Depreciation

Table of Contents

Depreciation

Depreciation is sometimes mistaken to indicate that anything is merely losing value or that a computation is made for tax purposes. Although it is a complicated subject, depreciation plays a significant role in a company’s tax returns.

A fixed asset’s carrying amount is reduced ratably through depreciation. When an item’s useful life is up, its carrying value should have decreased to its salvage value, which is approximately how depreciation is designed to represent how the underlying asset is used.

What is depreciation?

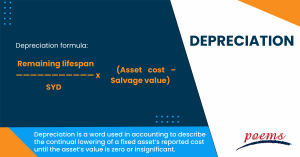

Depreciation is a word used in accounting to describe the continual lowering of a fixed asset’s reported cost until the asset’s value is zero or insignificant.

Fixed assets include buildings, office supplies, furniture, machinery, etc. As the value of land increases over time, it is the single exemption that cannot be depreciated.

The anticipated life span of an asset, or how long it may be utilised, impacts the number of years it is depreciated. For instance, a laptop’s useful life is estimated to be five years.

Commodities and real estate are just two examples of the many different forms of assets. Asset depreciation is an ongoing expense while preparing your annual budget or balance sheet, unless you use a technique where the depreciable value varies annually, which will be a variable cost.

Understanding depreciation

Depreciation enables a portion of a fixed asset’s cost to be transferred to the income the fixed asset produces. Given that revenues and related costs are reported in the accounting period during which the asset is in use, this is required under the matching principle. This aids in obtaining a comprehensive view of the income generation transaction.

Businesses frequently depreciate their assets to transfer their expenses from their balance sheets to their income statements. When a business purchases an asset, it records the transaction as a credit to decrease cash (or raise accounts payable), which appears on the balance sheet. A debit is done to enhance an asset account on the balance sheet. Neither journal entry has an impact on the income statement, which contains information about revenues and costs.

Businesses must carefully consider which depreciation method will best suit their needs. The method chosen should align with the business’s financial goals and provide accurate information for financial reporting.

Types of depreciation

In accounting, there are several depreciation techniques. The following are the four primary categories of depreciation.

- Straight-line depreciation

It is one of the easiest approaches. It evenly distributes an asset’s value across several years, requiring the same payment for each year the item is used. Straight-line depreciation is calculated as follows:

Annual depreciation expenditure = (Asset cost – Residual Value) / Useful life of the asset

- Units of production method

In contrast to the straight-line approach, this involves two steps. Each unit generated in this case is given an identical expenditure rate. The procedure is extremely helpful in assembly for manufacturing lines due to this assignment. As a result, rather than using the number of years, the estimate is based on the asset’s productive capacity.

The steps are:

- First, determine the per-unit depreciation:

Per unit depreciation is calculated as (asset cost – residual value) / useful life in production units.

- Calculate the overall depreciation of the actual units generated in step two:

total depreciation expense = units produced x per unit depreciation

- Declining balance depreciation

It is a more aggressive method that accelerates the depreciation of an asset. This means that a greater portion of the cost is depreciated in the early years of the asset’s life.

Declining Balance Depreciation = (net book value – salvage value) x (1 / useful life) x depreciation rate

- Sum-of-the-years’-digits depreciation

It is a method that accelerates the depreciation of an asset but at a declining rate. This means that a greater portion of the cost is depreciated in the early years of the asset’s life, but the number of depreciation declines each year.

Remaining lifespan

Depreciation formula: ——————————— x (Asset cost – Salvage value)

SYD

Calculation of depreciation

The depreciation of an asset is calculated using its purchase price, expected salvage value, and estimated useful life.

When calculating depreciation, businesses can use the straight-line or declining balance method. The most popular approach is the straight-line method. It evenly allocates the cost of an asset over its useful life. On the other hand, the declining balance method accelerates the depreciation rate. This means that a greater portion of the asset’s cost is allocated in the early years of its useful life.

Example of depreciation

An example of depreciation is when a company’s factory equipment becomes outdated and needs to be replaced. The company will take a loss on the equipment, which is reflected in the financial statements.

Frequently Asked Questions

Depreciation typically has two main causes:

- One is normal and includes things like usage wear and tear, the passing of time, the expiration of a legal right in the case of some assets, and unsustainability due to technological advancement.

- The other is abnormal and includes things like accidents brought on by fire, earthquakes, floods, etc.

A depreciation expenditure directly impacts a corporation’s income statement profit. The company’s stated net income, or profit, decreases proportionally to the depreciation expenditure incurred in a particular year.

Depreciation is a non-cash item; therefore, the cost does not impact the company’s cash flow but affects accounting ratios in several ways.

- First, it reduces a company’s net worth, making it appear less profitable than it is.

- Second, it can increase the company’s debt-to-equity ratio, making it appear more leveraged and riskier.

- Finally, it can reduce the company’s return on assets, making it appear less efficient.

There are two ways to determine the valuation of a corporate asset over time: amortisation and depreciation. A tangible asset’s cost is spread out throughout its useful life using the accounting technique of depreciation. Amortisation is an accounting method used to allocate the cost of an intangible asset over its useful life.

The cost of depreciating a company’s assets over a specific period is known as a depreciation expense. On the other hand, accumulated depreciation is the amount a business has depreciated its assets.

Depreciation expense is typically recorded monthly or yearly, while accumulated depreciation is a cumulative total of all depreciation expenses incurred on an asset.

Depreciation is an important factor in determining a company’s tax liability. When a company purchases an asset, the cost of that asset is spread out over its useful life. This process is called depreciation. The amount of depreciation that a company can claim each year is deducted from its taxable income, which reduces the company’s tax liability.

Depreciation can have a major impact on a company’s tax liability. For example, if a corporation buys a new piece of equipment for US$100,000 and has a useful life of 10 years, the company can claim US$10,000 in depreciation each year. This deduction reduces the company’s taxable income by US$10,000 each year, which reduces the company’s tax liability.

Related Terms

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Annualised rate of return

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Settlement currency

- Federal funds rate

- Active Tranche

- Convertible Securities

- Synthetic ETF

- Physical ETF

- Initial Public Offering

- Buyback

- Secondary Sharing

- Bookrunner

- Notional amount

- Negative convexity

- Jumbo pools

- Inverse floater

- Forward Swap

- Underwriting risk

- Reinvestment risk

- Final Maturity Date

- Payment Date

- Secondary Market

- Mark-to-market

- Yield Pickup

- Subordinated Debt

- Trailing Stops

- Treasury Stock Method

- Bullet Bonds

- Basket Trade

- Contrarian Strategy

- Exchange Control

- Notional Value

- Relevant Cost

- Dow Theory

- Speculation

- Stub

- Trading Volume

- Going Long

- Pink sheet stocks

- Rand cost averaging

- Sustainable investment

- Stop-limit sell order

- Economic Bubble

- Ask Price

- Constant prepayment rate

- Covenants

- Stock symbol

- Companion tranche

- Synthetic replication

- Bourse

- Beneficiary

- Witching Hour

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available...

Predicting Trend Reversals with Candlestick Patterns for Beginners

Candlestick patterns are used to predict the future direction of price movements as they contain...

In the diverse and complex world of investing, unit trusts stand out as a popular...

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Start trading on POEMS! Open a free account here! At a glance: Major indices continue...

Weekly Updates 15/4/24 – 19/4/24

This weekly update is designed to help you stay informed and relate economic and company...

From $50 to $100: Unveiling the Impact of Inflation

In recent years, inflation has become a hot topic, evoking strong emotions as the cost...

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Source: eSignal, Intercontinental Exchange, Inc. In the heart of Japan’s economic landscape, the Nikkei 225...

Weekly Updates 8/4/24 – 12/4/24

This weekly update is designed to help you stay informed and relate economic and...