Rebalancing

Table of Contents

Rebalancing

Investment in various asset types, such as debt and equities, is a crucial strategy in personal finance. If you build a portfolio that meets your risk tolerance and investment objectives, having the appropriate asset allocation might help.

Additionally, you need to maintain the balance of your portfolio. To do this, you must practice portfolio rebalancing, periodically purchasing and selling portions of your portfolio to restore the weight of each asset type to its prior position.

What is rebalancing?

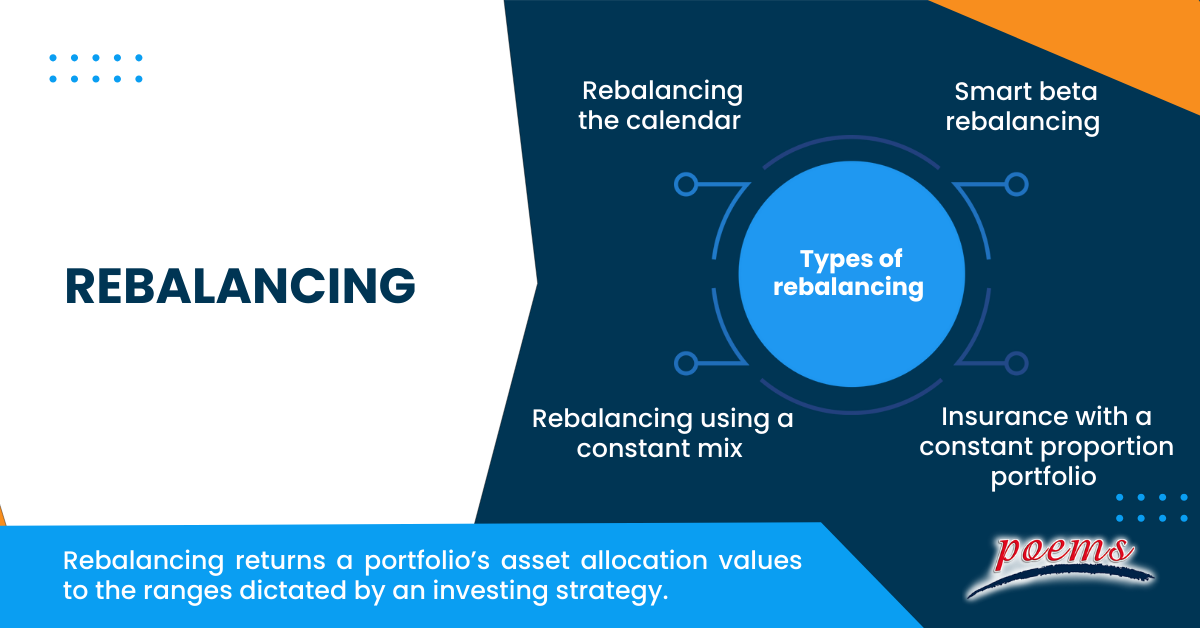

Rebalancing returns a portfolio’s asset allocation values to the ranges dictated by an investing strategy. These ranges reflect an investor’s willingness to accept risk and potential profits.

Depending on how the market performs, asset allocations may alter over time. Rebalancing requires periodically buying or selling the assets in a portfolio to restore and maintain the initial, planned asset allocation level.

Understanding rebalancing

Rebalancing a portfolio aims to protect investors from undesirable risks while exposing them to potential gains. It can also ensure that a portfolio’s exposure stays within the manager’s area of competence.

The price performance of a stock may occasionally change more dramatically than a bonds. Therefore, assessing a portfolio’s percentage of equity-related assets is crucial when market conditions change. If the value of the stocks in a portfolio causes their allocation to go beyond the predetermined ratio, rebalancing may be required. Selling some shares of stock would be necessary to lower the overall rate of equities in the portfolio.

How does rebalancing work?

Rebalancing is purchasing and disposing of portfolio assets to assist you in maintaining the appropriate balance of investment risk. When market returns throw your asset allocation out of whack, it helps you get your portfolio’s balance back to what it originally intended.

Rebalancing is straightforward: You will occasionally profit on stocks or other assets performing well and reinvest the money in underperforming assets. You might add new investments or send more funds toward bonds to get your portfolio’s allocation percentage back to the original level.

Types of rebalancing

The types of rebalancing areas follows:

- Rebalancing the calendar

Calendar rebalancing is the most basic form of rebalancing. This strategy comprises periodically analyzing and altering the financial positions in the portfolio. Many long-term traders rebalance their portfolios once every year. Other investors may rebalance quarterly and monthly, depending on their perspective and goals. Weekly rebalancing may be both costly and unneeded.

- Smart beta rebalancing

Indexes undergo smart beta rebalancing regularly to adjust for changes in stock prices and market capitalization.

If the appropriate settings are provided, smart beta may also be utilized to rebalance among asset classes. In this situation, risk-weighted returns are frequently used to assess various types of investments and modify exposure accordingly.

- Rebalancing using a constant mix

Greater focus is placed on the permitted percentage composition of each asset in a portfolio via more sensitive rebalancing procedures. This is a constant-mix method employing bands or corridors.

Each asset class or individual security is assigned a target weight and a tolerance range. For instance, an allocation plan may need 30% in developing market stocks, 40% in government bonds, and 30% in domestic blue chips with a +/- 5% margin for each asset class.

- Insurance with a constant proportion portfolio

Constant Proportion Portfolio Insurance (CPPI), a portfolio insurance that enables the investor to put a floor on the dollar worth of their portfolio and shape the asset allocation on it, is the most aggressive rebalancing approach frequently used.

The asset classes in the CPPI are labeled as risky (equities or mutual funds) and conservative (cash, treasury bonds, or cash equivalents).

Example of rebalancing

To better understand rebalancing, let’s look at the following example:

Let’s say Allen is building a portfolio of investments. According to his financial advisor Cleo, the first stage is determining the right allocation for each underlying investment asset class. These asset groups include local and foreign stocks, fixed-income securities, and cash. Asset allocation refers to investors allocating a specific portion of their investment portfolio to various asset types.

To achieve his aim of saving money for retirement, Allen requires a portfolio that includes the following investments:

- 60% of American stocks

- 15% invested in foreign stocks.

- 20% on a fixed income

- 5% in money

The performance of the markets will cause the value of the investments in Allen’s portfolio to fluctuate over time. The portfolio’s allocation percentages will alter as a result.

Suppose in Allen’s portfolio,

- the amount of US equity dropped to 35%

- the growth in foreign stocks went up to 30%

- cash stays at 5% and

- the fixed income investment has increased to 30%.

Allen may be unable to reach his retirement objective due to the portfolio’s out-of-balance allocation from the original plan. So, a rebalancing of the portfolio is required when this occurs.

Frequently Asked Questions

By rebalancing your portfolio, you may maintain your basic asset allocation strategy and put any changes you make to your investment strategy into effect. Rebalancing will help you stick to your investing plan no matter how the market does.

Rebalancing can have the drawback of occasionally removing an asset class’s legs before it has completed its bull run. According to research, the best periodic rebalancing schedule is two years.

Yes, it does. It entails the expenses related to purchasing and selling shares. It might also be connected to the price of performance. For instance, to rebalance, you might sell securities that have increased value and knocked your allocations out of kilter.

One must rebalance the portfolio to their desired allocation at regular intervals of 6 to 12 months (50:50). To achieve a 50/50 split; one may sell ownership or purchase debt. This is similar to how it will be biased toward debt if the market declines. So, one may sell some debt or buy more stock to rebalance.

By rebalancing, investors can keep their portfolios up to date and reflect their risk tolerance and need for a particular rate of return. It also maintains an asset allocation planned out and established in an investment strategy. And it is a calculated, emotion-free style of investing that could reduce risk exposure.

Related Terms

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...