Inflation

Table of Contents

Inflations

A rise in the standard price of commodities and services across the economy is referred to as inflation. The main drivers of inflation are the growth in the money supply and the demand for goods and services. Inflation can benefit businesses, leading to increased product demand and higher profits. However, it can also be detrimental for consumers as it reduces their purchasing power and erodes the value of their savings.

What is inflation?

Inflation is the rate of price growth over a predetermined time period. A country’s cost of living or the overall increase in prices are two examples of broad metrics used to quantify inflation. However, for other things, like as food or services, it may also be calculated with greater accuracy. Inflation is the measure of how much the relevant group of goods and services have increased in price over a given period of time, usually a year.

Understanding inflation

The cost of living for consumers is influenced by the cost of living for households and the cost of various goods and services. Government organisations undertake home surveys to determine a basket of frequently purchased commodities and monitor the costs of buying this basket over time to calculate the typical consumer’s cost of living. (Housing costs, including rent and mortgage, make up the greatest portion of the American consumer basket.)

The consumer price index (CPI), the most often used indicator of inflation, measures the cost of this basket at a particular moment relative to a base year. On the other hand, consumer price inflation measures the percentage variation in the CPI over a given period.

The objective of measuring inflation is to determine the overall effect of price increases for various goods and services. It enables a single-valued presentation of the rise in the price of commodities and services over time in an economy.

Causes of inflation

There are many different causes of inflation, but the most common cause is simply an increase in the money supply. When the money supply grows too rapidly, it can lead to inflationary pressures in the economy. This can happen when the central bank prints too much money or commercial banks make too many loans. Other causes of inflation include increases in the cost of raw materials or government spending.

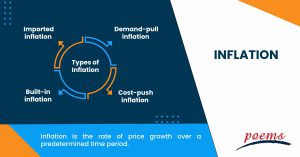

Types of inflation

There are generally four types of inflation: demand-pull inflation, cost-push inflation, built-in inflation, and imported inflation.

- Demand-pull inflation

It occurs whenever there is an increase in the demand for goods and services in an economy. This increase in demand can be due to several factors, such as population growth, government spending, or consumer confidence. When demand for goods and services increases, businesses will raise prices to meet this demand.

- Cost-push inflation

It occurs when the cost of production for goods and services rises. This can be due to increased raw materials, labour, or energy costs. Businesses will pass these costs on to consumers when production costs go up through higher prices.

- Built-in inflation

It is built into the price of goods and services over time. This type of inflation is often due to rise in the cost of living, such as higher housing costs, healthcare costs, or food costs. Businesses will boost prices to keep up with rising costs when living standards rise.

- Imported inflation

A rise in the valuation of imported goods and services causes it. This can happen due to many factors, such as a devaluation of the currency, an increase in import tariffs, or an increase in the price of oil. When imported goods and services increase, businesses will pass these costs on to consumers through higher prices.

Pros and cons of inflation

Some of the advantages of inflation are:

- People who own physical assets (like real estate or stockpiled commodities) that are valued in their native currency might prefer mild inflation since it will increase the value of their possessions, which they can then sell for more money.

- Due to the expectation of higher returns than inflation, firms and individual investors frequently speculate on hazardous business ventures due to inflation.

There are several potential drawbacks associated with inflation.

- First and foremost, it can lead to higher prices for goods and services, which can be a major burden for consumers, especially those on fixed incomes.

- Additionally, inflation can erode the value of savings and investments and reduce purchasing power. This can be a problem for seniors and retirees who rely on their savings to cover basic living expenses.

- Finally, inflation can create uncertainty and instability in the economy, leading to slower economic growth.

Frequently Asked Questions

Inflation will be advantageous to those who must pay off huge debts. The effects of inflation will be felt most by those with fixed salaries and cash savings. When the money’s value declines, fewer products can be bought with the same amount of money than they could previously. This is known as inflation.

Inflation can be good for companies as long as it is managed correctly. When inflation is low, it can provide companies with an opportunity to increase prices without fear of customers switching to cheaper alternatives. This can boost profits and allow companies to invest in new products or services. Inflation can also help to create jobs as companies expand to meet increased demand.

However, inflation can also be a risk for companies. If inflation is too high, it can eat into profits and make it difficult to maintain prices. This can lead to customers switching to cheaper alternatives, damaging a company’s bottom line. Inflation can also make it difficult to predict costs, which can make it difficult to budget properly.

The inflation rate is the percentage change in the general price level of services and goods in an economy over time. The inflation rate measures the change in the cost of living and is also a key indicator of economic growth. The inflation rate is calculated by taking the percentage change in the prices of a basket of goods and services.

We know that inflation occurs when there is an increase in the price of goods and services over time. Each dollar you have buys less products and services than what it did previously when inflation is strong.

Inflation favours lenders because the money they loan you today will be worth more in the future when you have to repay the loan. In other words, when inflation is high, the value of money decreases, and lenders are paid back in dollars worth less than the dollars they originally loaned out.

On the other hand, borrowers are hurt by inflation because they have to repay their loans with dollars worth more than they borrowed.

nflation caused by previous events and continues into the present is known as built-in inflation. One of the three main factors influencing the current inflation rate is built-in inflation.

Adaptive expectations, or the notion that individuals anticipate present inflation rates to persist in the future, are connected to built-in inflation. People may anticipate an ongoing increase at a similar pace as product and service prices grow.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...