Gross Income

Gross Income

Gross and net income are important ideas to understand whether you work for someone else or operate your firm. As a wage worker or business owner, knowing the difference will help you file your taxes or assess the health of your enterprise. Gross income is a crucial financial indicator that you may use to calculate other statistics and evaluate your company’s performance.

What is gross income?

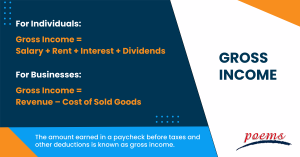

The amount earned in a paycheck before taxes and other deductions is known as gross income. Salaries, rental income, interest income, and dividends are all included in this total.

Individual gross income is reported on an income tax return as adjusted gross income, which is transformed into taxable income after several deductions and exemptions. When applying for a loan, people could also be required to disclose their gross income. Businesses usually use gross income rather than net income to evaluate the performance of their products.

Understanding gross income

Gross profit, gross earnings, and taxable income are synonymous with “gross incom”. The metric, though, has several contexts for both people and organisations. It is the sum of an individual’s gross earnings for each period, excluding taxes and deductions. This includes rent, interest payments, dividends, commissions, and wages.

Lenders and landlords evaluate a person’s gross income to assess their suitability as a borrower or tenant. Before deducting deductions to calculate the amount of tax due, gross income is the starting point when filing federal and state income taxes.

Gross income is a metric used by businesses to assess how well their product-specific operations performed. A company can better understand what drives success or failure by using gross income and restricting the expenses included in the analysis.

Gross income formula

The formulas used to calculate the gross income of people and businesses are provided below:

- For Individuals:

Gross Income = Salary + Rent + Interest + Dividends

- For Businesses:

Gross Income = Revenue – Cost of Sold Goods

How to calculate gross income

Individuals’ gross income is their earnings before any withholdings or taxes are deducted. A full-time employee’s annual pay or wages before taxes is his gross income. A full-time employee’s salary must also consider any additional income sources he may have.

For instance, a person’s gross income should include any dividends received on equities he owns. Rent-related income, interest from savings and investments, and other income sources should also be considered. David works as a financial management consultant and receives a yearly salary of $100,000. In addition, David gets $50,000 in rental income from his real estate holdings, $10,000 in dividends from his Company ABC stock holdings, and $7,000 in interest from his savings account. So, David’s income is as follows:

Gross income is calculated as 100,000 + 50,000 + 10,000 +7,000 = $167,000.

Gross income examples

To better help you in grasping the idea, here is an example of gross income:

Human resources manager Meredith works at XYZ Inc. She makes US$90,000 a year as the team leader for several states. She also owns two rental properties, which bring in another US$2,000 per month.

She recently received a business proposal from a friend, but it requires her to invest US$3,500 monthly. Meredith determines if she can afford it by calculating her gross monthly salary. She chooses to calculate her compensation using the gross income method using the following equation:

Gross monthly income = 90,000/ 2

Monthly gross income = US$7,500

With this amount in mind, she can also include her US$2,000 rental income, bringing her total monthly payment to US$9,500. She knows that her monthly expenses typically range from US$4,000 to US$6,000, so she can afford a US$3,500 investment with careful planning.

Frequently Asked Questions

Your gross income is your entire before expenses, typically over a year. Consider the revenue you generated from your services – the total of all client billings before any withholding, taxes, or other deductions. Add together all of your annual client billings to determine your yearly gross income.

Your company’s profit after expenses and legal deductions is net income. Take your gross income, deduct all of your business expenses, and then add back any assumptions you may be entitled to, such as those for a home office, a retirement plan, or professional and legal fees. This will give you your net income.

Gross income, as opposed to net income, is frequently used by businesses to assess the performance of their products.

Lenders base their loan approval on a borrower’s gross income. Examples of loans include auto loans and mortgages. The lender will use the borrower’s debt-to-income ratio, or DTI, to decide how much money to lend. By dividing monthly debt payments by monthly gross income, the DTI is calculated.

A lender will be less likely to want to loan money to someone with a greater DTI, and the interest rate on a loan will also be higher. While a DTI of no more than 36% is ideal, some lenders will provide loans with DTIs as high as 50%.

Individuals’ gross income is their earnings before any withholdings or taxes are deducted. A full-time employee’s annual pay or wages before taxes is his gross income.

Your take-home pay is determined by deducting your employee provident fund contribution, source-deducted taxes, and any additional deductions required by business policy from your net compensation. For house loan qualifying purposes, your net income is typically considered.

The amount that a person makes each month before deductions is referred to as his gross income. Your total monthly income, which includes regular pay and revenue from side employment and investments, is what you make on a gross monthly basis. Lenders consider your gross monthly income when determining your creditworthiness and ability to repay loans.

Additionally, your year-end W2 or 1099 will show your entire gross income. A different way to figure out your gross income is to multiply your hourly pay rate by the amount of time you’ll work in a particular month, or by your monthly income before taxes.

Related Terms

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Devaluation

- Grading Certificates

- Distributable Net Income

- Cover Order

- Tracking Index

- Auction Rate Securities

- Arbitrage-Free Pricing

- Net Profits Interest

- Borrowing Limit

- Algorithmic Trading

- Corporate Action

- Spillover Effect

- Economic Forecasting

- Treynor Ratio

- Hammer Candlestick

- DuPont Analysis

- Net Profit Margin

- Law of One Price

- Annual Value

- Rollover option

- Financial Analysis

- Currency Hedging

- Lump sum payment

- Annual Percentage Yield (APY)

- Excess Equity

- Fiduciary Duty

- Bought-deal underwriting

- Anonymous Trading

- Fair Market Value

- Fixed Income Securities

- Redemption fee

- Acid Test Ratio

- Bid Ask price

- Finance Charge

- Futures

- Basis grades

- Short Covering

- Visible Supply

- Transferable notice

- Intangibles expenses

- Strong order book

- Fiat money

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Optimal portfolio

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Escrow

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- Protective Put

- Perpetual Bond

- Option Adjusted Spread (OAS)

- Non-Diversifiable Risk

- Merger Arbitrage

- Liability-Driven Investment (LDI)

- Income Bonds

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Equity Carve-Outs

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Earning Surprise

- Bubble

- Beta Risk

- Bear Spread

- Asset Play

- Accrued Market Discount

- Ladder Strategy

- Junk Status

- Intrinsic Value of Stock

- Interest-Only Bonds (IO)

- Inflation Hedge

- Incremental Yield

- Industrial Bonds

- Holding Period Return

- Hedge Effectiveness

- Flat Yield Curve

- Fallen Angel

- Exotic Options

- Execution Risk

- Exchange-Traded Notes

- Event-Driven Strategy

- Eurodollar Bonds

- Enhanced Index Fund

- EBITDA Margin

- Dual-Currency Bond

- Downside Capture Ratio

- Dollar Rolls

- Dividend Declaration Date

- Dividend Capture Strategy

- Distribution Yield

- Delta Neutral

- Derivative Security

- Dark Pools

- Death Cross

- Fixed-to-floating rate bonds

- First Call Date

- Firm Order

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Recognising Biases in Investing and Tips to Avoid Them

Common biases like overconfidence, herd mentality, and loss aversion influence both risk assessment and decision-making....

What is Money Dysmorphia and How to Overcome it?

Money dysmorphia happens when the way you feel about your finances doesn’t match the reality...

The Employer’s Guide to Domestic Helper Insurance

Domestic Helper insurance may appear to be just another compliance task for employers in Singapore,...

One Stock, Many Prices: Understanding US Markets

Why Isn’t My Order Filled at the Price I See? Have you ever set a...

Why Every Investor Should Understand Put Selling

Introduction Options trading can seem complicated at first, but it offers investors flexible strategies to...

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Effective stop-loss placement is a cornerstone of prudent risk management in forex trading. It’s not...

Boosting ETF Portfolio Efficiency: Reducing Tax Leakage Through Smarter ETF Selection

Introduction: Why Tax Efficiency Matters in Global ETF Investing Diversification is the foundation of a...

How to Build a Diversified Global ETF Portfolio

Introduction: Why Diversification Is Essential in 2025 In our June edition article (https://www.poems.com.sg/market-journal/the-complete-etf-playbook-for-singapore-investors-from-beginner-to-advanced-strategies/), we introduced...