Sustainable investing

Table of Contents

Sustainable investing

To ensure financial success, investors can diversify and expand their portfolios using a variety of strategies. Sustainable investment is a new trend reshaping how companies and individuals approach investing. It integrates conventional investments with environmental, social, and governance-related (ESG) knowledge to enhance long-term results.

A key component of sustainable investment is the understanding that businesses best positioned to prosper are tackling the world’s most pressing problems. It is about introducing innovative new business practices and building the momentum to persuade an increasing number of people to choose the future we’re trying to create.

What is sustainable investing?

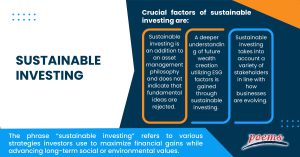

The phrase “sustainable investing” refers to various strategies investors use to maximize financial gains while advancing long-term social or environmental values. Investors have produced more thorough assessments and made better investment decisions by fusing conventional investing methods with ESG insights.

Three crucial factors of sustainable investing are:

- Sustainable investing is an addition to an asset management philosophy and does not indicate that fundamental ideas are rejected.

- A deeper understanding of future wealth creation utilizing ESG factors is gained through sustainable investing.

- Sustainable investing takes into account a variety of stakeholders in line with how businesses are evolving.

What are the strategies of sustainable investing?

There are several strategies that sustainable investors should consider when making investment decisions.

- One key strategy is considering a company or project’s environmental, social, and governance (ESG) factors.

- Another strategy is to invest in companies or projects working towards a sustainable future, such as those involved in renewable energy or clean technology.

Sustainable investing is an important way to impact the world while also achieving financial goals positively. Sustainable investors can make a real difference by considering ESG factors and investing in companies making a difference.

Importance of sustainable investing

The demand for investment companies to adopt the sustainable investing model is increasing as interest in sustainable investing grows. The alternative of preserving the status quo makes the investment industry prone to decline at a time when industry is confronted by increased end-client and regulatory demands as well as difficult economic conditions.

Industry’s leadership and innovations in investing practice and theory, as well as data management, will be crucial for the next development phase. Future prospects are incredibly promising if these are present.

Learning about sustainable investment methods can help you decide where and when to invest, depending on your principles and market trends. For instance, when businesses are urged to be more sustainable, certain investors are under growing pressure or stress from asset owners to concentrate on sustainability.

How to do sustainable investing?

You must conduct thorough research before making any ESG-based investments.

Many experts and organizations release yearly lists for the top-rated ESG equities as a starting point, which can assist you in finding investments that suit your strategy. To avoid picking assets manually, you may choose funds. By entering “ESG” into their screening tools, brokerages frequently have ESG-focused funds available.

Consider robo-advisors that provide sustainable investment portfolios if you’d want a more directed and somewhat less do-it-yourself investing strategy. Be aware that ESG rules differ amongst advisers and that automated investing may incur costs.

Future of sustainable investing

Balancing stakeholder interests and goals is essential for the future of sustainable investing. It is essential to the investment’s long-term viability, benefiting society by enhancing long-term results.

Sustainable investing is expected to gain popularity as more investors become aware of how their investment dollars help or harm the causes they care about. Likewise, businesses will feel pressure to raise their ESG scores to attract investment capital and favorable media attention.

Now, here are three key principles where sustainable investment goes further than its forerunners, even though the future of sustainable investing involves many unknown factors:

- It is complementary to investment theory and doesn’t imply a denial of fundamental ideas.

- A deeper understanding of future value creation employing environmental, social, and governance (ESG) factors is gained.

- Many stakeholders are taken into account.

In many areas, sustainable investing is changing from a wonderful notion to a reality that affects all investment portfolios. It is crucial to incorporate significant ESG variables in investing choices as there is growing acknowledgment that some ESG issues are economically significant, particularly over the long term.

Frequently Asked Questions

Sustainable investment stocks focus on environmental, social, and governance (ESG) factors. These stocks aim to promote sustainable practices and positively impact society and the environment. They are often considered to be more responsible and sustainable than traditional stocks.

Sustainable investment funds are investment vehicles focusing on achieving financial returns and positive social and environmental outcomes. Also known as impact investing, sustainable investing has grown in popularity in recent years as more and more investors are looking for ways to align their values with their investment portfolios.

There are many key benefits of sustainable investing, but one of the most important is that it can help to create a more sustainable world. By investing in companies and projects that are working to improve the environment and society, we can help support their efforts and positively impact the world. Sustainable investing can also help generate financial returns as more and more investors are looking for opportunities in this growing field.

Sustainable investment trends are those that focus on investments that have a positive impact on the environment and society. This can include investing in renewable energy, sustainable agriculture, and companies committed to social responsibility. Sustainable investing is often seen as a way to achieve financial returns while making a positive difference in the world.

There is a lot of debate about whether sustainable investing is profitable. Some argue it is a feel-good investment strategy that does not generate real returns. Others contend that sustainable investing can be profitable but requires a different approach than traditional investing.

There is no easy answer to this question. Some sustainable investments may be profitable, while others may not be. It depends on the individual investment and the approach that is taken. However, it is important to remember that sustainable investing is not just about making money. It is also about making a positive impact on the world. So, even if sustainable investing only sometimes generates the highest returns, it can still be worthwhile.

Related Terms

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

- Widow and Orphan stock

- Public Float

- Closing Price

- Reverse stock splits

- Quiet period

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...

How to soar higher with Positive Carry!

As US Fed interest rates are predicted to rise 6 times this year, it’s best...