Share Market

Table of Contents

Share Market

The share market, also known as the stock market or equity market, is a bustling hub where investors buy and sell shares of publicly-traded companies. It plays a crucial role in the global economy, allowing individuals and institutions to invest in businesses and participate in their growth. By understanding its functioning, types, and dynamics, investors can make informed decisions and navigate the market with confidence. While risks are inherent, diligent research, diversification, and a long-term perspective can help mitigate them.

What is a Share Market?

The share market is a platform where individuals and institutions can buy and sell shares, which represent ownership stakes in publicly-listed companies. Investors purchase shares with the expectation of profiting from the company’s growth and success. In return, they may receive dividends and enjoy capital appreciation. Shares represent ownership stakes in companies, entitling investors to potential dividends and capital appreciation. By investing in shares, individuals can align their financial interests with the growth prospects of various industries and sectors.

The primary exchanges in the United States are the New York Stock Exchange (NYSE) and the NASDAQ, while Singapore features the Singapore Exchange (SGX). These exchanges act as marketplaces for buyers and sellers to interact and execute transactions. They provide transparency, liquidity, and regulation to ensure fair and efficient trading.

Understanding the Share Market

To navigate the share market successfully, it is crucial to grasp its fundamental concepts and dynamics. A key aspect of understanding the share market is familiarising oneself with important terms such as stocks, market capitalisation, indices, and sectors. Stocks are units of ownership in a company, while market capitalisation refers to the total value of a company’s outstanding shares. Indices, such as the Straits Times Index, or STI, and the S&P 500, provide a snapshot of the overall market’s performance, representing a basket of selected stocks.

By comprehending these essential concepts, investors can gain insights into market trends, evaluate investment opportunities, and make informed decisions to maximise their returns

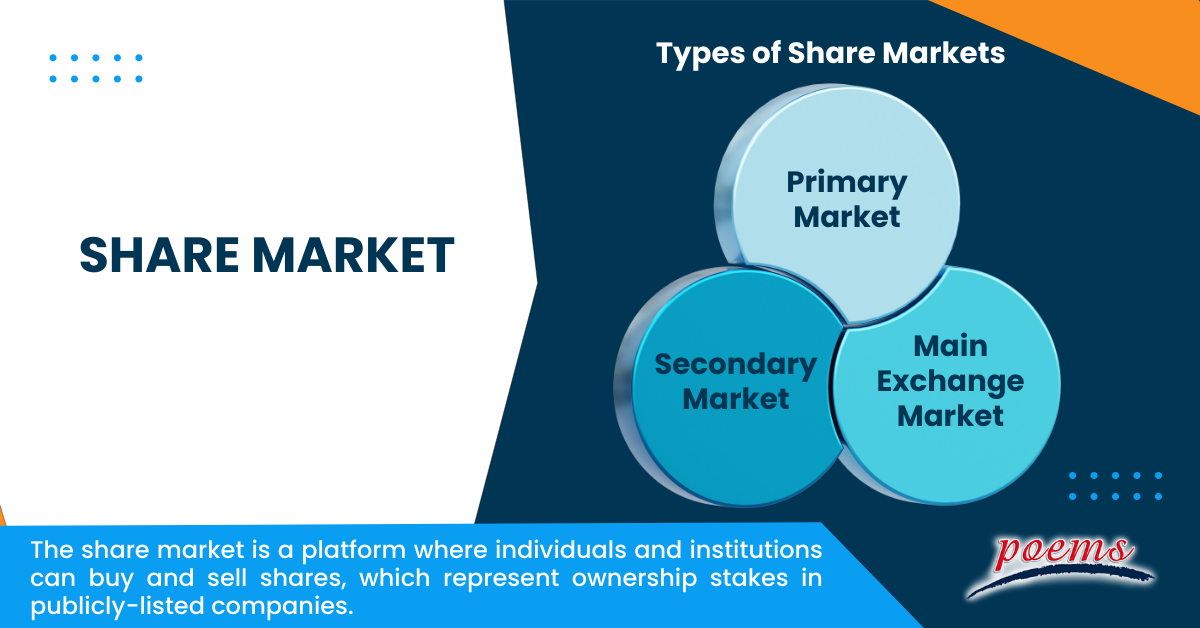

Types of Share Markets

The share market encompasses various types that cater to different stages of a company’s lifecycle and investment objectives. Some main types of share market are:

- Primary Market: This is where companies issue shares for the first time through initial public offerings, or IPOs. It allows companies to raise capital by offering shares to the public. Investors in the primary market can subscribe to these newly issued shares at the IPO price.

- Secondary Market: Once shares are listed and trading begins, the market becomes the secondary market. This is where investors buy and sell shares amongst themselves based on supply and demand. The secondary market provides liquidity, allowing investors to enter or exit positions as desired.

- Main Exchange Market: This type of market includes the major stock exchanges like the NYSE and the SGX. It features large, well-established companies that meet stringent listing requirements. Investors can find a wide range of companies and sectors listed on these exchanges.

Understanding the different types of share markets allows investors to choose the most suitable avenue for their investment goals and risk tolerance

Workings of the Share Market

The share market operates through a network of buyers, sellers, intermediaries, and exchanges. Buyers place orders to purchase shares, while sellers offer shares for sale. These orders are facilitated by brokerage firms, which act as intermediaries between investors and the exchanges. When a buyer and seller agree on a price, a trade is executed, and ownership is transferred. The share market operates on the principles of supply and demand, with prices fluctuating based on market sentiment, economic factors, company performance, and other variables.

The share market functions based on the principles of supply and demand. Share prices fluctuate as a result of various factors, including company performance, economic indicators, market sentiment, and investor expectations. Market participants, including individual investors, institutional investors, and traders, constantly analyse and react to these factors, buying or selling shares accordingly.

Overall, the working of the share market involves the interaction of buyers, sellers, intermediaries, and exchanges. It is a dynamic and ever-changing landscape driven by market forces and investor behaviour.

Examples of a Share Market

- Singapore Exchange (SGX): SGX is the main stock exchange in Singapore. It was founded in 1999 and is the 15th largest stock exchange in the world by market capitalisation. It features companies from various sectors, including finance, telecommunications, and real estate.

- New York Exchange (NYSE): The NYSE, founded in 1792, is the world’s largest stock exchange by market capitalisation. It lists numerous renowned American companies, including Apple, Microsoft, and JP Morgan.

- NASDAQ: Established in 1971, Nasdaq specialises in technology and growth-oriented stocks. It is home to industry giants such as Amazon, Facebook, and Google’s parent company, Alphabet.

Frequently Asked Questions

In the United States, the stock market typically opens at 9:30 am Eastern Time (ET) and closes at 4:00 pm ET, from Monday to Friday. In Singapore, the stock market opens at 9:00 am Singapore Time (SGT) and closes at 5:00 pm SGT, from Monday to Friday.

While investing in the share market carries risks, it is not synonymous with gambling. Investing involves thorough analysis, understanding of market dynamics, and long-term strategies. Investors evaluate company fundamentals, economic conditions, and other relevant factors before making investment decisions. Additionally, numerous investment options are available, including index funds, mutual funds, and exchange-traded funds, or ETFs, which can help mitigate risk and provide diversification.

Investing in the share market offers the potential for long-term wealth accumulation. Over time, well-performing stocks and diversified portfolios have historically generated attractive returns. Furthermore, investing in shares allows individuals to participate in a company’s growth, support innovation, and contribute to the broader economy. However, it is essential to conduct thorough research, understand personal risk tolerance, and consider investment goals before entering the share market.

Investing in the share market involves a step-by-step process. First, individuals need to educate themselves about the market, conduct research, and define investment goals. Then, they should open a brokerage account with a reputable firm. After funding the account, investors can analyse stocks, build a diversified portfolio, and execute trades based on their strategies. Regular monitoring and portfolio rebalancing are vital to align with changing market conditions and individual goals.

Share prices are determined through the interaction of supply and demand in the market. Buyers and sellers collectively establish the price based on their willingness to buy or sell shares at a level. Factors influencing share prices include company performance, economic indicators, market sentiment, and investor expectations. Market participants analyse these factors and engage in buying and selling activities accordingly, influencing the stock’s price. The stock market acts as a facilitator of price discovery, ensuring fair and transparent transactions.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Options expiry

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...