Dollar-Cost Averaging (DCA)

Table of Contents

What Is Dollar-Cost Averaging?

Dollar-cost averaging, a constant dollar plan, is an investment strategy used by an investor before making an investment decision. An investor who wishes to neutralise the short-term volatility often uses dollar-cost averaging. Here, the entire investment is divided into smaller sums in such a strategy. Then, the sums are invested at predetermined intervals separately. This is done until the amount is exhausted. By reducing the overall investment cost, dollar cost averaging mitigates the risk of volatility to a large extent. Take a look at the other facts about dollar-cost averaging.

Market Timing vs Dollar Cost Averaging

Market timing and dollar-cost averaging are investment techniques used by investors to make their final investment decision. Dollar-cost averaging is an investment technique that focuses on the periodic investment of funds. On the other hand, market timing is an investment technique that focuses on market conditions while investing. Choosing between the two techniques will help you get an appropriate return on investment and assist you in making a sound investment decision.

Market timing is a technique that mainly relates to current market conditions. So, the investor needs to enter or exit the investment based on ongoing market conditions. A thorough analysis of facts and figures is used to determine the right time to invest. If the investor chooses the right timing to invest, he can get a good return on investment. But if not, it can lead to losses and unexpected risk.

Dollar-cost averaging is an investment technique that involves investing money at regular intervals. This instrument ensures that investors can buy more stocks when prices are low and buy fewer when prices are high. Thus, DCA allows investors to make sound investing decisions without worrying about market trends.

How Does Dollar Cost Averaging Work?

Dollar-Cost Averaging is a financial instrument that can help you improve a particular investment’s performance over time. However, it won’t protect the investor from the threat of declining market prices. Instead, it allows investors to buy more stock when the prices are down. With dollar-cost averaging, investors can get high return on investment and generate more gains.

What Is an Example of Dollar-Cost Averaging?

To understand the working of dollar-cost averaging, let’s take an example in which the investor invests $1000 per month in an index fund. The investor invests the amount whether the index fund price is low and high. When the investor invests in the months with the price is high, it will lead to fewer purchases. Conversely, when the investor invests when the price is low, he can buy more shares. So, in the long run, the investor who invests using the dollar cost averaging benefits in both uptrend and downtrend markets. This technique protects the investor from market fluctuations and gets great results in the end.

Variants of Dollar-Cost Averaging

Variants of the dollar-cost averaging strategy can help investors to maximize their profits. For example, rather than focusing on a fixed amount or a periodic purchase, variants of the strategy focus on scaling up the buying of securities in a down market. And, a scaled selling plan is used in an uptrend market.

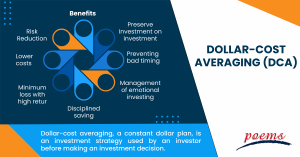

Benefits of Dollar-Cost Averaging

- Dollar-Cost Averaging comes with a host of benefits that include risk reduction, lower costs, preventing bad timing, disciplined saving, and management of emotional investing.

- DCA is one of the best investment strategies that can preserve investment and reduce investment risk.

- When you use DCA before investing, you can be rest assured that you will suffer a minimum loss along with a high return on investment.

- Moreover, when you regularly invest, you will save even if the assets depreciate.

Often, people find it hard to predict the market and make investments, and thus they end up losing money due to market fluctuations. By using dollar-cost averaging, investors can avoid bad timing and other market fluctuations.

Frequently Asked Questions

If you are an investor with a low risk tolerance, dollar cost averaging is, luckily, one of the best investment strategies. Studies show that dollar-cost averaging offers excellent results and a high return on investment compared with other investment strategies. Here, investors can reduce investment risk and preserve capital by avoiding market crashes.

Dollar-Cost Averaging involves investing at periodic intervals. Regardless of the market trend, investors can add to their investment account. When you combine dollar-cost averaging with deep research, you can be rest assured that you will get a high return on investment in the long run.

Market fluctuations often affect how investors invest and get returns from their investments. By using dollar-cost averaging, you can lower the impact of market volatility. To generate good results, it is essential to do dollar-cost averaging properly. Starting with DCA would be a good step if you are a novice to the investment industry. But be sure you remain consistent and rebalance your investment portfolio regularly. Do not abandon the strategy if you find the market is falling. Instead, stay calm and engaged to ensure that you get good results.

The best period for dollar-cost averaging is between 6 to 12 months. When you invest your money after thorough analysis, you can rest easy knowing that it will give you a good return along with helping you to secure your hard-earned wealth. Remember, dollar cost averaging is a long-term financial strategy. Be sure you are consistent with dollar-cost averaging to get good income from your financial investment.

Related Terms

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...

What Makes Forex Trading Attractive?

In a world where the click of a button can send goods across oceans and...

Weekly Updates 1/4/24 – 5/4/24

This weekly update is designed to help you stay informed and relate economic and company...