Operating assets

Table of Contents

Operating assets

Operating assets are crucial to a business’s performance and profitability. These material and intangible resources are directly used in day-to-day operations to produce income. Operating assets enable businesses to supply goods or services profitably and successfully. These assets range from manufacturing equipment and inventories to accounts receivable and intellectual property. A business’s operational efficiency, productivity, and, ultimately, financial performance and competitive advantage may all be improved via the efficient management and use of operating assets.

What are operating assets?

The tangible and intangible assets that a business uses in its regular operations to make money are referred to as operating assets. These resources, which include real estate, tools, machinery, stock, receivables, and intellectual property, are necessary for commercial operations. They are different from non-operating assets, which are often investments or assets retained for non-core company objectives, are operating assets. Businesses may increase operating effectiveness, productivity, and profitability by properly managing and using their operating assets. They are a crucial part of a business’s capacity to bring in money and provide goods or services to clients.

Understanding operating assets

The assets a firm employs to run its operations and make money are known as operating assets. Cash assets and assets from accounts receivable are two types of operating assets. Furthermore, it’s crucial to understand the difference between an organisation’s operational and non-operating assets for accounting reasons.

Operating assets are crucial financial indicators that show a company’s worth, revenue potential, and capacity to convert non-cash assets into cash. The operational assets also assist businesses in determining their net operating assets and provide light on their general financial stability and health.

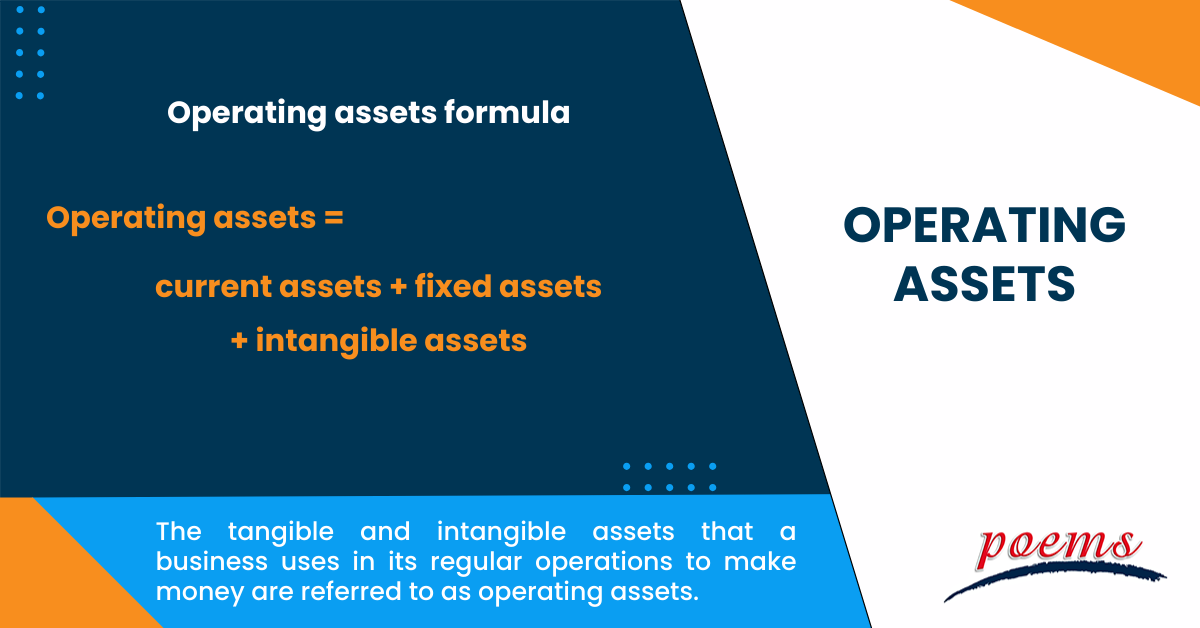

Operating assets formula

The value of different assets employed in a company’s daily operations is added to determine its operating assets. The precise formula will be determined by the detail needed and the organisation’s financial statements.

Current assets include cash, customer receivables, inventory, and other short-term assets. Property, plant, and equipment, including structures, equipment, and vehicles, are fixed assets. Among intangible assets are goodwill, copyrights, patents, and trademarks. The total operating assets of an organisation may be calculated by summing together the values of these various asset types.

The following formula can be used to determine operating assets:

Operating assets = current assets + fixed assets + intangible assets

Valuation of operating assets

Operating asset valuation entails calculating these assets’ fair value or worth on a company’s balance sheet. Depending on the kind of operating asset, several approaches might be used. The cost of physical assets, such as real estate and machinery, can be determined using appraisals, market analyses, or replacement costs.

Patents and trademarks are intangible assets that may be appraised using income-based methods or market comparables. You may also use valuation methods like discounted cash flow analysis or multiples. For financial reporting, making investment choices, and determining the overall worth of a corporation, accurate operating asset assessment is essential.

Example of operating assets

The following is an example of an operating asset. A manufacturing business has a variety of operating assets that support its activities. These consist of the equipment used in manufacturing, raw material and completed goods inventories, accounts receivable from clients, and the rented factory space.

Production equipment is essential for making items, and inventory ensures the supply chain runs smoothly. Uncollected revenue is represented by the accounts receivable. The factory space provides the infrastructure required for the manufacturing process. These operating assets enable the firm to earn income and satisfy client requests.

Frequently Asked Questions

Analysing operating assets often entails evaluating their efficiency and efficacy in producing income. Important measures like asset turnover ratio, return on assets (ROA), and fixed asset turnover may show how well-operating assets are performing and being used. The competitiveness of operating assets may also be assessed by comparing them to industry benchmarks.

Operating assets are the tangible and intangible resources essential to a company’s daily operations and generating revenue. These assets are used to produce goods or services that are sold by the company to its customers. Examples of operating assets include machinery, equipment, inventory, and accounts receivable. Operating assets are critical for a company’s success, as they directly contribute to its earning capacity.

Non-operating assets, on the other hand, are the resources that a company holds for investment or other purposes that are not directly related to its core business operations. Non-operating assets may include investments in stocks or bonds, vacant land, or real estate holdings not used in the company’s primary business activities. While non-operating assets can provide additional income for a company, they are not required for its day-to-day activities and do not contribute to its core revenue generation.

The difference between operating and non-operating assets is that operating assets are used in the core operations of a business to generate revenue. Non-operating assets, such as marketable securities or new properties, are typically held for investment or other non-core purposes.

An operating liability is a liability that results from a company’s ongoing activities, whereas an operating asset is an asset that is utilised in those operations.

The pros of operating assets include their capacity for income generation, assistance with corporate operations, and profitability. Additionally, they might improve market position and competitiveness. The cons could include the requirement for a capital commitment, upkeep expenses, and the possibility of obsolescence. Inefficiencies and financial hardship on the organisation might result from improperly managed operating assets.

Generally, the answer to whether an operating asset is a current asset depends on the definition of current assets used by the organisation. Both current and non-current assets can be included in operating assets. Current assets are expected to be turned into cash or used up within a year, as opposed to non-current assets with a longer useful life.

Some operating assets, such as inventory and accounts receivable, are typically classified as current assets because they are expected to be converted into cash within a year. However, other operating assets, such as buildings or machinery, may not be classified as current assets since they are not expected to be converted into cash in the short term.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Options expiry

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...