIRT completed the divestment of its non-core Imperial Aryaduta Hotel & Country Club (IAHCC) on December 4, 2025. Following the redemption of S$33.3 million of 4.9817% subordinated securities in January 2026, FIRT eliminated all perpetual securities from its capital structure. Excluding the IAHCC divestment, portfolio valuations declined 6.2% year-on-year, primarily due to foreign exchange depreciation in IDR and JPY. Investment Recommendation and Outlook Phillip Securities Research maintains its ACCUMULATE rating for First REIT with a revised target price of S$0.29, down from the previous S$0.31. This adjustment reflects updated dividend discount model forecasts that account for weaker IDR and JPY currencies, as well as the IAHCC divestment impact. FY26 and FY27 DPU estimates have been reduced by 5% and 8% respectively to incorporate these factors. Business Fundamentals and Market Position First REIT continues to operate as a healthcare-focused real estate investment trust with assets primarily in Indonesia, Singapore, and Japan. The company continues to benefit from a base 4.5% rental escalation across its Indonesia portfolio, with three Indonesian hospitals now operating under performance-based rent structures. A strategic review regarding Siloam's potential acquisition of FIRT's Indonesian hospital assets remains ongoing without material updates. Financial Strength Indicators FIRT demonstrated stable capital management with its cost of debt declining by 50 basis points year-on-year to 4.5%. Gearing and interest coverage ratios remained healthy at 42.1% and 3.7x respectively. FIRT trades at an FY26 estimated DPU yield of 8.4% and is currently in discussions to extend and refinance S$260 million of loans maturing in 2026. Key Takeaways Q: What was First REIT's DPU performance for 2H25/FY25? A: First REIT reported 2H25/FY25 DPU of 1.04/2.17 Singapore cents, representing declines of 10.3% and 8.1% year-on-year respectively, primarily due to IDR and JPY depreciation against the SGD. Q: What is Phillip Securities Research's current recommendation and target price? A: Phillip Securities Research maintains an ACCUMULATE rating with a revised target price of S$0.29, reduced from the previous S$0.31 due to weaker currency forecasts and the IAHCC divestment. Q: What major asset divestment did First REIT complete recently? A: First REIT completed the divestment of the non-core Imperial Aryaduta Hotel & Country Club (IAHCC) on December 4, 2025. Q: How did different geographical segments perform in local currency terms? A: FY25 income from Indonesia and Singapore properties rose by 5.1% and 2.0% respectively in local currency terms, while Japan remained stable. Q: What are the key financial health indicators for First REIT? A: The REIT maintains healthy financials with gearing at 42.1%, interest coverage ratio at 3.7x, and cost of debt at 4.5% (down 50bps year-on-year). Q: What is the status of rental payments from MPU? A: Rentals continue to be owed by MPU, with S$6.9 million outstanding as of December 31, 2025. S$1.5 million was received in January 2026, reducing the outstanding amount to S$5.4 million. Q: How did portfolio valuations perform excluding the IAHCC divestment?< A: On a same-store basis, portfolio valuations declined 6.2% year-on-year, primarily due to foreign exchange headwinds, with the Indonesia portfolio rising 1.4% in local currency terms while Japan declined 0.7%. Q: What is First REIT's current dividend yield? A: First REIT trades at an FY26 estimated DPU yield of 8.4%. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Singapore Exchange Posts Strong Performance Despite Treasury Headwinds

Financial Results Exceed Expectations Singapore Exchange Limited (SGX) reported a solid first-half FY26 results, meeting analysts’ expectations with revenue and earnings reaching 51% and 50% of full‑year forecasts respectively. The exchange operator demonstrated resilience by achieving core operating revenue growth that successfully offset declining treasury income, highlighting the strength of its diversified business model. Core Business Segments Drive Growth SGX's performance was anchored by robust growth across its primary trading segments. The Fixed Income, Currencies and Commodities (FICC) division delivered impressive 14% year-on-year growth, primarily driven by continued expansion in commodity and currency derivatives volumes alongside higher over-the-counter foreign exchange revenue. The equities segment also contributed positively with 6% revenue growth, fueled by a surge in Securities Daily Average Value (SDAV) that compensated for lower equity derivatives volumes. However, treasury income presented headwinds, declining 14% year-on-year due to lower average yields on margin deposits as interest rates decreased. Despite this challenge, SGX maintained strong shareholder returns, increasing its interim quarterly dividend per share by 22% to 11 cents, bringing the first-half dividend to 21.75 cents, representing a 21% year-on-year increase. Investment Outlook and Strategic Positioning SGX operates as Singapore's primary securities and derivatives exchange, serving as a critical financial infrastructure provider in Asia. The company has established strong market positioning through its comprehensive trading, clearing, and settlement services across multiple asset classes. The exchange's strategic focus on digitalisation and platform development continues to generate operating leverage benefits. Currency and commodities trading revenue increased 18% year-on-year, with currency derivatives volumes rising 18% and commodity derivatives volumes surging 24%. The OTC FX business maintained stable growth with revenue up 8% and average daily volume reaching US$180 billion, representing a 32% increase. Looking ahead, SGX is posed to benefit from several tailwinds including Equity Market Development Programme inflows, potential trade policy uncertainty from the Trump administration, and the Federal Reserve's monetary easing cycle, all of which should support volume growth through 2026. Research Recommendation Phillip Securities Research maintains an ACCUMULATE recommendation with a revised target price of S$18.30, increased from the previous S$16.90. The target price reflects a 28x price-to-earnings ratio based on FY26 estimates, up from the previous 26x multiple, positioned at two standard deviations above the five-year mean valuation. Key Takeaways Q: What was SGX's dividend performance in the first half of FY26? A: SGX increased its interim quarterly dividend per share by 22% to 11 cents. The total first‑half dividend amounted to 21.75 cents, representing a 21% year‑on‑year increase. The company maintains guidance to raise dividends by 0.25 cents per quarter until FY28. Q: Which business segments drove SGX's revenue growth? A: FICC revenue grew 14% year-on-year led by commodity and currency derivatives volumes and higher OTC FX revenue, while equities revenue rose 6% from increased SDAV, partially offset by lower equity derivatives volumes. Q: What challenges did SGX face during the reporting period? A: Treasury income declined 14% year-on-year due to lower average yields on margin deposits as interest rates fell, creating headwinds for overall earnings momentum. Q: How did SGX's OTC FX business perform? A: OTC FX revenue increased 8% year-on-year with average daily volume rising 32% to US$180 billion. SGX maintains guidance that OTC FX will contribute mid-to-high single digits to EBITDA in the medium term. Q: What is Phillip Securities Research's recommendation for SGX? A: Phillip Securities Research maintains an ACCUMULATE recommendation with a target price of S$18.30, increased from S$16.90, based on 28x price-to-earnings ratio for FY26 estimates. Q: What factors are expected to support SGX's future performance? A: Expected drivers include Equity Market Development Programme inflows, Preisdent Trump’s administration trade policy uncertainty, the Fed's monetary easing cycle boosting volumes in 2026, and operating leverage from rising SDAV offsetting treasury headwinds. Q: How did currency and commodities trading perform? A: Revenue for these segments increased 18% year‑on‑year, with currency derivatives volumes up 18% and commodity derivatives volumes surging 24%. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Singapore Telecommunications Expands Data Centre Portfolio with Strategic GDC Acquisition

Major Transaction Details Singapore Telecommunications Ltd (Singtel) has announced a significant expansion of its data centre operations through a strategic partnership with KKR. The two companies will jointly acquire the remaining 81.7% stake in ST Telemedia Global Data Centres (GDC) for S$6.6 billion in cash. Under this arrangement, Singtel will hold a 25% stake while KKR will control 75% of GDC. The transaction is expected to complete in the second half of 2026 and requires no shareholder approval, with Singtel funding its portion through debt and internal cash resources. Company and Asset Overview Singapore Telecommunications is a leading telecommunications company that continues to diversify its portfolio beyond traditional telecom services. GDC represents a substantial data centre platform operating 50 facilities across 12 countries with a combined power capacity of 673MW. As of December 2024, GDC maintained a book value of S$5.3 billion, though the company reported a net loss of S$185 million for the year. Despite the loss, GDC generated an estimated EBITDA of S$346 million, indicating operational cash flow generation capabilities. Investment Merits and Growth Potential The acquisition is positioned as a growth catalyst for Singtel following the completion of its ST28 strategic plan. The Asia-Pacific data centre market remains structurally underpenetrated, offering substantial long-term expansion opportunities. GDC’s development pipeline includes projects that could potentially triple its existing capacity, providing a clear runway for growth. The expanded footprint across multiple countries provides customers with enhanced geopolitical resilience and reduced redundancy risks. Additionally, there exists potential for value enhancement through selective listing of Asian assets. The scaling up of Singtel's data centre operations creates a more robust platform with a pipeline of 1.7GW, which doubles the combined capacity of Singtel's existing Nxera and GDC operations totaling 819MW. Financial Impact and Recommendation The proforma financial impact on Singtel's net earnings is minimal at less than 1%. While GDC's current loss-making status means no immediate earnings contribution, the long-term prospects for earnings and cash flow growth from additional data centres remain promising. Phillip Securities Research maintains an ACCUMULATE recommendation on Singapore Telecommunications, with an unchanged target price of S$5.35. The acquisition is viewed as a strategically positive move that positions the Group for sustained growth beyond its ST28 roadmap. Key Takeaways Q: What is the total value of the GDC acquisition and how is ownership structured? A: Singtel and KKR will jointly acquire the remaining 81.7% stake in GDC for S$6.6 billion in cash. Upon completion, KKR will hold a 75% stake, while Singtel will own the remaining 25%. Q: When is the transaction expected to complete? A: The transaction is expected to be completed in the second half of 2026, and does not require shareholder approval. Q: What is GDC's current operational scale? A: GDC operates 50 data centres across 12 countries with a total power capacity of 673MW and a book value of S$5.3 billion as of December 2024. Q: How did GDC perform financially in 2024? A: GDC reported a net loss of S$185 million for the year ended December 2024, though it generated an estimated EBITDA of S$346 million. Q: What growth potential does this acquisition offer? A: GDC has a development pipeline that could potentially triple its existing capacity. Post-acquisition, the combined pipeline of Singtel’s Nxera and GDC operations totals approximately 1.7GW, more than doubling current installed capacity. Q: What are the main benefits of this acquisition? A: The acquisition significantly scales up Singtel's data centre footprint across multiple countries, offers customers greater geopolitical resilience, reduces redundancy, and positions the company in the underpenetrated Asia-Pacific data centre market. Q: What is Phillip Securities Research's recommendation on Singtel? A: Phillip Securities Research maintains an ACCUMULATE recommendation with an unchanged target price of S$5.35. Q: What are the potential drawbacks of this deal? A: Key risks include the lack of immediate earnings contribution due to GDC’s current loss-making position, as well as relatively elevated valuations compared with listed US data centre peers, which trade at approximately 22x EV/EBITDA. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disney Maintains Strong Growth Trajectory with IP-Driven Strategy

Company Overview The Walt Disney Company stands as a global entertainment conglomerate renowned for its integrated intellectual property ecosystem. The company operates across multiple segments including entertainment production, streaming services through Disney+, and world-class theme park experiences. Disney's core strength lies in its ability to monetise beloved franchises across its diverse platform portfolio, creating a powerful flywheel effect that drives sustained revenue growth. Strong Financial Performance Meets Expectations Disney's first quarter 2026 results demonstrated solid execution, with both revenue and adjusted profit after tax and minority interests aligning with analyst expectations. The quarter represented 25% of full-year revenue forecasts and 26% of profit projections for fiscal 2026. Revenue growth accelerated 16% year-over-year, propelled by robust performance across entertainment operations, which expanded 7% annually, and experiences division growth of 6.3%. However, the company reported negative free cash flow for the first time in three years, attributed to elevated capital investment levels and timing-related factors. Investment Recommendation and Outlook Phillip Securities Research has upgraded Disney to a BUY rating from ACCUMULATE, maintaining an unchanged target price of US$130. This upgrade reflects recent price performance while acknowledging the company's fundamental strengths. The research firm's fiscal 2026 forecasts, terminal growth assumptions, and weighted average cost of capital projections remain unmodified, indicating confidence in the underlying business model. **Key Investment Merits Drive Long-Term Value** Disney's integrated IP flywheel continues to demonstrate exceptional monetisation capabilities across its ecosystem. The company generated over US$6.5 billion in global box office revenue during 2025, reinforcing its position as the leading global studio for nine of the past ten years. Flagship releases including Zootopia 2, which achieved over US$1.7 billion in global box office receipts as Hollywood's highest-grossing animated film, and Avatar: Fire and Ash with over IS$1 billion globally, exemplify the effectiveness of this strategy. The streaming business has reached a profitability inflection point, with the Direct-to-Consumer segment delivering 12% annual revenue growth and over 50% earnings expansion. Management projects achieving 10% streaming margins in fiscal 2026, up from approximately 5% in fiscal 2025, supported by strategic pricing actions and successful bundled offerings. Key Takeaways Q: What was Disney's financial performance in Q1 2026?* A: Disney's Q1 2026 revenue and adjusted profit after tax met expectations, representing 25% of full-year revenue estimates and 26% of profit projections. Revenue grew 16% year-over-year driven by entertainment (+7%) and experiences (+6.3%) growth. Q: Why did Disney experience negative free cash flow? A: Disney reported negative free cash flow for the first time in three years due to elevated investment levels and timing effects, reflecting the company's heavy ongoing investment in parks, cruises, and new IP-led attractions. Q: What is Phillip Securities Research's current recommendation for Disney? A: Phillip Securities Research upgraded Disney to BUY from ACCUMULATE with an unchanged target price of US$130, citing recent price performance while maintaining confidence in the company's long-term growth prospects. Q: How successful was Disney's box office performance in 2025? A: Disney generated over US$6.5 billion in global box office revenue in 2025, maintaining its position as the #1 global studio for nine of the past ten years, with major successes including Zootopia 2 (US$1.7+ billion) and Avatar: Fire and Ash (US$1+ billion). Q: What progress has Disney made in streaming profitability? A: Disney's Direct-to-Consumer business continued showing profitability with 12% revenue growth and over 50% earnings growth year-over-year, driven by pricing actions, improved plan mix, and successful bundled offerings. Q: What are Disney's streaming margin targets? A: Management has guided towards achieving streaming margins of approximately 10% in fiscal 2026, up from around 5% in fiscal 2025. Q: How does Disney's IP strategy create value across platforms? A: Disney monetises its franchises across theatrical releases, streaming platforms, and theme park attractions. Successful films drive streaming engagement and park visitation, with prior Zootopia and Avatar titles generating approximately one million first-time streams and hundreds of millions of viewing hours on Disney+. Q: What factors are driving growth in Disney’s streaming business? A: Streaming growth is driven by strategic pricing actions, improved plan mix, strong uptake of bundled offerings (Duo, Trio, and Max bundle), higher average revenue per user, lower customer churn, and scaling advertising revenue from growing ad-supported subscriber base. This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst. Disclaimer These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries. Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection