Fixed income

Table of Contents

Fixed income

Fixed income refers to any investment that pays a predetermined rate of return. The most typical fixed-income investment is a bond, although additional examples include annuities and particular loan types.

Fixed-income securities are typically less risky than stocks but offer lower returns. For this reason, many investors choose to invest in a mix of fixed-income and equity securities. A diverse investment portfolio may include fixed-income securities as a key component.

What is fixed income?

In general, investment securities that offer dividend payments or fixed interest to investors until their maturity date are referred to as having a fixed income. Investors receive their principal investment back when the investment reaches maturity. Bonds issued by governments and corporations are the most popular fixed-income vehicles.

The goal of the fixed-income investing strategy is to preserve both capital and income. Investments, including government and corporate bonds, money market funds, and certificates of deposit are frequently included. Compared to equities, fixed income can provide a consistent income source with lower risk.

Understanding fixed income

Fixed-income investments are attractive to many investors because they offer a degree of certainty in terms of both the timing and the amount of the return. This can be especially helpful in planning for major expenses or meeting other financial goals.

However, it is important to remember that fixed-income investments are not without risk. For example, if interest rates rise, the value of fixed-income securities will generally decline. As a result, investors need to carefully consider their overall investment strategy when adding fixed-income investments to their portfolios.

Conservative investors looking for a diverse portfolio are advised to purchase fixed-income assets. The amount of the portfolio allocated to fixed income relies on the investor’s preferred investing approach. Additionally, there is a chance to diversify the portfolio by combining stocks and fixed-income securities to produce a portfolio that may contain 50% fixed-income and 50% stocks.

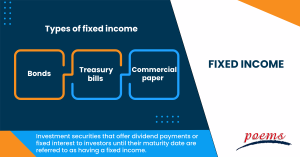

Types of fixed income

There are many types of fixed-income securities, each with unique characteristics. The most common fixed-income securities are bonds, treasury bills, and commercial paper.

- Bonds

Bonds are debt securities that offer a fixed interest rate and are typically issued by corporations or governments. Bonds can be short-term or long-term and are typically traded on secondary markets.

- Treasury bills

They are short-term debt securities issued by the government, with maturities of one year or less. Treasury bills are sold at a discount from face value and typically have higher yields than other types of fixed-income securities.

- Commercial paper

It is a type of short-term debt security issued by corporations. Commercial paper typically has maturities of one year or less and is often used to finance short-term business expenses.

Advantage and disadvantages of fixed income

Fixed-income investments offer the following advantages:

- Predictable income

It is among the biggest advantages of fixed-income investments. This type of investment provides regular interest payments, which can help to smooth out cash flow fluctuations.

- Safety of principal

Another major advantage is that fixed-income investments are generally less volatile than stocks and other investments. This means less risk of losing money in a fixed-income investment.

- Diversification

By investing in a variety of fixed-income securities, investors can reduce overall portfolio risk.

However, fixed-income investments also have some disadvantages.

- Low potential return

One of the biggest disadvantages is their low potential return. Fixed-income securities typically provide lower returns than stocks and other types of investments, making it difficult to grow wealth over time.

- Interest rate risk

Additionally, fixed-income investments are subject to interest rate risk. This means that if interest rates rise, the value of these investments will generally fall.

How to invest in fixed income?

Fixed-income investment is often a conservative approach where profits are derived from predictable interest-paying low-risk instruments. Since there is less risk, there are often fewer interest coupon payments.

Bond mutual funds, bonds, and certificates of deposit (CDs) are all possible investments for constructing a fixed-income portfolio. The laddering method is one such approach that makes use of fixed-income securities.

Thus investors have a variety of alternatives when deciding how to add fixed-income assets to their portfolios. Today, most brokers provide direct access to various bond markets, including treasuries and corporate and municipal bonds.

Bond funds offer exposure to various bonds and debt instruments for people who do not wish to choose individual bonds. These funds give investors access to an income stream through expert portfolio management.

While fixed-income ETFs function similarly to mutual funds, they may be more affordable and accessible to individual investors. These ETFs might have certain durations, credit ratings, or other objectives. ETFs are also charged for expert management.

Frequently Asked Questions

Fixed-income securities include certificates of deposit (CDs), corporate bonds, municipal and corporate bonds, and treasury bonds and bills.

Credit risk and interest rate are the primary risks of investing in fixed income. Usually, the market bond’s value decreases directly in response to an increase in interest rates. The likelihood that the bond issuer won’t be capable of paying principal and interest payments is called credit risk.

Other risks include inflation risk and liquidity risk.

Stock funds or stocks often make up equity investments, whereas government or corporate bonds typically make up fixed-income instruments.

The key difference between fixed-income and equity securities is the nature of the return they provide. With fixed-income securities, investors receive periodic interest payments. With equity securities, investors receive a share of the company’s profits through dividends.

Another key difference is the degree of risk involved. Fixed-income securities are generally less risky than equity securities. This is because the interest payments on fixed-income securities are typically contractually obligated, whereas dividends on equity securities are not.

When interest rates rise, the prices of fixed-income securities generally fall. This is because when interest rates go up, new investments will pay a higher interest rate than existing investments, making the latter less attractive to investors. This decrease in demand for existing investments will cause their prices to fall.

You can deposit money into a fixed-rate bond (also known as a fixed-term deposit) for a specific time. Typically, it lasts one, two, or three years, although it can last up to five years.

The advantages of selecting a fixed-rate bond are numerous and include a fixed interest rate for the duration of the bond’s life. You can be given a competitive rate if you agree to invest your money for a specific time.

Related Terms

- Floating Dividend Rate

- Real Return

- Non-Diversifiable Risk

- Liability-Driven Investment (LDI)

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Bubble

- Asset Play

- Accrued Market Discount

- Inflation Hedge

- Incremental Yield

- Holding Period Return

- Floating Dividend Rate

- Real Return

- Non-Diversifiable Risk

- Liability-Driven Investment (LDI)

- Guaranteed Investment Contract (GIC)

- Flash Crash

- Cost Basis

- Deferred Annuity

- Cash-on-Cash Return

- Bubble

- Asset Play

- Accrued Market Discount

- Inflation Hedge

- Incremental Yield

- Holding Period Return

- Hedge Effectiveness

- Fallen Angel

- EBITDA Margin

- Dollar Rolls

- Dividend Declaration Date

- Distribution Yield

- Derivative Security

- Fiduciary

- Current Yield

- Core Position

- Cash Dividend

- Broken Date

- Share Classes

- Valuation Point

- Breadth Thrust Indicator

- Book-Entry Security

- Bearish Engulfing

- Core inflation

- Approvеd Invеstmеnts

- Allotment

- Annual Earnings Growth

- Solvency

- Impersonators

- Reinvestment date

- Volatile Market

- Trustee

- Sum-of-the-Parts Valuation (SOTP)

- Proxy Voting

- Passive Income

- Diversifying Portfolio

- Open-ended scheme

- Capital Gains Distribution

- Investment Insights

- Discounted Cash Flow (DCF)

- Portfolio manager

- Net assets

- Nominal Return

- Systematic Investment Plan

- Issuer Risk

- Fundamental Analysis

- Account Equity

- Withdrawal

- Realised Profit/Loss

- Unrealised Profit/Loss

- Negotiable Certificates of Deposit

- High-Quality Securities

- Shareholder Yield

- Conversion Privilege

- Cash Reserve

- Factor Investing

- Open-Ended Investment Company

- Front-End Load

- Tracking Error

- Replication

- Real Yield

- DSPP

- Bought Deal

- Bulletin Board System

- Portfolio turnover rate

- Reinvestment privilege

- Initial purchase

- Subsequent Purchase

- Fund Manager

- Target Price

- Top Holdings

- Liquidation

- Direct market access

- Deficit interest

- EPS forecast

- Adjusted distributed income

- International securities exchanges

- Margin Requirement

- Pledged Asset

- Stochastic Oscillator

- Prepayment risk

- Homemade leverage

- Prime bank investments

- ESG

- Capitulation

- Shareholder service fees

- Insurable Interest

- Minority Interest

- Passive Investing

- Market cycle

- Progressive tax

- Correlation

- NFT

- Carbon credits

- Hyperinflation

- Hostile takeover

- Travel insurance

- Money market

- Dividend investing

- Digital Assets

- Coupon yield

- Counterparty

- Sharpe ratio

- Alpha and beta

- Investment advisory

- Wealth management

- Variable annuity

- Asset management

- Value of Land

- Investment Policy

- Investment Horizon

- Forward Contracts

- Equity Hedging

- Encumbrance

- Money Market Instruments

- Share Market

- Opening price

- Transfer of Shares

- Alternative investments

- Lumpsum

- Derivatives market

- Operating assets

- Hypothecation

- Accumulated dividend

- Assets under management

- Endowment

- Return on investment

- Investments

- Acceleration clause

- Heat maps

- Lock-in period

- Tranches

- Stock Keeping Unit

- Real Estate Investment Trusts

- Prospectus

- Turnover

- Tangible assets

- Preference Shares

- Open-ended investment company

- Ordinary Shares

- Leverage

- Standard deviation

- Independent financial adviser

- ESG investing

- Earnest Money

- Primary market

- Leveraged Loan

- Transferring assets

- Shares

- Fixed annuity

- Underlying asset

- Quick asset

- Portfolio

- Mutual fund

- Xenocurrency

- Bitcoin Mining

- Option contract

- Depreciation

- Inflation

- Cryptocurrency

- Options

- Asset

- Reinvestment option

- Capital appreciation

- Style Box

- Top-down Investing

- Trail commission

- Unit holder

- Yield curve

- Rebalancing

- Vesting

- Private equity

- Bull Market

- Absolute Return

- Leaseback

- Impact investing

- Venture Capital

- Buy limit

- Asset stripper

- Volatility

- Investment objective

- Annuity

- Sustainable investing

- Face-amount certificate

- Lipper ratings

- Investment stewardship

- Average accounting return

- Asset class

- Active management

- Breakpoint

- Expense ratio

- Bear market

- Hedging

- Equity options

- Dollar-Cost Averaging (DCA)

- Due Diligence

- Contrarian Investor

Most Popular Terms

Other Terms

- Flight to Quality

- Protective Put

- Perpetual Bond

- Option Adjusted Spread (OAS)

- Merger Arbitrage

- Income Bonds

- Equity Carve-Outs

- Cost of Equity

- Earning Surprise

- Capital Adequacy Ratio (CAR)

- Beta Risk

- Bear Spread

- Ladder Strategy

- Junk Status

- Intrinsic Value of Stock

- Interest-Only Bonds (IO)

- Interest Coverage Ratio

- Industry Groups

- Industrial Bonds

- Income Statement

- Historical Volatility (HV)

- Flat Yield Curve

- Exotic Options

- Execution Risk

- Exchange-Traded Notes

- Event-Driven Strategy

- Eurodollar Bonds

- Enhanced Index Fund

- Embedded Options

- Dynamic Asset Allocation

- Dual-Currency Bond

- Downside Capture Ratio

- Dividend Capture Strategy

- Depositary Receipts

- Delta Neutral

- Deferment Payment Option

- Dark Pools

- Death Cross

- Debt-to-Equity Ratio

- Fixed-to-floating rate bonds

- First Call Date

- Financial Futures

- Firm Order

- Credit Default Swap (CDS)

- Covered Straddle

- Contingent Capital

- Conduit Issuers

- Company Fundamentals

- Commodities Index

- Chart Patterns

Know More about

Tools/Educational Resources

Markets Offered by POEMS

Read the Latest Market Journal

Recognising Biases in Investing and Tips to Avoid Them

Common biases like overconfidence, herd mentality, and loss aversion influence both risk assessment and decision-making....

What is Money Dysmorphia and How to Overcome it?

Money dysmorphia happens when the way you feel about your finances doesn’t match the reality...

The Employer’s Guide to Domestic Helper Insurance

Domestic Helper insurance may appear to be just another compliance task for employers in Singapore,...

One Stock, Many Prices: Understanding US Markets

Why Isn’t My Order Filled at the Price I See? Have you ever set a...

Why Every Investor Should Understand Put Selling

Introduction Options trading can seem complicated at first, but it offers investors flexible strategies to...

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Effective stop-loss placement is a cornerstone of prudent risk management in forex trading. It’s not...

Boosting ETF Portfolio Efficiency: Reducing Tax Leakage Through Smarter ETF Selection

Introduction: Why Tax Efficiency Matters in Global ETF Investing Diversification is the foundation of a...

How to Build a Diversified Global ETF Portfolio

Introduction: Why Diversification Is Essential in 2025 In our June edition article (https://www.poems.com.sg/market-journal/the-complete-etf-playbook-for-singapore-investors-from-beginner-to-advanced-strategies/), we introduced...