Money market

Table of Contents

Money market

The money market emerges as a pillar of economic stability and liquidity in the fast-paced world of finance. It is a vibrant market where governments, businesses, and financial institutions trade short-term debt instruments to stimulate the economy and facilitate effective cash flow management. The core function of the money market is to facilitate short-term borrowing, lending, and trading by providing a variety of highly liquid and low-risk securities. The money market, a crucial part of the larger financial ecosystem, not only offers a sanctuary for excess cash but also acts as a channel for central banks to carry out monetary policy. Understanding the complexities of this market reveals a world that supports financial stability and economic resiliency.

What is the money market?

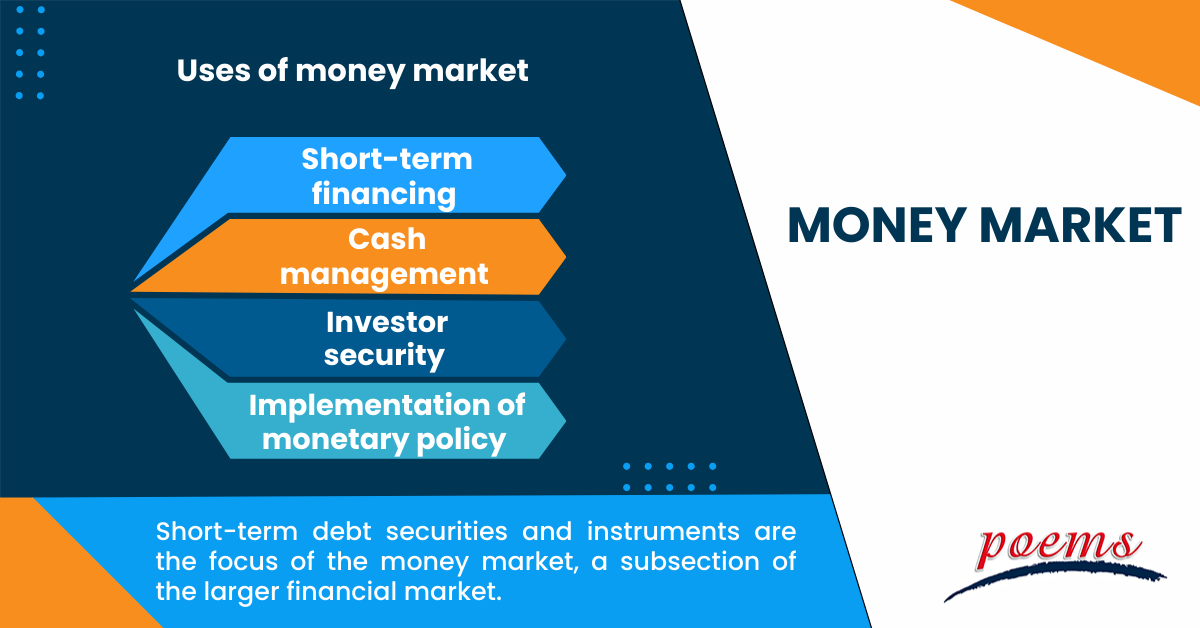

Short-term debt securities and instruments are the focus of the money market, a subsection of the larger financial market. These instruments are perfect for institutions and individuals to handle short-term finance needs because they are highly liquid and generally low-risk. The money market serves as a venue for financial organisations, businesses, and governments to raise money by offering investors short-term debt securities. These debt securities include treasury bills, commercial paper, certificates of deposit, and repurchase agreements, or repos.

Understanding the money market

The key features that set the money market apart from other financial markets are:

- Short maturity

The short maturities of money market instruments typically range from one day to one year. The short duration allows investors to get their money out quickly.

- High liquidity

Money market instruments can be bought or sold quickly and with slight fluctuation since they are highly liquid. For investors wishing to deposit their money temporarily, this liquidity is essential.

- Low risk

Because of their short tenure and often the strong credit quality of their issuers, money market instruments are regarded as relatively low-risk investments. For securities issued by the government, this is especially true.

Uses of money market

The money market performs several crucial tasks for the financial system and the larger economy, including:

- Short-term financing

Businesses and governments use the money market to get short-term financing to bridge cash flow gaps or meet urgent demands without incurring long-term debt.

- Cash management

Businesses and financial institutions use the money market to manage their cash reserves effectively. Excess money can be invested in money market instruments, where it can be easily accessed when needed.

- Investor security

Money market products are a safe choice for investors looking for safety and liquidity for their excess assets.

- Implementation of monetary policy

Central banks use the money market to carry out monetary policy. They can affect the money supply and manage short-term interest rates by engaging in open market operations (buying or selling government securities).

Working in the money market

Various actors, such as financial institutions, businesses, governments, and retail investors, make up the money market. The functioning of the money market is based on the interaction between these participants:

- Borrowers

Governments, businesses, and financial institutions frequently require short-term financing to handle cash flow gaps or fulfil immediate financial obligations. To raise money from investors, they issue money market instruments.

- Investors

To temporarily store extra funds, money market instruments are bought by institutional investors, money market mutual funds, banks, and individual investors. These investments produce a modest return while providing a secure sanctuary for money.

- Intermediaries

Purchasing money market instruments from issuers and reselling them to investors is how financial institutions serve as intermediaries. They make money off the price differential between buying and selling.

- Central banks

Central banks also have an impact by influencing the money market through monetary policy. Central banks can affect the amount of money available and the general cost of borrowing by changing interest rates and carrying out open market operations.

Examples of money market

The money market includes a range of instruments, each of which has a particular function. Some examples are:

- Treasury bills (T-Bills)

To raise money, governments issue these short-term debt securities. Due to their backing by the government’s credit, they are regarded as one of the safest money market securities.

- Commercial paper

Companies issue commercial paper to raise money for urgent short-term finance requirements, such as making payroll or keeping track of inventories. While slightly more risky than T-Bills, these products have larger yields.

- Certificates of deposit (CDs)

Banks and other financial organisations provide CDs as time deposits. They often offer set maturities and better interest rates than standard savings accounts.

- Repurchase agreements (Repos)

Repos entail the sale of securities and a commitment to repurchase them at a higher price at a specific later period. They provide institutions with a means of borrowing or lending money, frequently using government assets as security.

Frequently Asked Questions

Treasury bills, commercial paper, certificates of deposit, repos, and short-term corporate and government bonds are examples of money market products. These instruments meet the various needs of investors seeking secure and transitory investment options on the financial market by providing short maturities, high liquidity, and low risk.

The money market provides benefits like liquidity, safety, and effective cash flow management through short-term investment options, assisting in implementing monetary policy and offering low-risk instruments. On the other hand, it has drawbacks like lower returns than other markets, vulnerability to economic instability affecting instruments, and the potential for inflation to erode actual returns.

Pros of money market accounts include competitive interest rates, liquidity, and FDIC protection, which offers a safe location for money. They may, however, offer lower returns than riskier investments, some charge fees or require minimum balances, and inflation over time may reduce their actual value.

The money market is essential for sustaining short-term liquidity, helping businesses and individuals manage their cash flow, facilitating the effective execution of monetary policy, and providing a haven for excess cash. It is an essential part of the larger financial ecosystem due to its capacity to promote short-term borrowing, lending, and trading of low-risk securities, which helps to maintain overall financial stability and economic resilience.

The phrase “money market” derives from the market’s role as a marketplace for trading, purchasing, and selling short-term financial securities. When used in this context, the word “money” refers to resources that are readily convertible into cash and highly liquid assets. The word “money market” refers to a market that facilitates the borrowing, lending, and trading of instruments that entail the exchange of funds to meet short-term financial demands.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Options expiry

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...