Escrow

Table of Contents

Escrow

Stock issuances, real estate, and online sales are just a few transactions that might use escrow. A buyer’s payment is kept in escrow until the sale ends; the buyer may get the merchandise or confirm its condition, whichever comes first.

Escrow is typically seen positively since it safeguards the seller and buyer in a transaction. Additionally, escrow as a portion of mortgage payments also benefits the lender and benefits the buyer by guaranteeing timely payment of homeowners insurance and property taxes.

What is escrow?

Escrow is a legal contract where a third party holds funds or property until a specific condition is satisfied (such as fulfilling a purchase agreement).

In simple words, an escrow is a neutral third party who holds a valuable asset (often cash) until the transaction is completed between two parties in a significant financial transaction. The escrow agent’s role is to receive and disburse funds according to the parties’ instructions and to hold the funds in trust until the conditions of the agreement are met.

Understanding escrow

When anything is said to be “in escrow,” another party currently holds the asset. Although escrow is frequently associated with real estate, it can also be used in other significant financial transactions.

Escrows are used primarily to make sure that each party fulfils their commitments. It might be the transaction’s middleman. According to this, assets can only be transferred if all of the conditions of the transaction have been satisfied.

The use of escrow is common in the sale of real estate, where the buyer deposits the purchase price with the escrow agent to be disbursed to the seller when the sale is closed. The escrow agent may also be responsible for holding and disbursing funds for the payment of taxes, insurance, and other expenses related to the property.

How does escrow work?

Escrow is utilised in real estate transactions to safeguard both the buyer and the seller during the home-buying process. Funds for taxes and homeowner’s insurance will be kept in an escrow account for the duration of the mortgage.

The escrow process begins when the buyer and seller agree to the terms of the sale. The buyer then deposits the agreed-upon amount into the escrow account. Once the funds have been deposited, the escrow company will then disburse the funds to the seller. Once the transaction is complete and the home has been transferred to the buyer, the escrow company will release the funds to the seller.

Let’s understand, with an example. Suppose a company sells products abroad, Such a company needs confirmation that it will be compensated when the items arrive at their destination. On the other hand, the buyer will only agree to pay for items if they are delivered in acceptable condition.

The buyer might ask an agent to hold the money in escrow with instructions to release it to the seller as soon as the products are received in an acceptable condition. Both parties are safeguarded this way, and the deal may go through.

Why use an escrow?

Since you aren’t required to save for them individually, using escrow makes handling your insurance premiums and home’s property taxes simple. You’re putting money aside for them each month, which is sometimes simpler than attempting to come up with the cash for yearly lump sum payments.

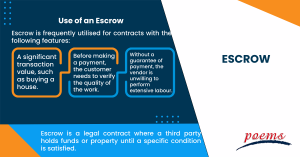

Escrow is frequently utilised for contracts with the following features:

- A significant transaction value, such as buying a house.

- Before making a payment, the customer needs to verify the quality of the work.

- Without a guarantee of payment, the vendor is unwilling to perform extensive labour.

Frequently Asked Questions

Your monthly payment is divided into three equal portions if your mortgage is escrowed. The amortisation plan for your loan specifies that two halves go towards principal and interest. The majority of your initial monthly payment goes towards interest. More will eventually go to your principal. The third portion of your payment that is being paid is termed as “escrow balance”.

When purchasing or selling a property, real estate brokers, sellers, and buyers should all be highly familiar with and understand the concept of escrow. “Escrow” implies a third party managing the real estate transaction, the money exchange, and any associated paperwork. A property may be in escrow for several months or as short as just a few days.

Choosing the best escrow service may require some time and analysis, but it is necessary. If you don’t pick the correct escrow provider, there may be a lot of doubt about how your finances and possessions are managed, which can cause unwanted tension. Follow these simple steps:

- Try seeking an escrow service with a reputable status. Choose a renowned company that is ethical, has excellent ratings, and is highly recommended by others.

- Your chosen escrow service should communicate in a manner that is the same as yours. Search for a company that responds quickly, communicates information clearly, is simple, and is transparent.

- Choose an escrow service with a comprehensive knowledge base and an experienced staff. You can contact the office to learn more about this and ask any questions.

- Choose an escrow service that operates in the area where you are transacting real estate. Ensure the business is knowledgeable about the local real estate market before you complete the purchase.

- Finally, you should check pricing among several escrow services to ensure you receive the greatest deal.

A third party handles the escrow. This could be an escrow agency, a bank or other financial institution, or a business offering this service. Deposited money or other assets in this account cannot be taken back without permission.

Compared to other types of accounts in the banking system, escrow accounts offer the following benefits:

- The first benefit of using escrows is that they give all parties a secure and safe way to route financial flows.

- Second, an escrow account enables transactions to be customised to each party’s needs.

- Thirdly, top banks enable customers to create and manage several accounts for transactions using a waterfall system.

- Fourth, escrow banking offers channel support. Specialised escrow teams play a significant role in facilitating efficient operations.

- Finally, an escrow bank account enables easier paperwork and online tracking in light of the significant rise of digital media.

Related Terms

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Cost of Equity

- Capital Adequacy Ratio (CAR)

- Interest Coverage Ratio

- Industry Groups

- Income Statement

- Historical Volatility (HV)

- Embedded Options

- Dynamic Asset Allocation

- Depositary Receipts

- Deferment Payment Option

- Debt-to-Equity Ratio

- Financial Futures

- Contingent Capital

- Conduit Issuers

- Calendar Spread

- Devaluation

- Grading Certificates

- Distributable Net Income

- Cover Order

- Tracking Index

- Auction Rate Securities

- Arbitrage-Free Pricing

- Net Profits Interest

- Borrowing Limit

- Algorithmic Trading

- Corporate Action

- Spillover Effect

- Economic Forecasting

- Treynor Ratio

- Hammer Candlestick

- DuPont Analysis

- Net Profit Margin

- Law of One Price

- Annual Value

- Rollover option

- Financial Analysis

- Currency Hedging

- Lump sum payment

- Annual Percentage Yield (APY)

- Excess Equity

- Fiduciary Duty

- Bought-deal underwriting

- Anonymous Trading

- Fair Market Value

- Fixed Income Securities

- Redemption fee

- Acid Test Ratio

- Bid Ask price

- Finance Charge

- Futures

- Basis grades

- Short Covering

- Visible Supply

- Transferable notice

- Intangibles expenses

- Strong order book

- Fiat money

- Trailing Stops

- Exchange Control

- Relevant Cost

- Dow Theory

- Hyperdeflation

- Hope Credit

- Futures contracts

- Human capital

- Subrogation

- Qualifying Annuity

- Strategic Alliance

- Probate Court

- Procurement

- Holding company

- Harmonic mean

- Income protection insurance

- Recession

- Savings Ratios

- Pump and dump

- Total Debt Servicing Ratio

- Debt to Asset Ratio

- Liquid Assets to Net Worth Ratio

- Liquidity Ratio

- Personal financial ratios

- T-bills

- Payroll deduction plan

- Operating expenses

- Demand elasticity

- Deferred compensation

- Conflict theory

- Acid-test ratio

- Withholding Tax

- Benchmark index

- Double Taxation Relief

- Debtor Risk

- Securitization

- Yield on Distribution

- Currency Swap

- Overcollateralization

- Efficient Frontier

- Listing Rules

- Green Shoe Options

- Accrued Interest

- Market Order

- Accrued Expenses

- Target Leverage Ratio

- Acceptance Credit

- Balloon Interest

- Abridged Prospectus

- Data Tagging

- Perpetuity

- Optimal portfolio

- Hybrid annuity

- Investor fallout

- Intermediated market

- Information-less trades

- Back Months

- Adjusted Futures Price

- Expected maturity date

- Excess spread

- Quantitative tightening

- Accreted Value

- Equity Clawback

- Soft Dollar Broker

- Stagnation

- Replenishment

- Decoupling

- Holding period

- Regression analysis

- Wealth manager

- Financial plan

- Adequacy of coverage

- Actual market

- Credit risk

- Insurance

- Financial independence

- Annual report

- Financial management

- Ageing schedule

- Global indices

- Folio number

- Accrual basis

- Liquidity risk

- Quick Ratio

- Unearned Income

- Sustainability

- Value at Risk

- Vertical Financial Analysis

- Residual maturity

- Operating Margin

- Trust deed

- Profit and Loss Statement

- Junior Market

- Affinity fraud

- Base currency

- Working capital

- Individual Savings Account

- Redemption yield

- Net profit margin

- Fringe benefits

- Fiscal policy

- Externality

- Multi-level marketing

- Joint tenancy

- Liquidity coverage ratio

- Hurdle rate

- Kiddie tax

- Giffen Goods

- Keynesian economics

- EBITA

- Risk Tolerance

- Disbursement

- Bayes’ Theorem

- Amalgamation

- Adverse selection

- Contribution Margin

- Accounting Equation

- Value chain

- Gross Income

- Net present value

- Liability

- Leverage ratio

- Inventory turnover

- Gross margin

- Collateral

- Being Bearish

- Being Bullish

- Commodity

- Exchange rate

- Basis point

- Inception date

- Riskometer

- Trigger Option

- Zeta model

- Racketeering

- Market Indexes

- Short Selling

- Quartile rank

- Defeasance

- Cut-off-time

- Business-to-Consumer

- Bankruptcy

- Acquisition

- Turnover Ratio

- Indexation

- Fiduciary responsibility

- Benchmark

- Pegging

- Illiquidity

- Backwardation

- Backup Withholding

- Buyout

- Beneficial owner

- Contingent deferred sales charge

- Exchange privilege

- Asset allocation

- Maturity distribution

- Letter of Intent

- Emerging Markets

- Cash Settlement

- Cash Flow

- Capital Lease Obligations

- Book-to-Bill-Ratio

- Capital Gains or Losses

- Balance Sheet

- Capital Lease

Most Popular Terms

Other Terms

- Protective Put

- Perpetual Bond

- Option Adjusted Spread (OAS)

- Non-Diversifiable Risk

- Merger Arbitrage

- Liability-Driven Investment (LDI)

- Income Bonds

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Equity Carve-Outs

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Earning Surprise

- Bubble

- Beta Risk

- Bear Spread

- Asset Play

- Accrued Market Discount

- Ladder Strategy

- Junk Status

- Intrinsic Value of Stock

- Interest-Only Bonds (IO)

- Inflation Hedge

- Incremental Yield

- Industrial Bonds

- Holding Period Return

- Hedge Effectiveness

- Flat Yield Curve

- Fallen Angel

- Exotic Options

- Execution Risk

- Exchange-Traded Notes

- Event-Driven Strategy

- Eurodollar Bonds

- Enhanced Index Fund

- EBITDA Margin

- Dual-Currency Bond

- Downside Capture Ratio

- Dollar Rolls

- Dividend Declaration Date

- Dividend Capture Strategy

- Distribution Yield

- Delta Neutral

- Derivative Security

- Dark Pools

- Death Cross

- Fixed-to-floating rate bonds

- First Call Date

- Firm Order

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Recognising Biases in Investing and Tips to Avoid Them

Common biases like overconfidence, herd mentality, and loss aversion influence both risk assessment and decision-making....

What is Money Dysmorphia and How to Overcome it?

Money dysmorphia happens when the way you feel about your finances doesn’t match the reality...

The Employer’s Guide to Domestic Helper Insurance

Domestic Helper insurance may appear to be just another compliance task for employers in Singapore,...

One Stock, Many Prices: Understanding US Markets

Why Isn’t My Order Filled at the Price I See? Have you ever set a...

Why Every Investor Should Understand Put Selling

Introduction Options trading can seem complicated at first, but it offers investors flexible strategies to...

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Effective stop-loss placement is a cornerstone of prudent risk management in forex trading. It’s not...

Boosting ETF Portfolio Efficiency: Reducing Tax Leakage Through Smarter ETF Selection

Introduction: Why Tax Efficiency Matters in Global ETF Investing Diversification is the foundation of a...

How to Build a Diversified Global ETF Portfolio

Introduction: Why Diversification Is Essential in 2025 In our June edition article (https://www.poems.com.sg/market-journal/the-complete-etf-playbook-for-singapore-investors-from-beginner-to-advanced-strategies/), we introduced...