Private equity

Table of Contents

Private equity

Private equity is an important source of financing. It refers to the investment of funds in a company that is not publicly traded. Investors seek private equity (PE) funds to generate higher returns than those available from the stock markets. However, there are certain aspects of the sector that you must be aware of.

Institutional investors, such as pension funds and major private equity (PE) companies supported by accredited investors, make up the PE sector. Due to the direct investment needed by PE, frequently done to obtain control or influence over a company’s activities, the industry is dominated by funds with large financial reserves.

What is PE?

PE typically refers to investment funds rather than individual investments. These funds are set up by PE firms, which raise money from investors and use it to buy stakes in companies. The firms then work to improve the performance of these companies and sell them for a profit.

PE firms typically charge investors a management fee, as well as a percentage of any profits that are made. These fees can be quite high, which is why PE is often considered a high-risk investment.

Understanding PE

PE companies raise client money to start PE funds, run them as general partners, and manage fund assets in return for fees and a cut of earnings over a certain minimum or hurdle rate.

When stock markets are soaring, and interest rates are down, PE investment becomes more lucrative and well-liked; conversely, when those cyclical elements become less favorable, they become less lucrative and popular.

The money invested in PE funds has a limited duration of 7 to 10 years and cannot be withdrawn again after the first investment. After a few years, the funds usually start paying out rewards to their investors.

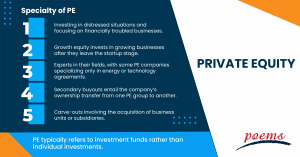

Specialty of PE

Some PE funds and businesses focus only on one type of PE investment. Although venture capital is sometimes referred to as a part of PE, its unique role and skill set it apart. They led to the emergence of specialized venture capital companies that now rule their industry. Other areas of specialization in PE are:

- Investing in distressed situations and focusing on financially troubled businesses.

- Growth equity invests in growing businesses after they leave the startup stage.

- Experts in their fields, with some PE companies specializing only in energy or technology agreements.

- Secondary buyouts entail the company’s ownership transfer from one PE group to another.

- Carve-outs involving the acquisition of business units or subsidiaries.

How does PE work?

PE firms raise capital from institutional investors (such as pension funds, sovereign wealth funds, insurance companies, and family offices) to invest in private businesses, grow them, and then sell them years later to provide investors with higher returns than they can dependably expect from investments in the public markets.

PE fund managers are typically very experienced and knowledgeable in the businesses they invest in. They work closely with the companies’ management teams in their portfolio to provide advice and guidance on improving performance.

In many cases, the fund manager will also take an active role in the company’s management, working to implement changes to help the company achieve its growth potential.

Who is a PE investor?

A PE investor is an individual or firm that invests in companies that are not publicly traded. PE investors typically seek to invest in companies with the potential for high growth and need capital to finance their expansion. PE investors are typically willing to take on more risk than traditional investors, such as banks or insurance companies, in exchange for the potential for higher returns.

PE investors typically invest through a private equity firm, a partnership that pools the capital of multiple investors. The PE firm then uses this capital to invest in companies that fit its investment criteria. The PE firm typically seeks to exit its investment within a few years through a sale of the company to another firm or through an initial public offering (IPO).

Frequently Asked Questions

A PE firm is an investment firm that specializes in investing in and acquiring private companies. PE firms typically invest in companies that are not publicly traded on a stock exchange. Their goal is to generate a return on their investment through various means, including selling the company outright, taking it public, or selling it to another private equity firm.

PE firms typically have a team of investment professionals who work to identify potential investments, perform due diligence, and negotiate and execute transactions. PE firms typically raise capital from various sources, including institutional investors such as pension funds, endowments, insurance companies, and high-net-worth individuals.

PE firms include venture capital, leveraged buyout, and growth equity firms. Each type of firm has a different focus, but all are looking to invest in companies with high growth potential.

PE and venture capital are both forms of investment in companies, but there are some key differences:

- PE typically invests in more established companies, while venture capital is for early-stage or startup companies.

- PE is usually a longer-term investment, while venture capital is typically shorter-term.

- Finally, PE is typically more hands-off than venture capital, with the latter often being about more active involvement in the company’s management.

PE funds are managed in various ways, depending on the type of fund and the goals of the fund managers. In general, PE funds are managed with a focus on maximizing returns for the investors in the fund. This typically involves making investments in companies that have a high potential for growth and profitability and then working to improve the performance of those companies so that they can generate higher returns.

The history of PE investments can be traced back to the early days of capitalism. The first PE firm in the United States was established in 1869. Since then, PE firms have played a vital role in the development of the American economy.

Today, PE firms are a major source of capital for businesses of all sizes. They provide the capital that businesses need to grow and expand. PE firms also help businesses restructure and become more efficient.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...