Value of Land

Table of Contents

Value of Land

Investing in land is a timeless strategy that has been proven to yield substantial returns over the long term. The value of land plays a crucial role in determining the profitability and potential of any real estate investment. Understanding the value of land is paramount for successful real estate investment. By comprehending the factors that influence land value, investors can make informed decisions and maximise their returns.

What is value of land?

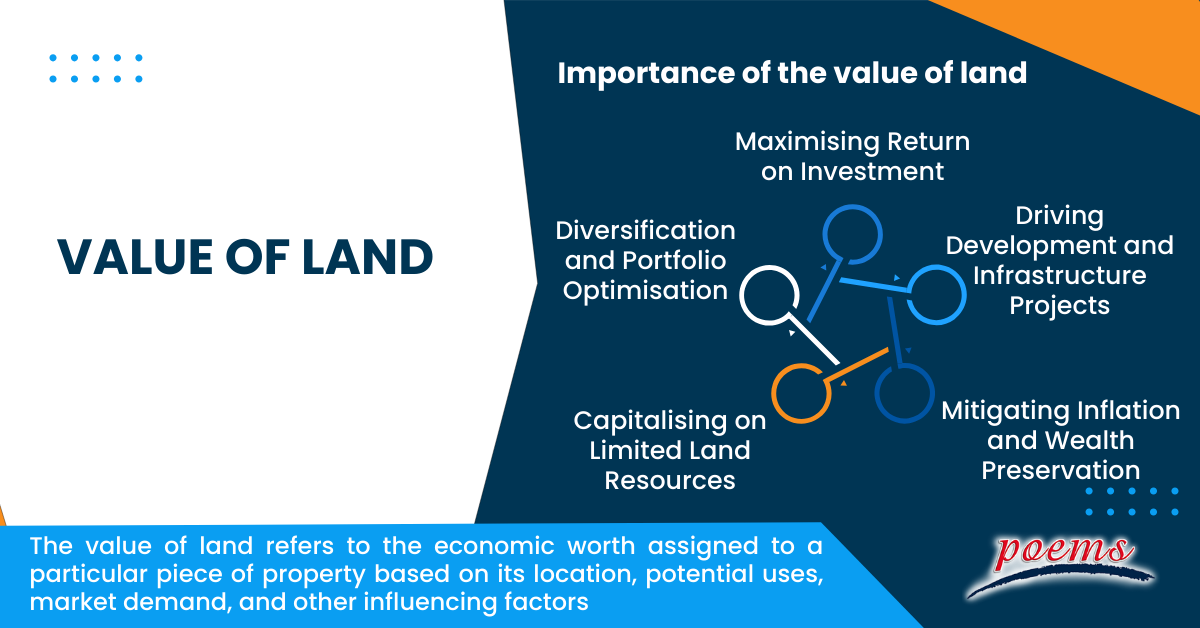

The value of land refers to the economic worth assigned to a particular piece of property based on its location, potential uses, market demand, and other influencing factors. It plays a vital role in determining the financial viability and potential appreciation of real estate investments. Knowing the value of land is crucial for making informed investment decisions. Factors such as scarcity of land, desirable locations, proximity to amenities, and development potential all contribute to the value of land in these markets. By recognising the significance of land value, investors can strategically assess opportunities and maximise their returns in real estate markets.

Understanding the value of land

To grasp the value of land, one must consider both intrinsic and extrinsic factors. Intrinsic factors include the physical characteristics of the land, such as size, topography, soil quality, and access to amenities. Extrinsic factors encompass the location of the land, proximity to transportation, schools, commercial hubs, and potential for future development.

In places where land is limited, strategic urban planning has driven land prices to soaring heights. These places command high land values due to their desirability and attractive amenities. Similarly, in places where the land value can vary significantly based on location, they experience exceptionally high land values due to limited availability and high demand. By comprehending these factors, investors can make informed decisions and capitalise on the value of land in their respective markets.

How is value of land calculated?

Calculating the value of land involves a comprehensive analysis and valuation process to determine its economic worth. In some markets, this assessment takes into account various factors such as the land’s location, size, topography, access to amenities, and potential for development. Professional appraisers and real estate experts utilise different valuation methods, including comparative market analysis and income capitalisation, to estimate the value of specific land parcels. By examining recent sales data of similar properties and considering local zoning regulations, utility access, and growth prospects, the value of land can be derived with accuracy. This information allows investors to make informed decisions, negotiate deals effectively, and identify opportunities for future development, ensuring that their investments align with the value of land in these respective markets

Importance of the value of land

The importance calculating the value of land cannot be overstated, particularly in the context of real estate investment. The value of land holds significant importance for investors and potential buyers. It serves as a crucial metric to determine the profitability and potential return on investment. By comprehending the factors that influence land value, such as location, scarcity, and potential for development, investors can make informed decisions, negotiate better deals, and identify opportunities for future growth. Moreover, land value plays a vital role in securing financing and insurance for real estate projects. Recognising the significance of land value empowers investors to capitalise on opportunities and navigate the real estate market with confidence.

Some important factors to consider are:

- Maximising Return on Investment: Land value serves as a key determinant of the potential return on investment. A property with higher land value offers greater appreciation potential, leading to enhanced profitability over time.

- Capitalising on Limited Land Resources: As population grows and urban areas expand, the scarcity of land becomes increasingly evident. In such environments, the value of land skyrockets, presenting investors with lucrative opportunities. Recognising the scarcity of land and its potential for appreciation allows investors to secure valuable assets and benefit from the increasing demand.

- Driving Development and Infrastructure Projects: The value of land is instrumental in driving development and infrastructure projects. Prime land parcels with high value often attract developers, leading to the creation of vibrant communities, commercial hubs, and leisure destinations.

- Mitigating Inflation and Wealth Preservation: Land has historically proven to be a reliable hedge against inflation. As inflation erodes the purchasing power of currencies, the value of land tends to appreciate, protecting investors’ wealth.

- Diversification and Portfolio Optimisation: The importance of land value extends beyond individual investments. Land can serve as an essential component of a diversified investment portfolio. By incorporating land holdings, investors can spread their risk across different asset classes and reduce vulnerability to market fluctuations.

Examples of Value of Land

- In the US, the value of land can vary dramatically based on location. A prime example is Manhattan, New York, where land value is exceptionally high due to its limited availability and high demand. Land in prestigious neighbourhoods such as Beverly Hills, California, also command a premium due to its exclusivity and desirability.

- Singapore, a land-scarce country, provides a compelling example of land value. The city-state’s strategic urban planning has driven land prices skyward. Areas like Orchard Road, the Central Business District, and Sentosa Island boast exorbitant land values due to their prime locations and attractive amenities.

Frequently Asked Questions

The value of land can be determined through various methods, including comparable sales, income capitalisation, and the cost approach. Engaging a professional appraiser or utilising online real estate platforms can assist in obtaining an accurate valuation.

While land value refers specifically to the worth of the land itself, market value encompasses the total worth of the property, including buildings and improvements. Land value is a crucial component of market value and helps determine the overall property’s worth.

Investing in land offers several advantages, including potential appreciation, diversification of assets, and a hedge against inflation. Land can also provide passive income through leasing or development opportunities.

Investing in land can be capital-intensive and illiquid, meaning it may take time to convert land into cash. Additionally, land values can fluctuate due to economic conditions and changes in regulations, making it essential to conduct thorough due diligence before investing.

The value of land is determined through a combination of factors, such as location, size, potential uses, market demand, and recent sales data of comparable properties. Professional appraisers and real estate experts employ various valuation methods to arrive at an accurate estimate.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...